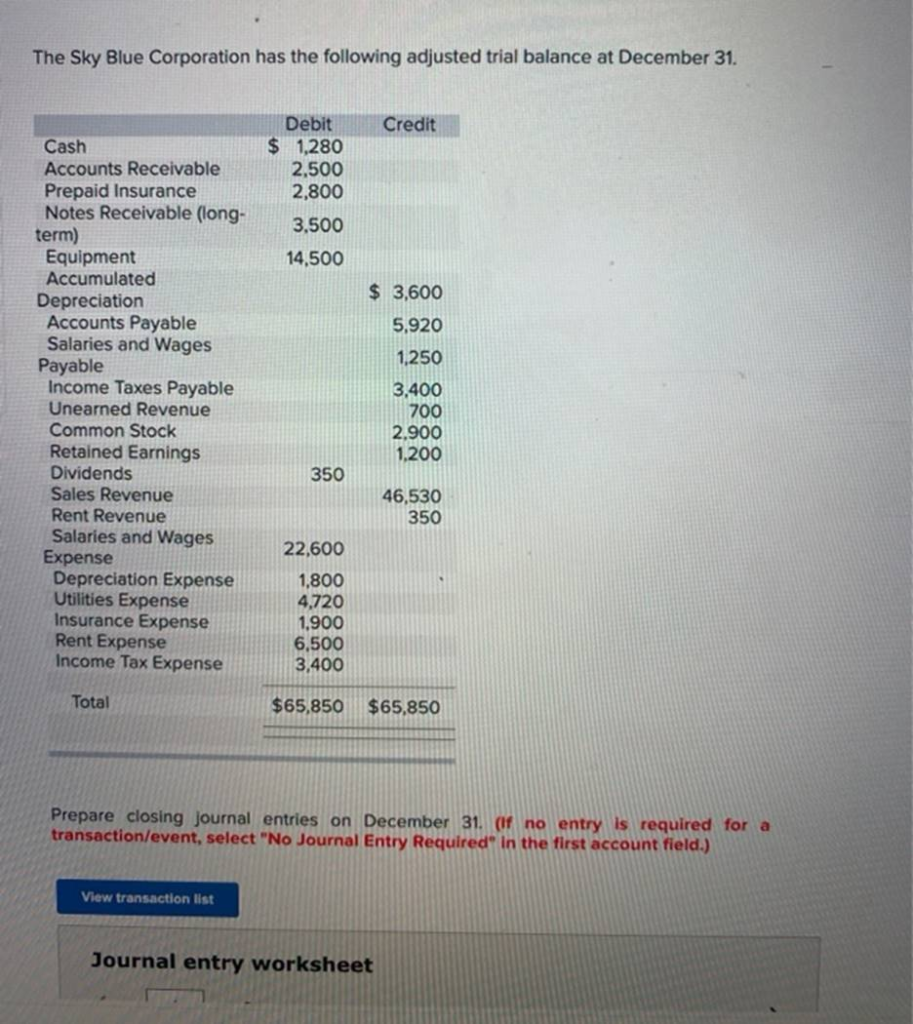

The Sky Blue Corporation has the following adjusted trial balance at December 31. Credit Debit $ 1,280 2,500 2,800 3,500 14,500 $ 3,600 5,920 1,250 Cash Accounts Receivable Prepaid Insurance Notes Receivable (long- term) Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Income Taxes Payable Unearned Revenue Common Stock Retained Earnings Dividends Sales Revenue Rent Revenue Salaries and Wages Expense Depreciation Expense Utilities Expense Insurance Expense Rent Expense Income Tax Expense 3,400 700 2,900 1,200 350 46,530 350 22,600 1,800 4,720 1,900 6,500 3,400 Total $65,850 $65,850 Prepare closing Journal entries on December 31. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.) View transaction list Journal entry worksheet

The Correct Answer and Explanation is :

Closing Journal Entries for Sky Blue Corporation on December 31

Step 1: Close Revenue Accounts to Income Summary

Close all revenue accounts by debiting them and crediting the Income Summary account.

- Journal Entry

Account Title Debit Credit

Sales Revenue 46,530

Rent Revenue 3,400

Income Summary 49,930 Step 2: Close Expense Accounts to Income Summary

Close all expense accounts by crediting them and debiting the Income Summary account.

- Journal Entry

Account Title Debit Credit

Income Summary 22,120

Salaries and Wages Expense 4,720

Depreciation Expense 1,900

Utilities Expense 6,500

Insurance Expense 3,400

Rent Expense 3,400

Income Tax Expense 2,200 Step 3: Close Income Summary to Retained Earnings

The net income (Revenues – Expenses) is transferred to Retained Earnings.

- Journal Entry

Account Title Debit Credit

Income Summary 27,810

Retained Earnings 27,810 Step 4: Close Dividends to Retained Earnings

Dividends are closed by debiting Retained Earnings and crediting the Dividends account.

- Journal Entry

Account Title Debit Credit

Retained Earnings 3,400

Dividends 3,400 Explanation

Closing entries are journal entries made at the end of an accounting period to prepare accounts for the next period. The process involves:

- Clearing temporary accounts (revenues, expenses, and dividends) to zero to ensure proper accumulation for the next period.

- Transferring net income or loss to retained earnings, which reflects the cumulative earnings available to shareholders.

Revenue accounts are closed to the Income Summary to summarize total earnings.

Expense accounts are closed to the Income Summary, reflecting total costs. The resulting balance in the Income Summary represents net income, transferred to Retained Earnings. Finally, Dividends are closed to Retained Earnings, reducing the shareholders’ equity by the amount distributed to them.