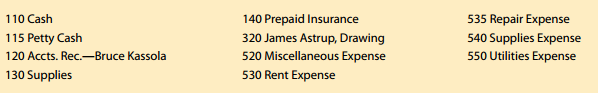

Reconciling a bank statement; journalizing a bank service charge, a dishonored check, and petty cash transactions James Astrup owns a business called LawnMow. Selected general ledger accounts are given below

Instructions: 1. Journalize the following transactions completed during August of the current year. Use page 20 of the journal given in the Working Papers. Source documents are abbreviated as follows: check, C; memorandum, M; calculator tape, T.

The Correct Answer and Explanation is :

To reconcile the bank statement and journalize the specified transactions for LawnMow, we will address each item individually:

1. Bank Service Charge:

Banks often charge fees for account maintenance, check processing, and other services. These charges are typically deducted directly from the business’s bank account and need to be recorded in the company’s books.

Journal Entry:

| Date | Account | Debit | Credit | |————|————————-|——–|——–| | August 31 | Bank Service Charges | $XX | | | | Cash | | $XX |

Explanation:

- Bank Service Charges (Debit): This account is debited to recognize the expense incurred due to the bank’s service charges. - Cash (Credit): The cash account is credited to reflect the reduction in the bank balance resulting from the service charges.

2. Dishonored Check (NSF Check):

A dishonored check, or NSF (Non-Sufficient Funds) check, occurs when a customer’s check is returned due to insufficient funds in their account. The bank deducts the amount of the NSF check from the business’s account, and the business must reverse the initial receipt.

Journal Entry:

| Date | Account | Debit | Credit | |————|————————-|——–|——–| | August 31 | Accounts Receivable | $XX | | | | Cash | | $XX |

Explanation:

- Accounts Receivable (Debit): This account is debited to reinstate the amount owed by the customer, as the payment was not successfully processed. - Cash (Credit): The cash account is credited to reverse the earlier cash receipt, reflecting the reduction in the bank balance due to the NSF check.

3. Petty Cash Transactions:

Petty cash is used for small, incidental expenses. Transactions from the petty cash fund should be recorded to ensure accurate financial reporting.

Journal Entry:

| Date | Account | Debit | Credit | |————|————————-|——–|——–| | August 31 | Various Expense Accounts | $XX | | | | Petty Cash | | $XX |

Explanation:

- Various Expense Accounts (Debit): Debit the appropriate expense accounts (e.g., Office Supplies, Postage) to recognize the costs incurred. - Petty Cash (Credit): Credit the petty cash account to reflect the reduction in the petty cash fund after the expenses are paid.

Note: The specific amounts for each transaction (denoted as $XX) should be obtained from the company’s records or the bank statement.

Conclusion:

Accurate journal entries are essential for maintaining correct financial records. By properly recording bank service charges, NSF checks, and petty cash transactions, LawnMow ensures that its financial statements accurately reflect its financial position. Regular bank reconciliations and diligent journalizing practices are vital components of effective financial management.