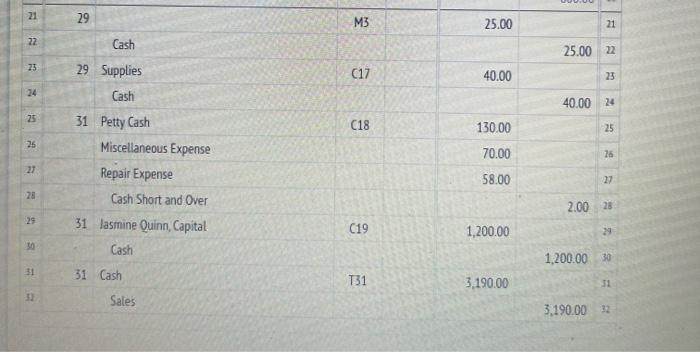

Transactions: Aug 29 29 31 Received bank statement showing August bank service charge $25.00 M3. Paid cash for supplies, $40.00. C17. Paid cash to replenish the petty cash fund, $13000: miscellaneous expense, $70.00; repairs, $58.00, cash short, $2.00. C18 Paid cash to owner as a withdrawal of equity, $1,200.00.019. Received cash from sales, $3,190.00. T31. 31 31 21 29 M3 25.00 21 22 Cash 25.00 22 25 (17 40.00 23 24 40.00 24 25 C18 130.00 25 26 29 Supplies Cash 31 Petty Cash Miscellaneous Expense Repair Expense Cash Short and Over 31 Jasmine Quinn, Capital Cash 70.00 26 21 58.00 27 28 2.00 25 29 C19 1,200.00 29 50 1,200.00 30 31 31 Cash T31 3.190.00 51 Sales 3.190.0022

The Correct Answer and Explanation is :

To address the transactions provided, let’s break down each item step-by-step, focusing on journal entries and explanations.

1. Bank Service Charge:

Date: Aug 29

Transaction: Received bank statement showing a bank service charge of $25.00.

Journal Entry:

- Debit: Bank Service Charges $25.00

- Credit: Cash $25.00

Explanation: This represents a fee charged by the bank, which reduces the cash balance.

2. Paid for Supplies:

Date: Aug 29

Transaction: Paid cash for supplies amounting to $40.00.

Journal Entry:

- Debit: Supplies $40.00

- Credit: Cash $40.00

Explanation: This entry records the purchase of supplies using cash, increasing the Supplies account while reducing the Cash account.

3. Replenishing Petty Cash Fund:

Date: Aug 31

Transaction: Paid cash to replenish the petty cash fund of $130.00. The details include miscellaneous expenses ($70.00), repairs ($58.00), and a cash shortfall of $2.00.

Journal Entry:

- Debit: Miscellaneous Expense $70.00

- Debit: Repairs Expense $58.00

- Debit: Cash Short and Over $2.00

- Credit: Cash $130.00

Explanation: When replenishing the petty cash fund, the total of the expenses (miscellaneous and repairs) and the cash shortage is recorded as debits. The cash balance is reduced by the amount spent and replenished.

4. Owner Withdrawal of Equity:

Date: Aug 31

Transaction: Paid cash to the owner as a withdrawal of equity, amounting to $1,200.00.

Journal Entry:

- Debit: Owner’s Equity $1,200.00

- Credit: Cash $1,200.00

Explanation: This entry represents the withdrawal of cash by the owner, reducing both the Cash balance and the owner’s equity in the business.

5. Cash Received from Sales:

Date: Aug 31

Transaction: Received cash from sales, amounting to $3,190.00.

Journal Entry:

- Debit: Cash $3,190.00

- Credit: Sales Revenue $3,190.00

Explanation: Cash received from sales is recorded as an increase in Cash, with a corresponding increase in Sales Revenue.

Overall Explanation:

These journal entries are necessary to accurately reflect the financial activity of a business. Each transaction involves a debit and a credit to maintain the accounting equation, ensuring that assets equal liabilities and equity. The entries cover expenses, equity withdrawals, replenishing petty cash, and sales receipts. By following this systematic approach, the business can maintain accurate financial records, which is vital for assessing its financial health and making informed decisions.

These transactions collectively provide a snapshot of the business’s cash flow activities and changes in financial position during the period.