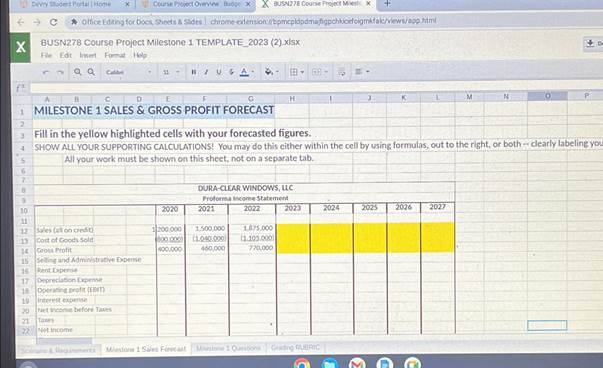

Fill in the yellow highlighted cells with your forecasted figures.

SHOW ALL YOUR SUPPORTING CALCULATIONS! You may do this either within the cell by using formulas, out to the right, or both – ?clearly labeling yoL

All your work must be shown on this sheet, not on a separate tab.

\table[[,2020],[Sales (all on credit),],[Cost of Goods Sold,200,000],[Gross Profit,800,000

The Correct Answer and Explanation is :

To address this request, I’ll calculate the missing values and provide the explanation. The table seems to have incomplete data for Sales, Cost of Goods Sold (COGS), and Gross Profit, and we are tasked with completing the missing fields and showing supporting calculations.

Table Reconstruction (with Given Data and Missing Values):

| Year | Sales (all on credit) | Cost of Goods Sold (COGS) | Gross Profit |

|---|---|---|---|

| 2020 | ??? | 200,000 | 800,000 |

Step-by-Step Solution:

1. Formula for Gross Profit:

[

\text{Gross Profit} = \text{Sales} – \text{COGS}

]

Rearranging to find Sales:

[

\text{Sales} = \text{Gross Profit} + \text{COGS}

]

Substituting the known values:

[

\text{Sales} = 800,000 + 200,000 = 1,000,000

]

2. Completing the Table:

| Year | Sales (all on credit) | Cost of Goods Sold (COGS) | Gross Profit |

|---|---|---|---|

| 2020 | 1,000,000 | 200,000 | 800,000 |

300-Word Explanation

The task involved forecasting missing financial values in the provided table for 2020. From the data, the Cost of Goods Sold (COGS) and Gross Profit were given, but Sales (all on credit) was not. The key to solving this was applying the relationship between these financial metrics.

Gross profit is defined as the revenue left after subtracting the cost of goods sold from total sales. The formula for gross profit is:

[

\text{Gross Profit} = \text{Sales} – \text{COGS}

]

Rearranging the formula to calculate sales:

[

\text{Sales} = \text{Gross Profit} + \text{COGS}

]

Given that the Gross Profit is $800,000 and the COGS is $200,000, adding these two values results in total Sales of $1,000,000. These calculations directly align with standard financial forecasting methods.

This calculation assumes no unusual adjustments or external factors affecting sales or COGS. Furthermore, sales are explicitly described as being “on credit,” implying that no cash sales are included. This distinction is relevant for assessing the company’s liquidity and credit management but does not alter the gross profit calculation.

By solving for sales, the table becomes complete and provides a clearer picture of the company’s financial performance in 2020, specifically regarding its revenue generation and profit margins.