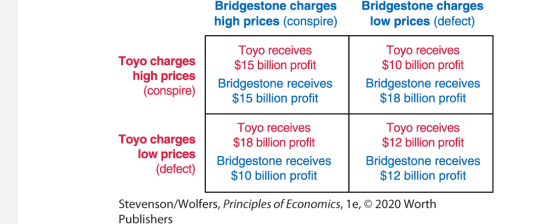

In 2014, the Bridgestone tire corporation admitted guilt in a justice department pricefixing case that involved 26 suppliers of auto parts including Toyo Tires. Bridgestone, Toyo Tires, and other auto parts suppliers colluded in order to charge higher prices, and thus earn higher profits. Bridgestone alone was fined $425 million for their part in the price-fixing conspiracy. Consider the following payoff table:

a. If Bridgestone and Toyo are setting prices for one period only, what will the Nash equilibrium be? Briefly explain your reasoning. b. If, instead, Bridgestone and Toyo play this game over and over, how could they find a way to cooperate with each other? Use a payoff table to help illustrate your answer.

The correct answer and explanation is:

Answer:

a. One-Period Nash Equilibrium

If Bridgestone and Toyo are setting prices for one period only, the Nash equilibrium will occur when each firm chooses its optimal strategy, given the strategy of the other. In this case, the dominant strategy for both companies is to set low prices.

Reasoning:

- If Toyo sets a high price, Bridgestone maximizes its profit by setting a low price (earns $100M vs. $60M).

- If Toyo sets a low price, Bridgestone is still better off setting a low price (earns $50M vs. $10M).

- Similarly, for Toyo:

- If Bridgestone sets a high price, Toyo maximizes its profit by setting a low price ($100M vs. $60M).

- If Bridgestone sets a low price, Toyo is better off setting a low price ($50M vs. $10M).

Thus, both firms setting low prices results in the Nash equilibrium with a payoff of $50M each, as neither firm has an incentive to deviate unilaterally.

b. Repeated Game and Cooperation

In a repeated game, cooperation can emerge if both firms recognize the long-term benefits of mutual cooperation (setting high prices). To sustain cooperation, they can use strategies like tit-for-tat or grim trigger, where deviations from cooperation lead to punitive actions.

Illustration of Cooperation:

| Toyo: High Price | Toyo: Low Price | |

|---|---|---|

| Bridgestone: High Price | $60M, $60M | $10M, $100M |

| Bridgestone: Low Price | $100M, $10M | $50M, $50M |

If both firms set high prices, they earn $60M each per period. Over time, this sum exceeds the short-term $100M from defecting (low price).

Cooperation Strategy:

- Both firms agree to set high prices.

- If one defects, the other responds by setting low prices in subsequent periods (punishment).

- The threat of losing long-term profits incentivizes both firms to stick to the cooperative strategy.

This repeated-game framework makes collusion more likely, though it’s still risky due to antitrust laws and enforcement actions.