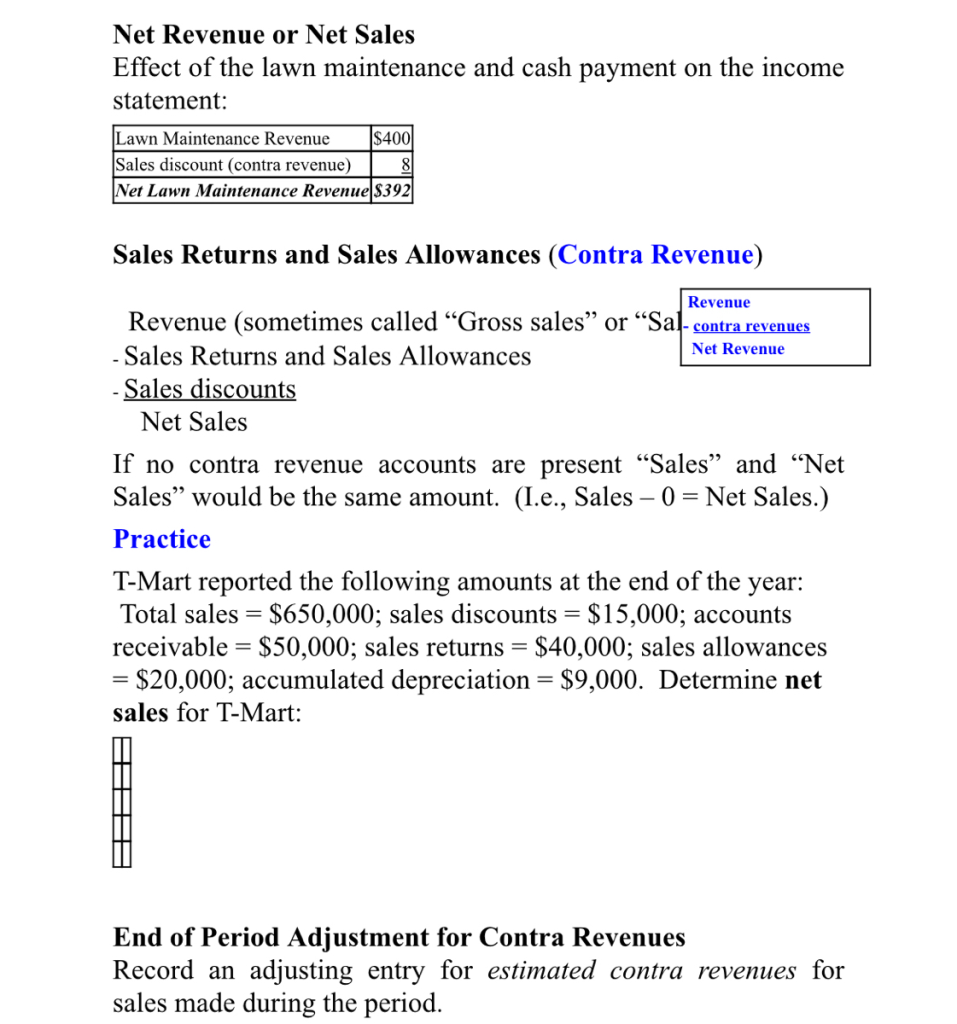

Net Revenue or Net Sales Effect of the lawn maintenance and cash payment on the income statement: Lawn Maintenance Revenue Sales discount (contra revenue) $400 8 Net Lawn Maintenance Revenue $392 Sales Returns and Sales Allowances (Contra Revenue) Revenue (sometimes called “Gross sales” or “Sal Revenue – contra revenues – Sales Returns and Sales Allowances Net Revenue – Sales discounts Net Sales If no contra revenue accounts are present “Sales” and “Net Sales” would be the same amount. (I.e., Sales – 0 Net Sales.) Net Revenue or Net Sales Practice T-Mart reported the following amounts at the end of the year: Total sales $650,000; sales discounts = $15,000; accounts receivable = $50,000; sales returns = $40,000; sales allowances = $20,000; accumulated depreciation = $9,000. Determine net sales for T-Mart: End of Period Adjustment for Contra Revenues Record an adjusting entry for estimated contra revenues for sales made during the period.

The Correct Answer and Explanation is :

To calculate Net Sales for T-Mart, we need to consider the following items from the information provided:

- Total Sales: $650,000

- Sales Discounts: $15,000 (contra revenue)

- Sales Returns: $40,000 (contra revenue)

- Sales Allowances: $20,000 (contra revenue)

The formula for calculating Net Sales is:

[

\text{Net Sales} = \text{Total Sales} – \text{Sales Discounts} – \text{Sales Returns} – \text{Sales Allowances}

]

Step-by-Step Calculation:

[

\text{Net Sales} = 650,000 – 15,000 – 40,000 – 20,000

]

[

\text{Net Sales} = 650,000 – 75,000

]

[

\text{Net Sales} = 575,000

]

Thus, Net Sales for T-Mart would be $575,000.

Explanation:

Net Sales represent the amount a company retains after accounting for returns, discounts, and allowances that reduce the total sales revenue.

- Sales Discounts: These represent the reductions in the selling price given to customers who pay their bills early or based on other promotional pricing strategies. Sales discounts of $15,000 reduce the total sales revenue.

- Sales Returns: These occur when customers return purchased goods, and it represents a reduction in the company’s sales. In this case, customers returned products worth $40,000.

- Sales Allowances: These are price reductions granted to customers due to issues with the purchased goods, like defects or late delivery. T-Mart offered $20,000 in sales allowances.

By subtracting these contra-revenue items (sales discounts, sales returns, and sales allowances) from the total sales, we arrive at Net Sales, which provides a more accurate figure of the revenue T-Mart can expect to collect after these reductions. This is an important number because it reflects the actual earnings of the company from its sales activities, and it is used in various profitability and financial analysis metrics.