The _ decision rule is considered the “”best”” in principle.

A) internal rate of return

B) payback period

C) average accounting return

D) net present value

E) profitability index

The Correct Answer and Explanation is :

The correct answer is D) Net Present Value (NPV).

Explanation:

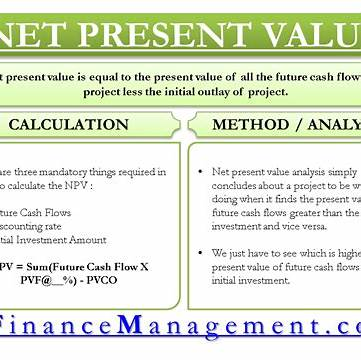

In capital budgeting, the Net Present Value (NPV) decision rule is widely regarded as the most effective method for evaluating investment opportunities. NPV measures the difference between the present value of cash inflows generated by a project and the present value of its cash outflows, discounted at the project’s cost of capital. This approach accounts for the time value of money, ensuring that future cash flows are appropriately adjusted to reflect their value in today’s terms.

Advantages of NPV:

- Time Value of Money Consideration: NPV incorporates the principle that money’s value decreases over time due to factors like inflation and opportunity cost. By discounting future cash flows, NPV provides a realistic assessment of a project’s profitability.

- Direct Measure of Value Addition: A positive NPV indicates that a project is expected to add value to the firm, as the present value of inflows exceeds the present value of outflows. Conversely, a negative NPV suggests the project would diminish shareholder value.

- Consistency with Profit Maximization: NPV aligns with the goal of maximizing shareholder wealth. Projects with higher NPVs are preferred, as they are anticipated to contribute more significantly to the company’s financial performance.

- Comprehensive Cash Flow Assessment: NPV considers all expected cash flows throughout a project’s lifespan, providing a holistic view of its financial impact.

Comparison with Other Methods:

- Internal Rate of Return (IRR): While IRR is a popular metric that calculates the discount rate at which a project’s NPV equals zero, it can be misleading when comparing projects of different sizes or durations. IRR assumes that intermediate cash flows are reinvested at the IRR itself, which may not be realistic. citeturn0search7

- Payback Period: This method determines how long it takes to recover the initial investment. However, it ignores the time value of money and does not consider cash flows beyond the payback period, potentially overlooking the project’s overall profitability. citeturn0search1

- Average Accounting Return (AAR): AAR calculates the average annual accounting profit as a percentage of the average investment. It is based on accounting data rather than cash flows and does not account for the time value of money, limiting its effectiveness in capital budgeting decisions. citeturn0search14

In summary, the NPV decision rule is considered the “best” in principle because it provides a clear, time-adjusted measure of a project’s expected contribution to shareholder value, aligning closely with the objective of profit maximization.