Innovative Inc. has a piece of equipment with a carrying amount of $200,500. Technology has changed, indicating that the machine may be impaired. A new machine with updated technology could be purchased for $367,000. A used machine of similar vintage is listed on-line for $177,000. The estimated discounted cash flows from continuing to use the asset are $165,000. The undiscounted cash flows from the use of the asset are $197,000. The estimated value if the company sold the asset less commission costs is $172,000.

Required:

What is the recoverable amount?

What is the amount of impairment?

The correct answer and explanation is :

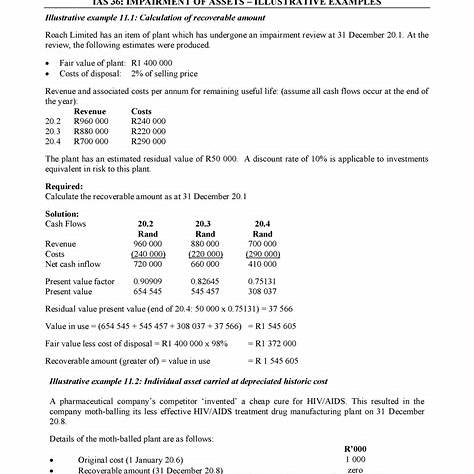

To determine the recoverable amount and any impairment for Innovative Inc.’s equipment, we follow the guidelines set out in IAS 36 – Impairment of Assets. An asset is considered impaired when its carrying amount exceeds its recoverable amount. The recoverable amount is defined as the higher of:

- Fair Value Less Costs of Disposal (FVLCD): The price obtainable from the sale of an asset in an arm’s length transaction between knowledgeable, willing parties, less the costs of disposal.

- Value in Use (VIU): The present value of the future cash flows expected to be derived from the asset.

Given Data:

- Carrying Amount: $200,500

- Fair Value: $177,000

- Costs of Disposal: Not explicitly provided; however, the estimated value if sold less commission costs is $172,000, implying disposal costs of $5,000 ($177,000 – $172,000).

- Undiscounted Cash Flows: $197,000

- Discounted Cash Flows (VIU): $165,000

Calculations:

- Fair Value Less Costs of Disposal (FVLCD): [ \text{FVLCD} = \$177,000 – \$5,000 = \$172,000 ]

- Value in Use (VIU): Given as $165,000.

- Recoverable Amount: The recoverable amount is the higher of FVLCD and VIU: [ \text{Recoverable Amount} = \max(\$172,000, \$165,000) = \$172,000 ]

- Impairment Loss: [ \text{Impairment Loss} = \text{Carrying Amount} – \text{Recoverable Amount} = \$200,500 – \$172,000 = \$28,500 ]

Explanation:

Innovative Inc.’s equipment has a carrying amount of $200,500. To assess impairment, we compare this to the recoverable amount, which is the higher of the asset’s FVLCD and VIU. The FVLCD is calculated by subtracting the estimated costs of disposal from the fair value, resulting in $172,000. The VIU, representing the present value of expected future cash flows from the asset, is $165,000. Between these two, the FVLCD of $172,000 is higher and thus considered the recoverable amount. Since the carrying amount exceeds the recoverable amount, an impairment loss of $28,500 is recognized.

Conclusion:

- Recoverable Amount: $172,000

- Impairment Loss: $28,500

This impairment loss should be recognized in Innovative Inc.’s financial statements, reducing the carrying amount of the equipment to its recoverable amount of $172,000, in accordance with IAS 36.