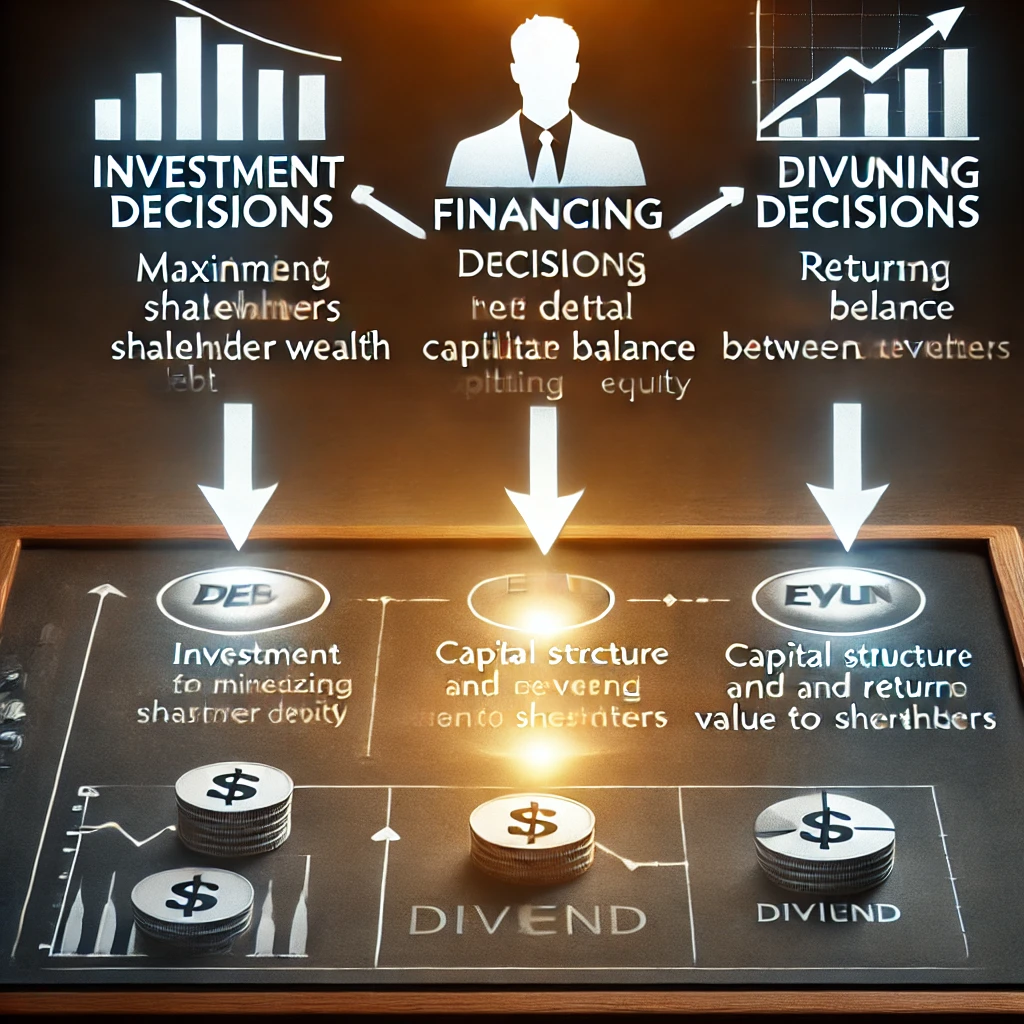

An optimal combination of decisions relating to investment, financing and dividends will maximize the value of the firm to its shareholder.

The correct answer and explanation is :

The correct answer to the statement is “The goal of financial management is to maximize the value of the firm to its shareholders”.

Explanation:

In financial management, the primary objective is to maximize the wealth of the firm’s shareholders. This is accomplished through a combination of decisions relating to investment, financing, and dividends, which are crucial elements of corporate finance.

- Investment Decisions (Capital Budgeting):

These decisions determine where and how a firm will allocate its resources. The firm must decide which projects or investments will generate the highest returns. The goal is to choose investments that increase the firm’s value, considering the risks involved. Investments are typically evaluated based on metrics like Net Present Value (NPV), Internal Rate of Return (IRR), and payback period. An optimal investment decision means investing in projects that generate more return than their cost of capital. - Financing Decisions (Capital Structure):

These decisions focus on how to fund the firm’s investments. Firms can raise capital through equity (issuing shares) or debt (taking loans). The optimal capital structure is one that minimizes the cost of capital while maintaining the flexibility to fund projects that create value. A balanced mix of debt and equity ensures that a firm can take advantage of financial leverage without overburdening itself with excessive debt risk. The cost of capital and the weighted average cost of capital (WACC) are crucial concepts here. - Dividend Decisions:

The dividend decision involves determining how much profit the company should distribute to shareholders as dividends versus how much it should retain for reinvestment in the firm. The goal is to strike a balance between returning value to shareholders and retaining enough earnings to fund future growth opportunities. The dividend payout ratio should be set such that it aligns with the firm’s long-term strategic goals while also satisfying shareholder preferences for income versus capital gains.

By making the optimal combination of these decisions, a firm maximizes its shareholder value. The value of a firm is typically measured by its stock price, and financial managers strive to enhance this value through these interrelated decisions.

Here is a conceptual diagram illustrating how the investment, financing, and dividend decisions are interconnected and contribute to maximizing the value of the firm to its shareholders. The optimal combination of these decisions directly affects the firm’s stock price and, ultimately, its value.