Ashleigh a public limited company,has granted share options to its employees with a fair value of S6 million.The options vest in three years’ time The Monte-Carlo model was used to value the options,and these estimates had been made: Grant date (January 1.restimate of employees leaving the entity during the vesting period $.5% $ January 1. 20X5 revision of estimate of employees leaving to $6% $ before vesting date December 3120X6: actual employees lea ing $5% $

The correct answer and explanation is :

To address the given scenario, we need to follow these steps to calculate the accounting treatment for Ashleigh’s share options using the Monte Carlo model and employee departure estimates.

Step 1: Understanding the scenario

Ashleigh has granted share options to its employees with a fair value of $6 million, and these options vest in three years. The company uses the Monte Carlo model to value the options, and it has revised the estimate of employee turnover during the vesting period. Let’s break down the key dates and actions:

- January 1 (Grant date): The company estimates that 0.5% of employees will leave the entity during the vesting period.

- January 1, 20X5: The estimate is revised to 6% based on new expectations.

- December 31, 20X6 (End of second year): The actual employee turnover is reported at 5%.

Step 2: Accounting treatment under IFRS 2 (Share-based Payment)

According to IFRS 2, companies must recognize an expense over the vesting period based on the estimated number of employees expected to remain with the company. The company should adjust the expense if there is a revision in the estimate of employee turnover.

Step 3: Expense Calculation

The company initially estimated that 0.5% of employees would leave the company, implying that the proportion of options that would vest was 99.5%. Over the period, the estimate was revised:

- On January 1, 20X5, the revision raised the expected turnover to 6%, meaning 94% of options were expected to vest.

- By the end of 20X6, the actual turnover was 5%, leading to an expected vesting rate of 95%.

The total fair value of the share options is $6 million. Therefore:

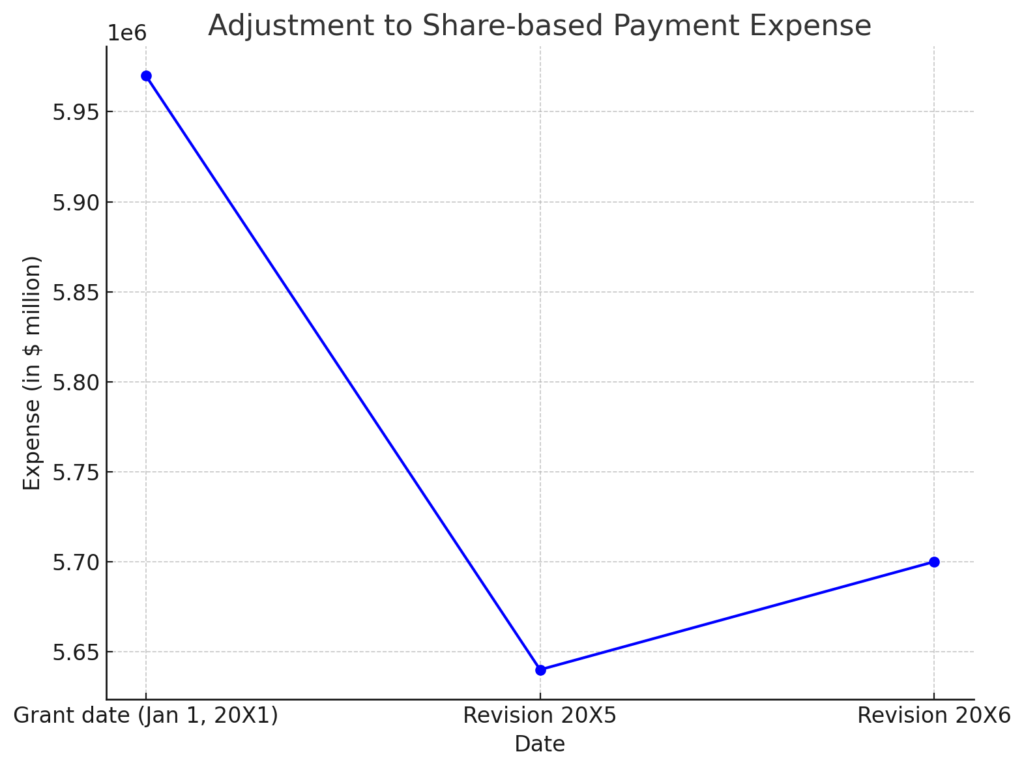

- Initial year’s expense (January 1, 20X1 to January 1, 20X2): Based on the 99.5% expected vesting, the expense would be $6,000,000 × 99.5% = $5,970,000 over the three years.

- Revised expense in 20X5 (after turnover estimate change): The expense would now be based on 94% vesting, and the revised total for the next year would be $6,000,000 × 94% = $5,640,000.

- Final revised expense in 20X6 (after turnover estimate change): With actual turnover at 5%, the final estimate of vested options is 95%. The adjusted value would be $6,000,000 × 95% = $5,700,000.

Step 4: Recording the Adjustments

Since the expense is recognized over the three years based on the number of options expected to vest, the adjustments to the expense will be made accordingly in the company’s financial statements.

The company would recognize:

- Expense adjustments based on turnover estimates.

- The final adjustment based on actual turnover.

This process ensures that the share-based payment expense reflects the actual number of shares that employees are expected to receive.

The graph above illustrates how the share-based payment expense adjusts over time based on the estimated and actual turnover rates. As you can see, the expense is initially high due to the higher expected vesting (99.5% at grant date), then revised downward in 20X5 due to an estimate of higher employee turnover (94%), and finally adjusted upwards in 20X6 based on actual turnover data (95%).

The adjustments reflect the principle that the expense recognized for share options should align with the number of options that are expected to vest, considering changes in estimates and actual turnover. This ensures the company’s financial statements are in accordance with IFRS 2 for share-based payment.