Assume that gasoline is sold in a competitive market in which demand is relatively inelastic and supply is relatively elastic.

(a) Draw a correctly labeled graph of the gasoline market. On your graph show the equilibrium price and quantity of gasoline, labeled Pn ?and Qi.

(b) Suppose the government imposes a $2 ?per unit tax on the producers of gasoline. On your graph from part (a), ?show each of the following after the tax is imposed.

(i) The price paid by buyers, labeled Pn

(ii) The after-tax price received by sellers, labeled Ps

(iii) The quantity, labeled QT

(c) Using the labeling on your graph, explain how to calculate the total tax revenue collected by the government.

(d) Will the tax burden fall entirely on buyers, entirely on sellers, more on buyers and less on sellers, more on sellers and less on buyers, or equally on buyers and sellers? Explain.

The correct answer and explanation is :

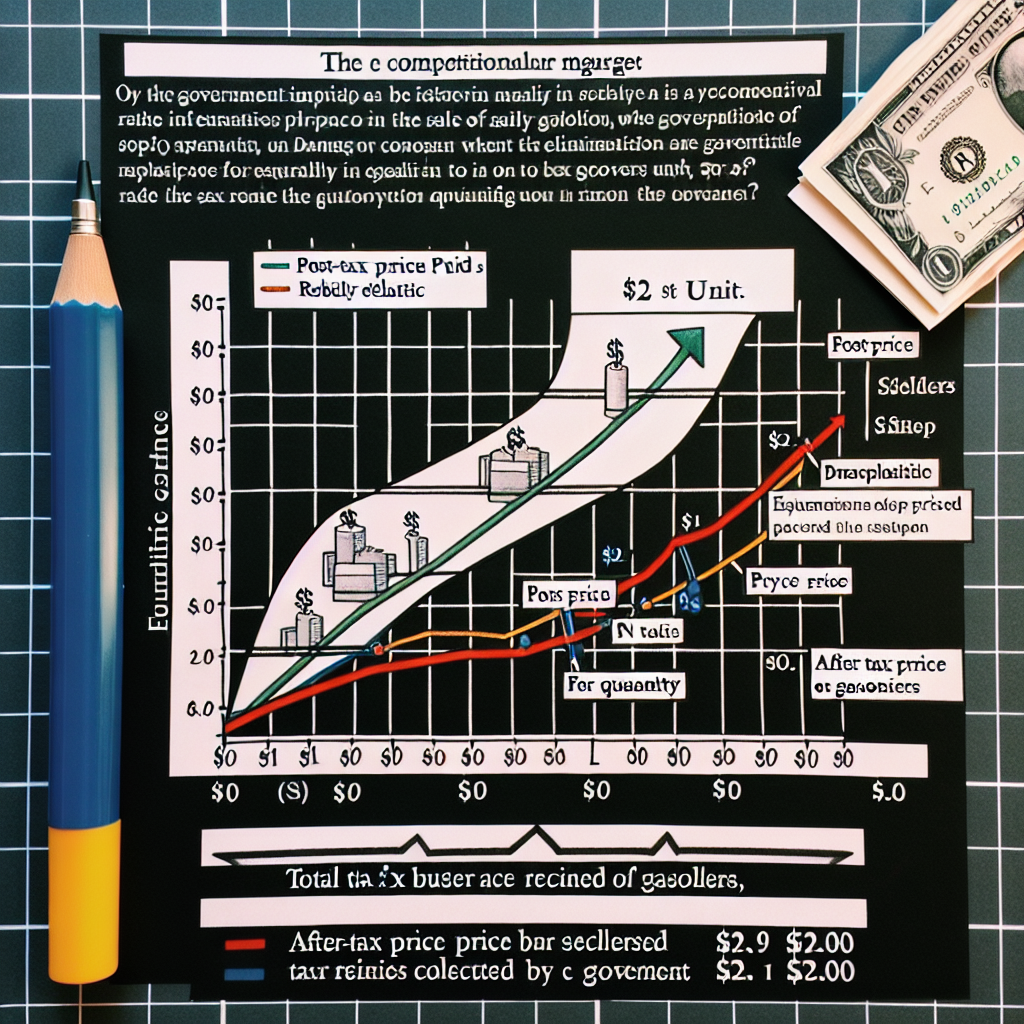

(a) Graph of the Gasoline Market

We can assume that the demand curve is relatively inelastic and the supply curve is relatively elastic. In a competitive market, the intersection of the demand and supply curves determines the equilibrium price and quantity. Let’s label the equilibrium price as ( P_n ) and the equilibrium quantity as ( Q_i ).

- The demand curve (D) will be steep, reflecting that price changes have a small effect on the quantity demanded (inelastic demand).

- The supply curve (S) will be relatively flat, reflecting that producers can respond to price changes with larger changes in quantity supplied (elastic supply).

On the graph, the equilibrium price ( P_n ) and quantity ( Q_i ) will be where the demand and supply curves intersect.

(b) Impact of a $2 Tax on Gasoline Producers

When a tax of $2 per unit is imposed on the producers, it shifts the supply curve upward by the amount of the tax. This is because the tax increases the cost of production, which reduces the quantity supplied at every price level.

(i) Price Paid by Buyers (( P_n’ )):

The price paid by buyers will increase due to the tax. This price, ( P_n’ ), will be above the original price ( P_n ), but not by the full amount of the tax, because the burden of the tax is shared between buyers and sellers.

(ii) Price Received by Sellers (( P_s )):

The after-tax price received by sellers, ( P_s ), will be lower than the price paid by buyers, reflecting the tax burden on the sellers. This price will be below ( P_n’ ), since part of the tax burden falls on the sellers.

(iii) Quantity After Tax (( Q_T )):

The quantity of gasoline sold in the market will decrease from the original equilibrium quantity ( Q_i ) to the new quantity ( Q_T ), because the tax increases the price for buyers and reduces the price received by sellers, leading to less trade.

(c) Total Tax Revenue

The total tax revenue collected by the government is calculated by multiplying the tax rate per unit by the quantity of gasoline sold after the tax. The formula is:

[

\text{Total Tax Revenue} = \text{Tax Rate} \times \text{Quantity Sold After Tax}

]

In this case, the tax rate is $2 per unit, and the quantity sold after the tax is ( Q_T ), so:

[

\text{Total Tax Revenue} = 2 \times Q_T

]

The rectangle formed on the graph, with the tax rate as the height and ( Q_T ) as the width, represents the total tax revenue.

(d) Who Bears the Burden of the Tax?

The incidence of the tax, or the burden of the tax, depends on the relative elasticities of demand and supply. Since demand is relatively inelastic and supply is relatively elastic, the burden of the tax will fall more on buyers than on sellers.

- Inelastic demand means that buyers do not significantly reduce their quantity demanded when the price rises. Therefore, they bear a larger portion of the tax burden.

- Elastic supply means that producers can easily adjust the quantity supplied when prices change. As a result, producers are less able to pass the tax burden onto consumers and bear a smaller share of the tax.

Thus, in this case, more of the tax burden falls on buyers and less on sellers.

In conclusion, since the demand for gasoline is inelastic, buyers are less responsive to price increases, and they end up paying a larger portion of the tax. Sellers, on the other hand, have a more elastic supply curve, which allows them to pass a smaller portion of the tax burden to consumers.