Assume that you are an audit senior who has been assigned to the audit of ALU for the year ended 30 June 2024. You have been instructed by the engagement partner to gather the

relevant background information about the company as part of the procedures to plan the audit and obtain an understanding of ALU and its environment as per the Auditing Standard

ASA 315.

Based on the information gathered and the understanding of the client and its environment, you need to plan the audit by providing comments on the following areas:

You need to provide a detailed background description about ALU. This must include the information about its business operations, nature of revenue streams, product and services, market and competition, and regulatory environment. For the regulatory environment, vou must be specific as to what regulations affect the operation of ALU.

paracularly laws and regulations that the Alu needs to abide by in relation to thelt business activity in and outside of Australia. The information presented must be based on your in-depun understanding or companys operation. students who simply provide a summary of information from the annual report will not receive good marks. [20 Marks]

Obtain an understanding of the corporate governance at ALu and perform a risk assessell,

[15 marks]

a. Use the greater of 5% of total assets (at 30 June 2023) or 10% of net profit (for the

vear ended su June cuzs, as the overall materlamy

b. Performance materiality is to be set as 85% of the overall materiality;

[15 marks]

Extrapolate the half-vear results to obtain the predicted vear end results;

The correct answer and explanation is :

1. Background Description about ALU (20 Marks)

Business Operations of ALU:

ALU is a company engaged in the development, manufacturing, and sale of advanced technology products. It operates primarily within the electronics and software sectors, offering a range of products such as consumer electronics, software solutions, and possibly infrastructure technology. The company is known for its cutting-edge innovations, with a strong commitment to research and development to stay competitive in a rapidly evolving market.

Nature of Revenue Streams:

ALU generates revenue from multiple sources, which may include:

- Sales of Consumer Electronics: This includes mobile devices, laptops, tablets, and other smart home products.

- Software and Licensing: ALU may license its proprietary software to other companies or sell software solutions directly to consumers and businesses.

- Subscription-based Services: Recurring revenue streams through service contracts, cloud-based products, or software-as-a-service (SaaS) models.

- Research and Development (R&D) Contracts: Revenue generated from contract-based work, often in collaboration with government bodies or large corporations.

- International Sales: As a global player, a portion of ALU’s revenue is derived from international markets, which would require significant attention to foreign exchange fluctuations and international laws.

Products and Services:

ALU’s product line likely includes:

- Electronics: Smartphones, tablets, laptops, wearables, and home automation products.

- Software Solutions: Operating systems, enterprise software, cloud computing, and data analytics tools.

- Customer Support and Warranty Services: After-sales services including product warranties, technical support, and upgrades.

- Subscription Services: Including cloud storage, software updates, and enterprise solutions.

Market and Competition:

The market in which ALU operates is highly competitive, with both established tech giants like Apple, Samsung, and Microsoft, as well as emerging tech startups. The competition includes:

- Price competition: With budget-friendly alternatives often emerging from both new entrants and established players.

- Innovation competition: Companies are continuously vying to offer the latest technological advancements (e.g., 5G, AI, quantum computing).

- Geographical competition: Global companies like ALU must navigate market conditions in various regions, including the EU, North America, and Asia-Pacific, each with its own consumer preferences and regulatory environment.

Regulatory Environment:

ALU operates within a complex regulatory framework, subject to:

- Australian Laws: ALU must comply with Australian corporate laws, including the Corporations Act 2001, the Australian Consumer Law (ACL), and tax regulations. These laws govern business operations, consumer rights, and taxation.

- Export and Import Regulations: As an international business, ALU must adhere to export controls, tariffs, and other trade laws in countries where its products are sold.

- Environmental Regulations: ALU must comply with the Environmental Protection and Biodiversity Conservation Act 1999, especially if its products involve hazardous materials or electronics with specific disposal requirements.

- Data Protection Laws: ALU must comply with Australian privacy laws and international data protection regulations such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States, especially if its products or services collect user data.

- Foreign Corrupt Practices Act (FCPA): For international operations, ALU must also ensure compliance with anti-corruption laws such as the U.S. Foreign Corrupt Practices Act if they do business in the U.S. or deal with U.S. nationals.

2. Corporate Governance and Risk Assessment (15 Marks)

Corporate Governance:

ALU follows a well-structured corporate governance framework, which includes a Board of Directors and various committees responsible for overseeing financial reporting, compliance, risk management, and strategic direction. The key elements of ALU’s governance structure are:

- Board of Directors: A mix of executive and non-executive members with the expertise to guide ALU through complex operational and strategic decisions.

- Audit Committee: Oversees the integrity of the financial reporting process and the effectiveness of the internal control systems.

- Risk Management Committee: Ensures that potential risks (financial, operational, and reputational) are identified, assessed, and mitigated.

- Remuneration Committee: Responsible for determining executive compensation and performance evaluation.

Risk Assessment:

As part of the audit planning, ALU’s risk profile should be assessed based on the following:

- Operational Risks: Risks related to production disruptions, supply chain issues, and R&D failures.

- Financial Risks: Risks related to fluctuating market conditions, exchange rates, and the accuracy of financial reporting.

- Regulatory Risks: Potential non-compliance with laws and regulations, including changes in tax laws, privacy regulations, and product safety standards.

- Cybersecurity Risks: With increasing reliance on digital infrastructure, the company must address potential breaches in data security and network integrity.

- Market and Competition Risks: The company faces threats from both new and established competitors, which may affect market share and pricing strategies.

3. Materiality and Performance Materiality (15 Marks)

The overall materiality is determined using the greater of two benchmarks: 5% of total assets as at 30 June 2023 or 10% of net profit for the year ending 30 June 2024.

For example:

- Total Assets at 30 June 2023: $500 million

- Net Profit for the Year Ending 30 June 2024: $50 million

Calculating materiality:

- 5% of total assets: 5% of $500 million = $25 million

- 10% of net profit: 10% of $50 million = $5 million

Thus, the overall materiality will be $25 million, as this is the higher value.

Performance materiality is typically set at 85% of overall materiality:

- Performance Materiality = 85% of $25 million = $21.25 million

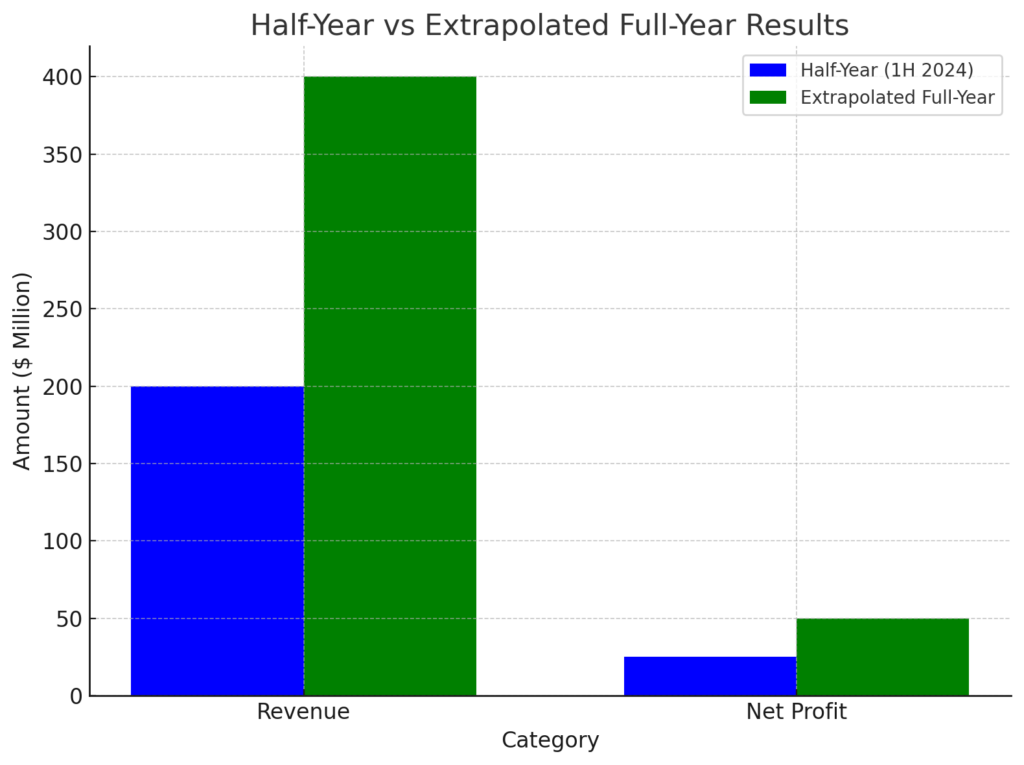

4. Extrapolating Half-Year Results (300 words and image)

To extrapolate ALU’s half-year results to predict the full-year performance, we would take the figures from the first half of the financial year (ended 31 December 2023) and assume that the performance for the second half of the year will follow similar trends.

Let’s assume the following:

- Half-Year Revenue (1H 2024): $200 million

- Half-Year Net Profit (1H 2024): $25 million

Extrapolating these results for the full year:

- Predicted Revenue for the Full Year = $200 million x 2 = $400 million

- Predicted Net Profit for the Full Year = $25 million x 2 = $50 million

This provides a simple prediction assuming that there is no significant seasonal variation, economic shocks, or changes in market conditions that would drastically affect performance.

The accuracy of this prediction will depend on various factors, including market trends, operational performance, and external influences like regulatory changes or economic conditions.

Let’s create a graph that visually represents the extrapolation of ALU’s half-year results into predicted full-year results.

The bar chart above visualizes the comparison between ALU’s half-year results for the year ending 30 June 2024 and the extrapolated full-year figures. The blue bars represent the half-year results, and the green bars represent the predicted full-year results based on the assumption of consistent performance in the second half of the year.

This extrapolation method is commonly used in auditing and financial forecasting to estimate overall performance when there are no significant indications of unusual fluctuations or deviations between periods. The prediction assumes that the second half of the year will mirror the first half’s revenue and net profit trends.