Listed below are audit situations that may affect the audit of receivables and revenue.

a. The audit of a construction company that enters into long-term construction contracts.

b. Kidz Toy Manufacturing Co. introduced a number of new products in the last quarter of the year. The company has a liberal return policy allowing retail customers to return products within 120 days of purchase.

For each circumstance, provide an indication of its audit significance and any special audit procedures that would result.

The correct answer and explanation is :

a. The audit of a construction company that enters into long-term construction contracts.

Audit Significance:

The audit of a construction company that enters into long-term construction contracts involves unique complexities. The primary audit risk is related to revenue recognition, as these contracts may span several years. According to the percentage-of-completion method (or the completed-contract method), revenue and profit must be recognized in a manner that reflects the progress of the construction project. These methods can be complex and require substantial judgment to determine the stage of completion. Therefore, the auditor must be careful to ensure that revenue and expenses are appropriately matched, with adequate disclosures related to contracts, costs, and estimates.

Special Audit Procedures:

- Review of Contract Terms: The auditor should review the contract terms and conditions to ensure proper revenue recognition methods are applied.

- Estimates of Costs and Progress: Since costs and completion estimates are subjective, auditors should evaluate the reasonableness of management’s estimates through direct observation, discussions with project managers, and testing of actual costs incurred.

- Verification of Construction Costs: Auditors should examine the costs charged to the contracts to ensure they are directly related to the construction activities.

- Work-in-Progress Review: The auditor must verify work-in-progress (WIP) balances to ensure that they align with the physical progress of construction. This can involve inspecting detailed schedules or reports on the work completed.

- Examination of Billings: The auditor should confirm the contract billings with customers to ensure that revenues are being appropriately recognized.

b. Kidz Toy Manufacturing Co. introduced a number of new products in the last quarter of the year. The company has a liberal return policy allowing retail customers to return products within 120 days of purchase.

Audit Significance:

Kidz Toy Manufacturing Co.’s liberal return policy presents a risk in the audit of revenue recognition and the estimation of sales returns. The primary issue is the possibility that revenue has been prematurely recognized, given the extended return period. Under the revenue recognition standard, sales should only be recognized when it is probable that a return will not occur, or when an estimate of returns is made based on past trends. Auditors must consider the effect of this return policy on reported sales and verify that an adequate provision for returns is recorded.

Special Audit Procedures:

- Review of Return Policy: Auditors should obtain and review the return policy to understand its terms and assess its impact on revenue recognition.

- Analysis of Return History: The auditor should analyze the company’s historical return data to assess the reasonableness of return estimates and validate the adequacy of any provisions for returns.

- Examine Sales Cutoff: The auditor should verify the sales cutoff by inspecting sales transactions occurring close to the year-end to ensure that revenues are recognized in the correct period, considering the possibility of returns.

- Assessment of Provision for Returns: The auditor should evaluate the adequacy of the provision for returns by comparing the balance in the sales returns reserve with the actual return history, ensuring that it accurately reflects expected returns.

- Customer Confirmation: For high-value transactions, auditors may confirm the terms of sales with customers to check if returns are likely and whether the terms of sale were properly followed.

Explanation:

In both cases, the primary concerns are accurate revenue recognition and estimates related to costs, returns, and completion. The construction company audit involves verifying the progress of long-term contracts and ensuring the correct timing of revenue recognition. The toy company audit focuses on the risk of premature revenue recognition due to a liberal return policy, making it critical for the auditor to ensure that the appropriate allowances for returns are recognized and that revenue is not inflated.

Both situations require specialized audit procedures tailored to the nature of the business, contractual obligations, and risk assessments related to revenue recognition.

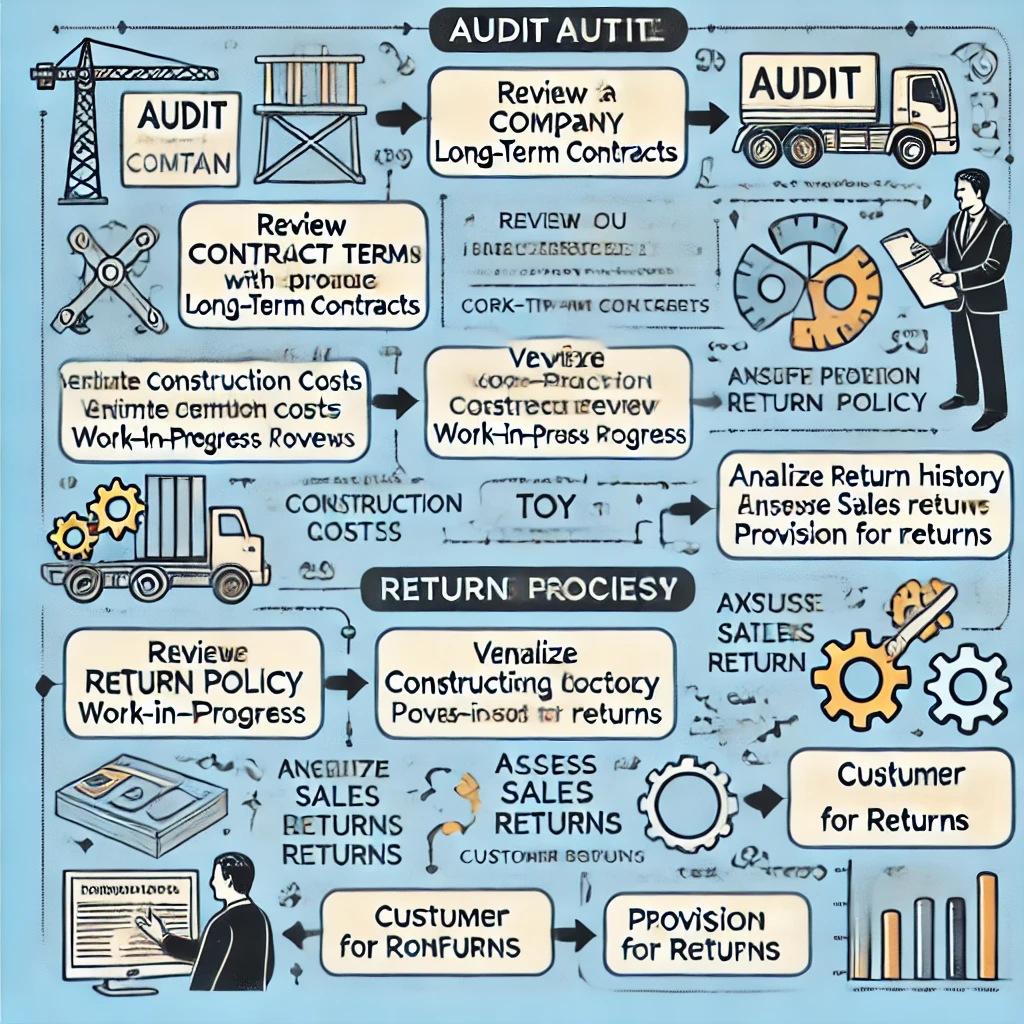

Image:

Here is the flowchart summarizing the audit procedures for both scenarios. It outlines the key audit steps for the construction company with long-term contracts and the toy manufacturing company with a liberal return policy.