When recording transactions into the accounting equation, which of the following statements are correct? (Check all that apply.)

Cash must always equal Owner’s Equity.

After recording the transaction, total assets will always equal total liabilities plus owner’s equity.

Expenses are listed on the right side of the accounting equation and will increase the owner’s equity account.

The accounting equation must always remain in balance.

The correct answer and explanation is :

Correct Statements:

- After recording the transaction, total assets will always equal total liabilities plus owner’s equity.

- The accounting equation must always remain in balance.

Incorrect Statements:

- Cash must always equal Owner’s Equity.

- This statement is incorrect. Cash is just one asset in the accounting equation, and it does not need to equal owner’s equity. The accounting equation is:

[

\text{Assets} = \text{Liabilities} + \text{Owner’s Equity}

]

Cash is part of assets, but the sum of all assets, including cash, receivables, and inventory, must balance with liabilities and owner’s equity, not just cash.

- Expenses are listed on the right side of the accounting equation and will increase the owner’s equity account.

- This statement is also incorrect. Expenses decrease owner’s equity because they reduce the net income, which ultimately reduces the equity. Expenses are not listed on the right side of the accounting equation (which represents liabilities and equity). They are recorded in the income statement and affect the equity indirectly.

Explanation:

The Accounting Equation is the fundamental principle of double-entry accounting, ensuring that the balance between assets, liabilities, and owner’s equity is maintained at all times. The equation is:

[

\text{Assets} = \text{Liabilities} + \text{Owner’s Equity}

]

- Assets are what the company owns (e.g., cash, buildings, equipment).

- Liabilities represent what the company owes (e.g., loans, payables).

- Owner’s Equity represents the owner’s investment in the company (e.g., capital, retained earnings).

Whenever a transaction occurs, the equation must remain in balance. For example:

- If a company takes out a loan (increasing liabilities), it also increases cash (an asset).

- If a company earns revenue, it increases both assets (cash or accounts receivable) and equity (through retained earnings).

Impact of Expenses:

Expenses reduce the equity side of the equation because they reduce the overall profit. When expenses are incurred, they are recorded as debits, and the corresponding decrease in equity is reflected.

Thus, after every transaction, the accounting equation must remain balanced to ensure the financial integrity of the company.

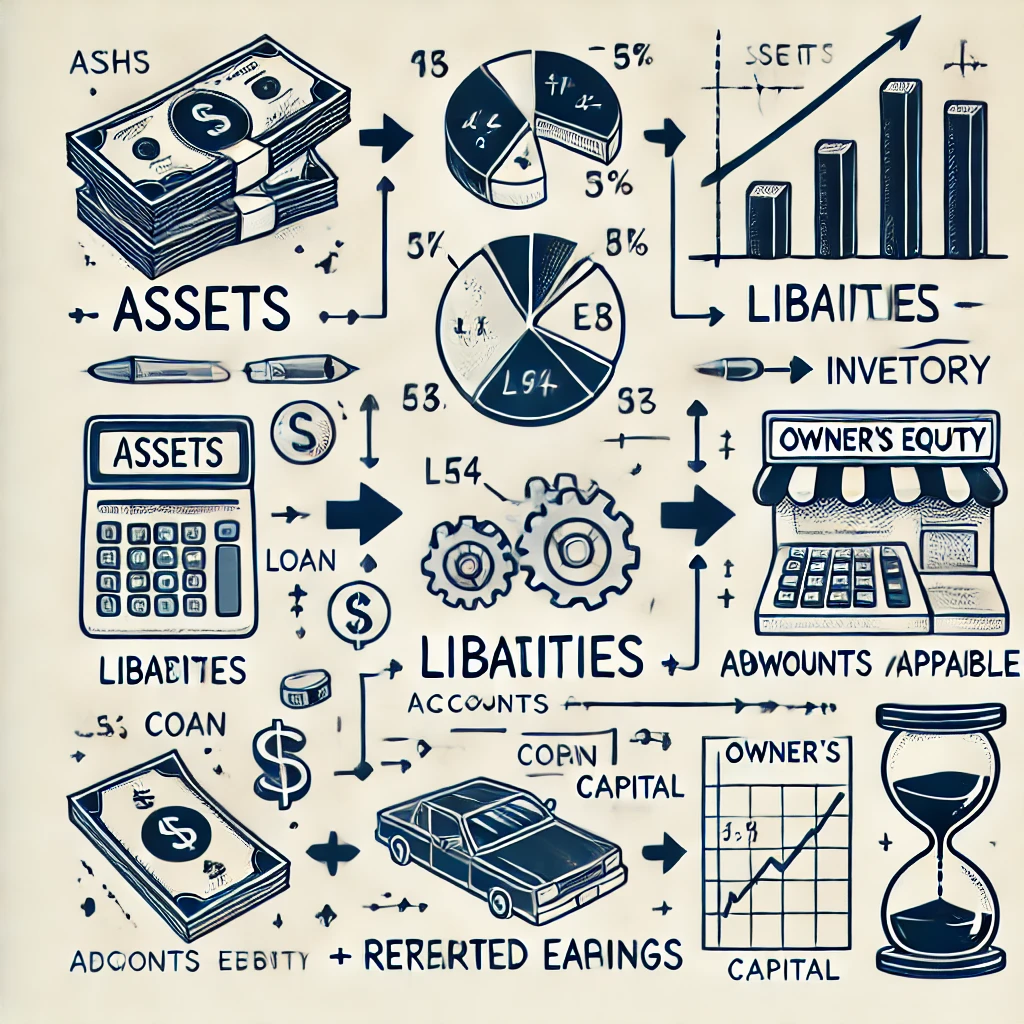

Here is a visual representation of the accounting equation showing the relationship between assets, liabilities, and owner’s equity. It highlights how each element affects the equation, helping to understand how changes in one part influence the others.