Listed below are audit situations that may affect the audit of receivables and revenue.

a. The audit of a construction company that enters into long-term construction contracts.

b. Kidz Toy Manufacturing Co. introduced a number of new products in the last quarter of the year. The company has a liberal return policy allowing retail customers to return products within 120 days of purchase.

For each circumstance, provide an indication of its audit significance and any special audit procedures that would result.

The correct answer and explanation is :

Audit Situation A: Audit of a Construction Company with Long-Term Construction Contracts

Audit Significance:

The audit of receivables and revenue in a construction company that enters into long-term contracts is highly significant due to the complexity of recognizing revenue in these contracts. The main challenge is the application of the percentage-of-completion method for revenue recognition, which involves estimating the total contract revenue, the costs to complete, and the percentage of completion. This method can significantly impact the reported revenue, expenses, and ultimately the profit.

Special Audit Procedures:

- Review of Contract Terms: Auditors must carefully review the terms of each construction contract to ensure that the method of revenue recognition aligns with the applicable accounting standards (e.g., ASC 606 or IFRS 15).

- Evaluation of Estimated Costs and Revenues: Auditors need to verify the estimates used by the company in determining the percentage of completion, ensuring they are reasonable and supported by documentation such as cost-to-date and estimates of total costs to complete.

- Inspection of Documentation: The auditor should inspect contracts, progress billing, and payments received to confirm the amounts recorded as revenue and accounts receivable are accurate and supported by the terms of the contracts.

- Assessment of the Accuracy of Construction Work in Progress (WIP): Auditors should assess the WIP reports, confirm the physical progress of the project with on-site inspections, and verify that the billing is consistent with the completion of contract milestones.

- Review of Change Orders: Since construction projects often involve change orders, the auditor must verify that these have been properly recorded in the accounting records and have been included in revenue estimates.

Audit Situation B: Kidz Toy Manufacturing Co. with Liberal Return Policy

Audit Significance:

The liberal return policy introduces a high degree of uncertainty in the recognition of revenue. As customers can return products within 120 days, it creates the need for an estimated liability for future returns, which directly affects the recognition of revenue and the associated receivables. Overestimating sales or underestimating return liabilities can distort financial reporting.

Special Audit Procedures:

- Review of Return Policies and Historical Data: Auditors need to evaluate the company’s historical return rates and analyze whether the current return policy is reasonable. This will help estimate the potential return liabilities accurately.

- Confirmation of Sales Cut-off: The auditor should test sales cut-off procedures to ensure that revenue is recognized in the appropriate period, taking into account the possibility of future returns.

- Evaluation of Return Allowance: Auditors should review the methodology for estimating return allowances and verify whether the amount recognized is reasonable. This might involve analyzing historical trends, reviewing return patterns, and testing the adequacy of the provisions made.

- Inspection of Sales and Return Transactions: Auditors should inspect a sample of sales and corresponding returns to ensure the proper adjustment of the revenue and receivables balances.

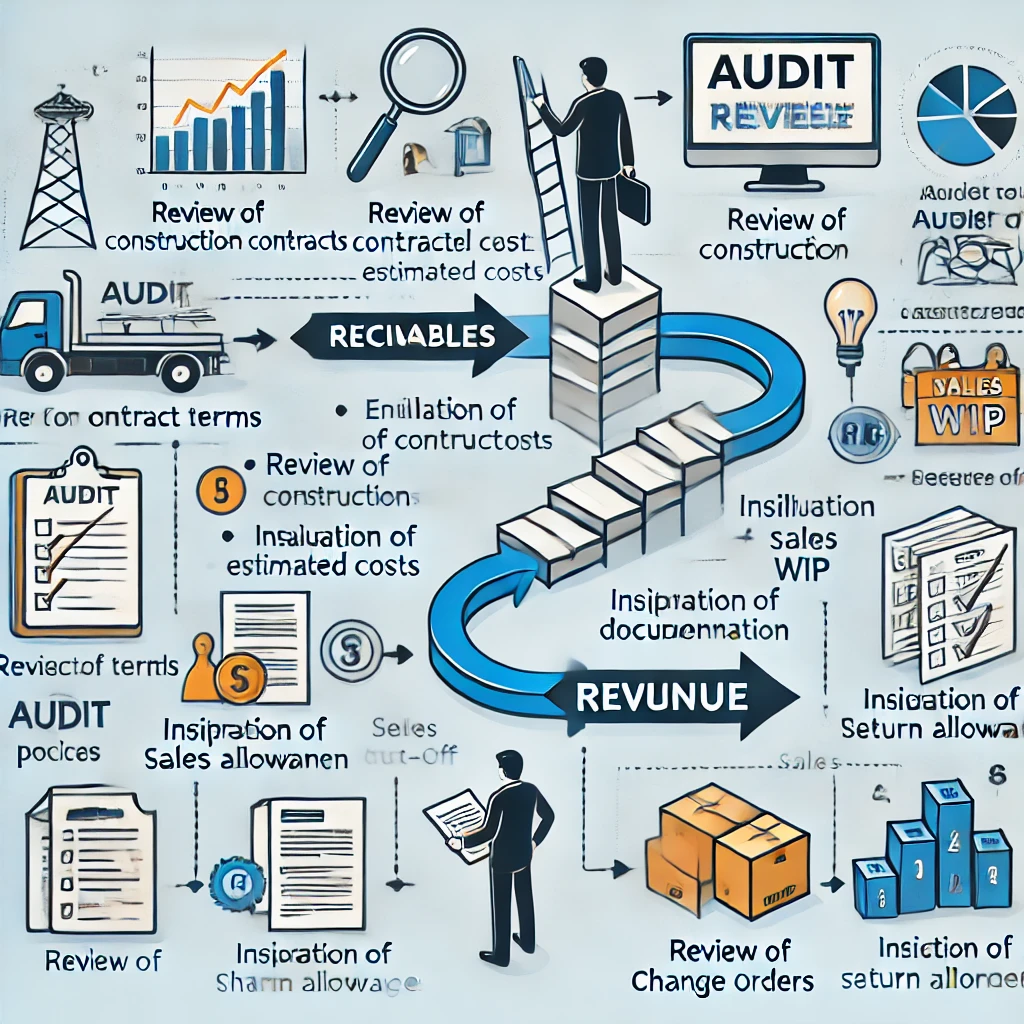

Image of the Audit Process

Here is the flowchart summarizing the audit process for both audit situations. It visually distinguishes between auditing long-term construction contracts and auditing a company with a liberal return policy.