M&M Proposition II, without taxes, states that the:

capital structure of a firm is highly relevant.

return on equity remains constant as the debt-equity ratio increases.

weighted average cost of capital decreases as the debt-equity ratio decreases.

return on equity is equal to the return on assets multiplied by the debt-equity ratio.

cost of equity increases as a firm increases its debt-equity ratio.

The correct answer and explanation is :

The correct answer is:

Cost of equity increases as a firm increases its debt-equity ratio.

Explanation:

Modigliani and Miller’s Proposition II (without taxes) is a foundational concept in corporate finance, particularly regarding capital structure and its relationship to firm value. Proposition II states that, in a world without taxes, the capital structure of a firm (i.e., the proportion of debt versus equity) does not affect the overall value of the firm. This means that the total value of the firm remains the same regardless of whether the firm is financed by more debt or more equity. However, Proposition II also highlights a key relationship between the firm’s cost of equity, its cost of debt, and its overall cost of capital.

Proposition II asserts that as a firm increases its leverage (i.e., increases its debt-to-equity ratio), the cost of equity increases. This happens for the following reasons:

- Increased Risk for Equity Holders: As the firm takes on more debt, the risk borne by equity holders increases. This is because, in the case of financial distress, debt holders are paid before equity holders. To compensate for this increased risk, equity investors demand a higher return, which leads to an increase in the cost of equity.

- Relationship with the Debt-Equity Ratio: The cost of equity is directly related to the firm’s debt-equity ratio. The formula derived from Proposition II shows that the cost of equity increases as the debt-equity ratio rises. This can be expressed as: [

\text{Cost of Equity} = \text{Cost of Assets} + (\text{Cost of Assets} – \text{Cost of Debt}) \times \text{Debt-Equity Ratio}

] As debt increases, the cost of equity rises to reflect the higher financial risk for equity holders. - Weighted Average Cost of Capital (WACC): Although the weighted average cost of capital (WACC) remains constant in the absence of taxes (since the increase in the cost of equity is offset by the cheaper cost of debt), the increase in the cost of equity due to higher leverage reflects the trade-off between risk and return.

In summary, Modigliani and Miller’s Proposition II highlights that as a firm increases its leverage, its cost of equity rises due to the increased risk faced by shareholders, even though the overall cost of capital may remain constant.

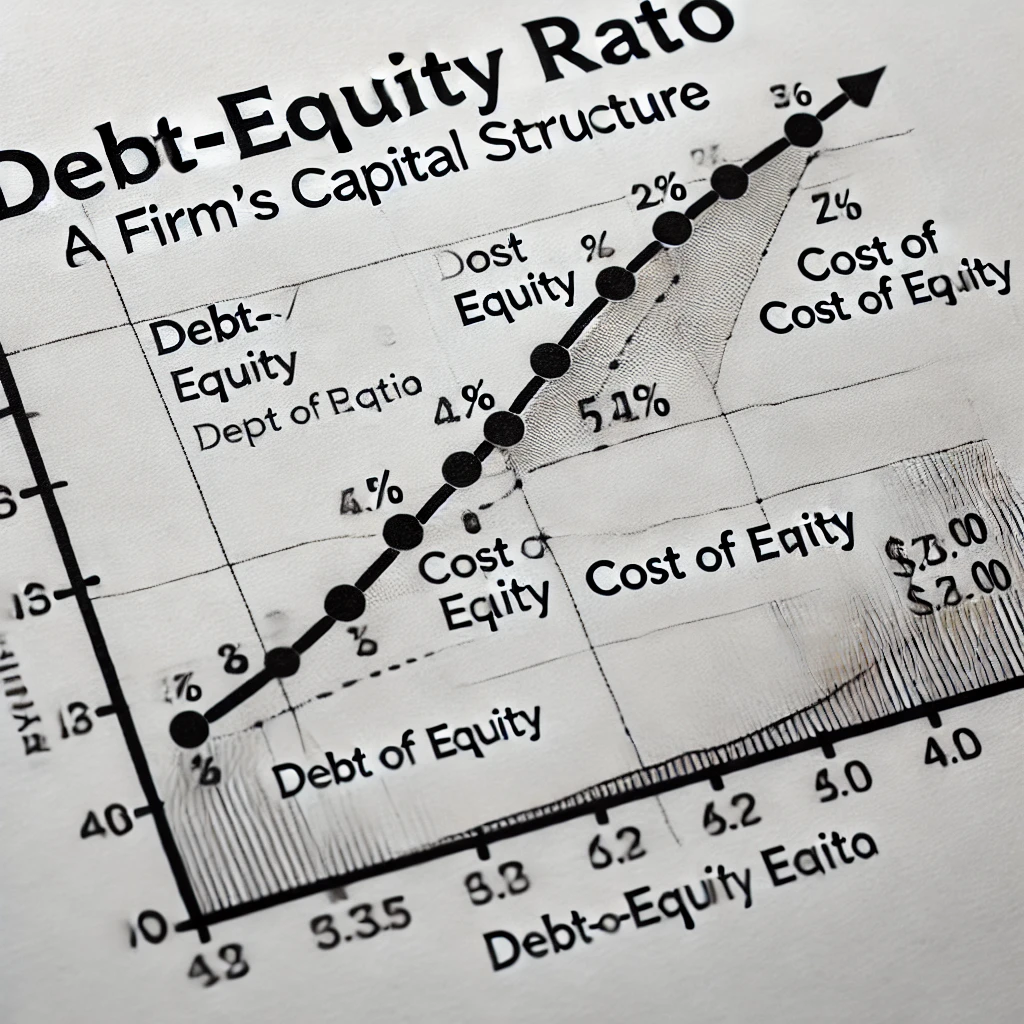

Here is the chart showing the relationship between the debt-equity ratio and the cost of equity in a firm’s capital structure. As you can see, the cost of equity increases as the debt-equity ratio rises, illustrating the key point of Modigliani and Miller’s Proposition II.