Most investors are risk averse which means:

they will assume more risk only if they are compensated by higher expected return.

they will always invest in the investment with the lowest possible risk.

they actively seek to minimize their risks.

they avoid the stock market due to the high degree of risk.

The correct answer and explanation is :

The correct answer is:

They will assume more risk only if they are compensated by higher expected return.

Explanation:

Risk aversion refers to an investor’s preference for avoiding uncertainty and potential losses. Investors who are risk-averse tend to avoid situations where there is a high likelihood of losing their investment, or where the potential for returns is uncertain or volatile. This concept is based on the fundamental principle that risk-averse investors will generally prefer a safer, more predictable return, even if it means accepting lower gains.

However, while risk-averse investors prefer safer investments, they are not completely unwilling to take on any risk. If the potential for a higher return justifies the additional risk, these investors may choose to take on more risk. This is called the risk-return tradeoff. For example, if an investor can potentially earn higher returns by investing in a volatile stock or a high-risk investment, they may choose to do so — but only if they are compensated for the risk they are taking. This compensation typically takes the form of higher expected returns to balance the added uncertainty.

In this sense, risk-averse investors are still willing to take on some degree of risk, but they will demand a higher expected return to compensate for that increased uncertainty. If the expected return does not justify the risk, the investor may avoid the investment altogether.

This is why most risk-averse investors will not necessarily avoid the stock market altogether, nor will they always opt for the lowest-risk investment. They will seek investments where the potential reward is worth the potential risk. It’s also important to note that risk aversion can vary from one investor to another, depending on factors like their financial goals, time horizon, and personal risk tolerance.

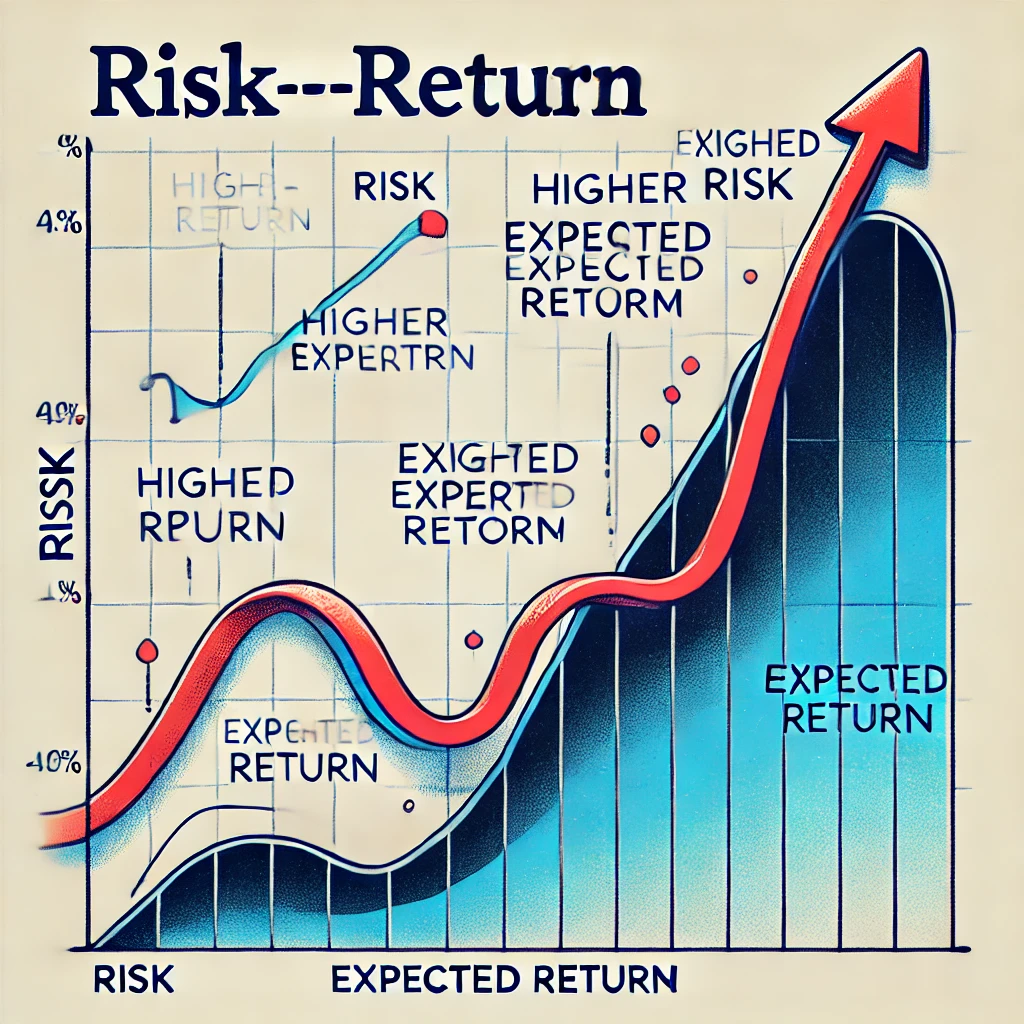

The chart above illustrates the risk-return tradeoff, showing how higher risk is associated with higher expected return. It demonstrates that risk-averse investors typically prefer lower-risk investments unless the potential return justifies the additional risk. The curve for risk-averse investors rises more gradually compared to that of more risk-tolerant investors. This visual representation helps in understanding the key concept that risk-averse investors are willing to take on additional risk only if they are compensated with higher returns.