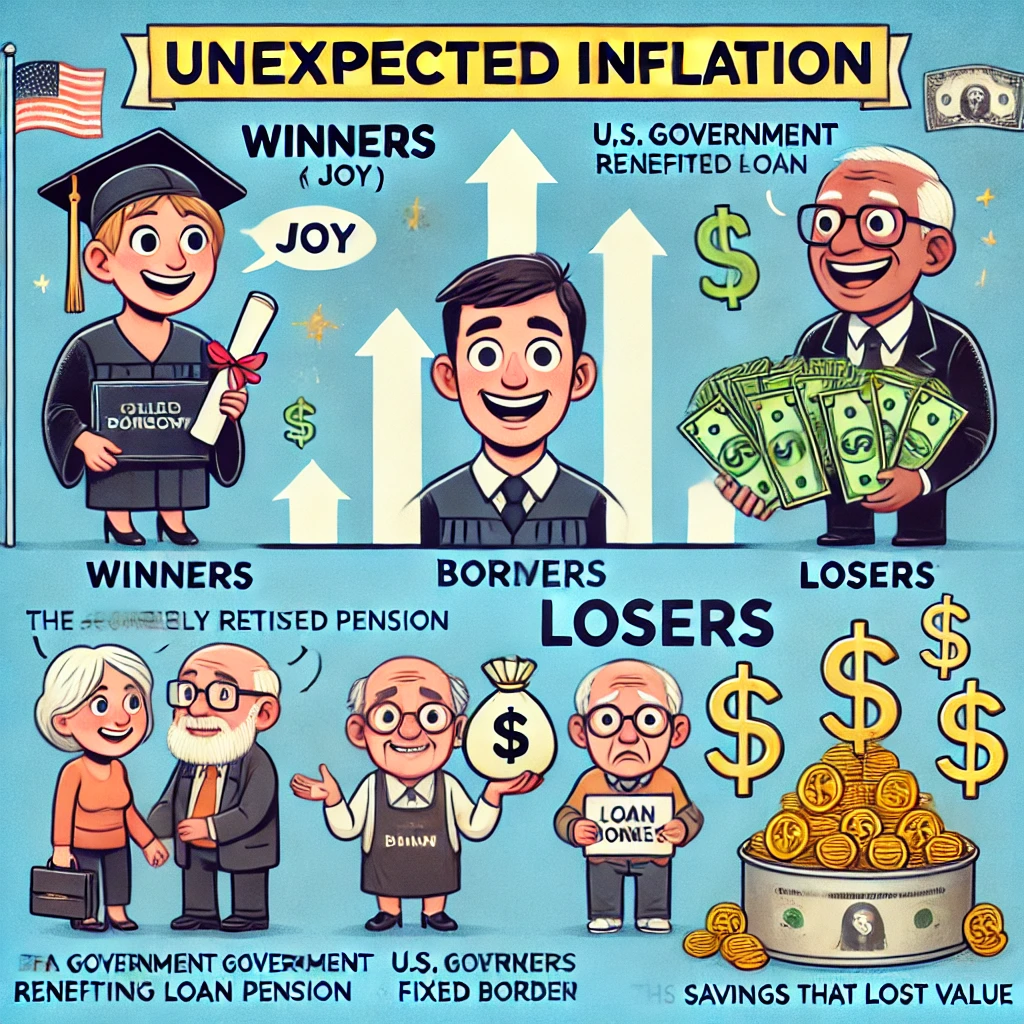

Determine if the people in the example have benefited (i.e., are winners) or have been harmed (i.e., are losers) by unexpected inflation. Winners Losers Answer Bank Karen, a retired school teacher who relies upon her fixed pension to pay for her expenses Third National, a bank that loaned many people money for home purchases Herb, who keeps his savings in an old coffee can The United States federal government, which had almost $15 trillion in debt in 2011 Joy, who borrowed $40,000 to pay for her college education

The correct answer and explanation is:

Winners and Losers of Unexpected Inflation

Winners:

- The United States federal government – The government benefits from unexpected inflation because the real value of its debt decreases. Since the government borrowed money at a fixed interest rate, inflation makes it easier to repay the debt with less valuable dollars.

- Joy, who borrowed $40,000 for college – Borrowers benefit from unexpected inflation because the real burden of their debt decreases. Since Joy borrowed money at a fixed interest rate, she will repay her loan with less valuable dollars over time.

Losers:

- Karen, a retired school teacher on a fixed pension – Fixed-income earners suffer from unexpected inflation because their purchasing power declines. Karen’s pension payments remain the same, but the cost of goods and services increases, making it harder for her to afford necessities.

- Third National Bank – Banks that issue fixed-rate loans lose during unexpected inflation. They receive repayments in devalued dollars, reducing their real earnings.

- Herb, who keeps his savings in a coffee can – People who save in cash lose during unexpected inflation because their money loses purchasing power. Since Herb does not earn interest on his savings, his real wealth declines as prices rise.

Explanation

Unexpected inflation redistributes wealth between borrowers and lenders. Borrowers benefit because they repay loans with money that has lost value, while lenders (such as banks) suffer because the money they receive has less purchasing power. Governments with large debt loads also benefit, as inflation erodes the real value of their obligations. On the other hand, people with fixed incomes or cash savings lose, as inflation reduces their ability to buy goods and services.

Now, I’ll generate an image illustrating this concept.

Here is the educational infographic illustrating the effects of unexpected inflation. It visually represents the winners and losers of inflation, showing their different financial situations. Let me know if you need any modifications!