In each succeeding payment on an installment note, the amount:

- That goes to decreasing the carrying value of the note is unchanged.

- That goes to decreasing the carrying value of the note decreases.

- Paid for both interest and principal increase proportionately.

- That goes to decreasing the carrying value of the note increases.

The correct answer and explanation is:

Correct Answer:

That goes to decreasing the carrying value of the note increases.

Explanation:

An installment note is a type of loan that requires periodic payments consisting of both principal and interest. These payments are usually structured so that the total payment amount remains constant throughout the loan term. However, the composition of each payment changes over time.

- How Payments are Structured

- Each installment payment includes two components:

- Interest Expense: This is calculated based on the remaining principal balance (carrying value) and the interest rate.

- Principal Repayment: This is the portion of the payment that reduces the carrying value of the loan.

- Each installment payment includes two components:

- Decreasing Interest Over Time

- At the beginning of the loan term, the carrying value is highest, leading to a larger interest portion in the first payments.

- As payments are made, the principal balance reduces, leading to lower interest charges on subsequent payments.

- Since the total payment amount remains the same, as interest decreases, a larger portion of each payment is allocated to reducing the principal.

- Increasing Principal Portion

- Since the interest expense decreases with each payment, the amount applied to the principal increases.

- This means that with every successive payment, a larger portion of the payment reduces the outstanding loan balance.

- As a result, the carrying value of the note decreases at an increasing rate.

- Final Payments

- Toward the end of the loan term, interest makes up a very small portion of each payment, with the majority going toward principal repayment.

- The final payment clears the remaining balance, fully paying off the note.

This pattern is characteristic of loans such as mortgages, car loans, and other structured installment debts.

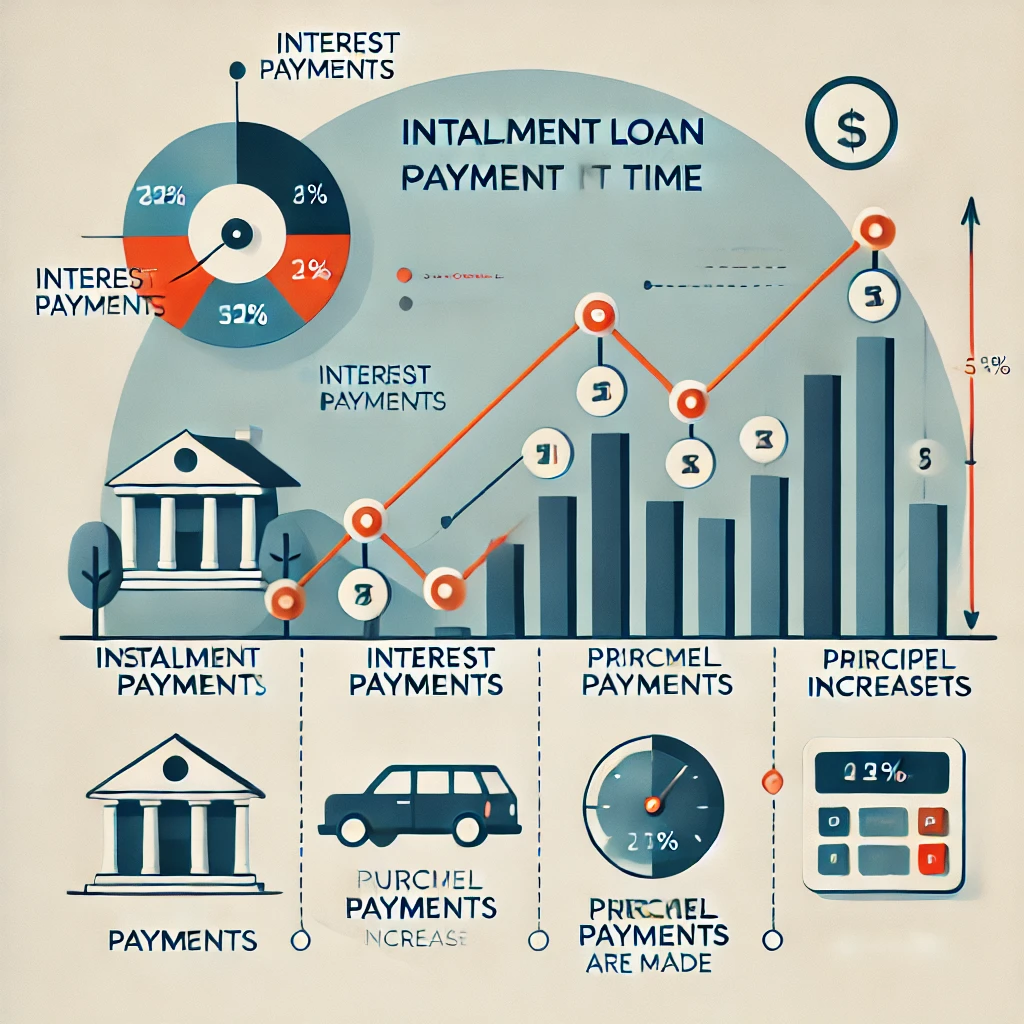

I’ve provided an educational illustration that visually represents the breakdown of an installment loan payment over time. It includes a graph showing interest payments decreasing while principal payments increase, along with a visual depiction of the loan balance decreasing as payments are made. Let me know if you need any modifications!