If a company uses $1,400 of its cash to purchase supplies, the effect on the accounting equation would be:

Assets increase $1,400 and liabilities decrease $1,400.

One asset increases $1,400 and another asset decreases $1,400, causing no effect.

Assets decrease $1,400 and equity decreases $1,400.

Assets decrease $1,400 and equity increases $1,400.

Assets increase $1,400 and liabilities increase $1,400.

The correct answer and explanation is :

The correct answer is:

One asset increases $1,400 and another asset decreases $1,400, causing no effect.

Explanation:

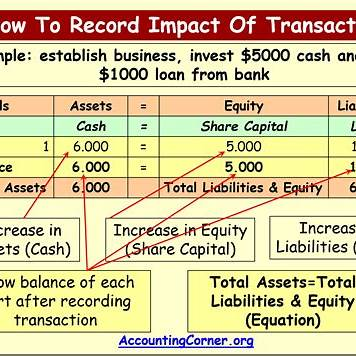

When a company purchases supplies for $1,400 using cash, it is essentially exchanging one asset (cash) for another asset (supplies). In accounting terms, this is called an asset exchange transaction, where no liabilities or equity are affected. Let’s break down the transaction:

- Cash Decreases: The company pays $1,400 in cash. Cash is an asset, so when the company spends cash, it decreases its cash balance. This is a decrease in one asset.

- Supplies Increase: At the same time, the company receives supplies worth $1,400. Supplies are also classified as an asset on the balance sheet. Therefore, the company’s supplies asset increases by $1,400.

The key point is that the total assets of the company don’t change in total. Cash decreases by $1,400, and supplies increase by $1,400. The overall asset balance remains the same because one asset is simply swapped for another.

In terms of the accounting equation:

- Assets = Liabilities + Equity

On the left side of the equation, the total assets remain unchanged because:

- The decrease in cash is offset by the increase in supplies.

On the right side, neither liabilities nor equity is affected by this transaction because the company has not incurred any debt nor earned additional income or equity from the transaction.

Thus, the accounting equation remains in balance, and the company’s overall financial position is unaffected by this exchange of assets.