Inventoriable (i.e., product) costs that have become expenses can be found in:

A. period costs.

B. selling expenses.

C. cost of goods sold.

D. administrative expenses

The correct answer and explanation is :

The correct answer is:

C. Cost of Goods Sold (COGS)

Explanation:

Inventoriable costs, also known as product costs, refer to all costs incurred in acquiring or manufacturing a product that is intended for sale. These costs include direct materials, direct labor, and manufacturing overhead. Unlike period costs, which are expensed immediately, inventoriable costs are first recorded as inventory on the balance sheet. They only become expenses when the product is sold.

Once a product is sold, its associated inventoriable cost moves from the inventory account on the balance sheet to the Cost of Goods Sold (COGS) account on the income statement. At this point, it is recognized as an expense that reduces a company’s gross profit.

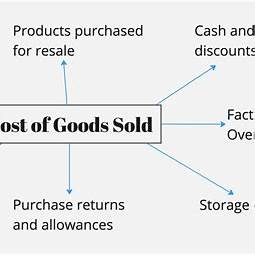

COGS represents the direct costs associated with producing goods that a company has sold during a period. It does not include selling, general, and administrative expenses (SG&A) such as marketing, distribution, or executive salaries. Those costs are classified as period costs and are expensed as they occur, regardless of sales volume.

Why Not the Other Options?

- A. Period Costs – These are costs that are expensed in the period incurred and are not part of inventory costs. Examples include office rent, utilities, and administrative salaries.

- B. Selling Expenses – These include marketing, advertising, and distribution expenses, which are not directly tied to inventory production.

- D. Administrative Expenses – These include costs related to the general operation of the business, such as executive salaries and office supplies, which are also not related to inventory.

Thus, inventoriable costs become expenses when they are recorded as Cost of Goods Sold (COGS) after the product is sold.