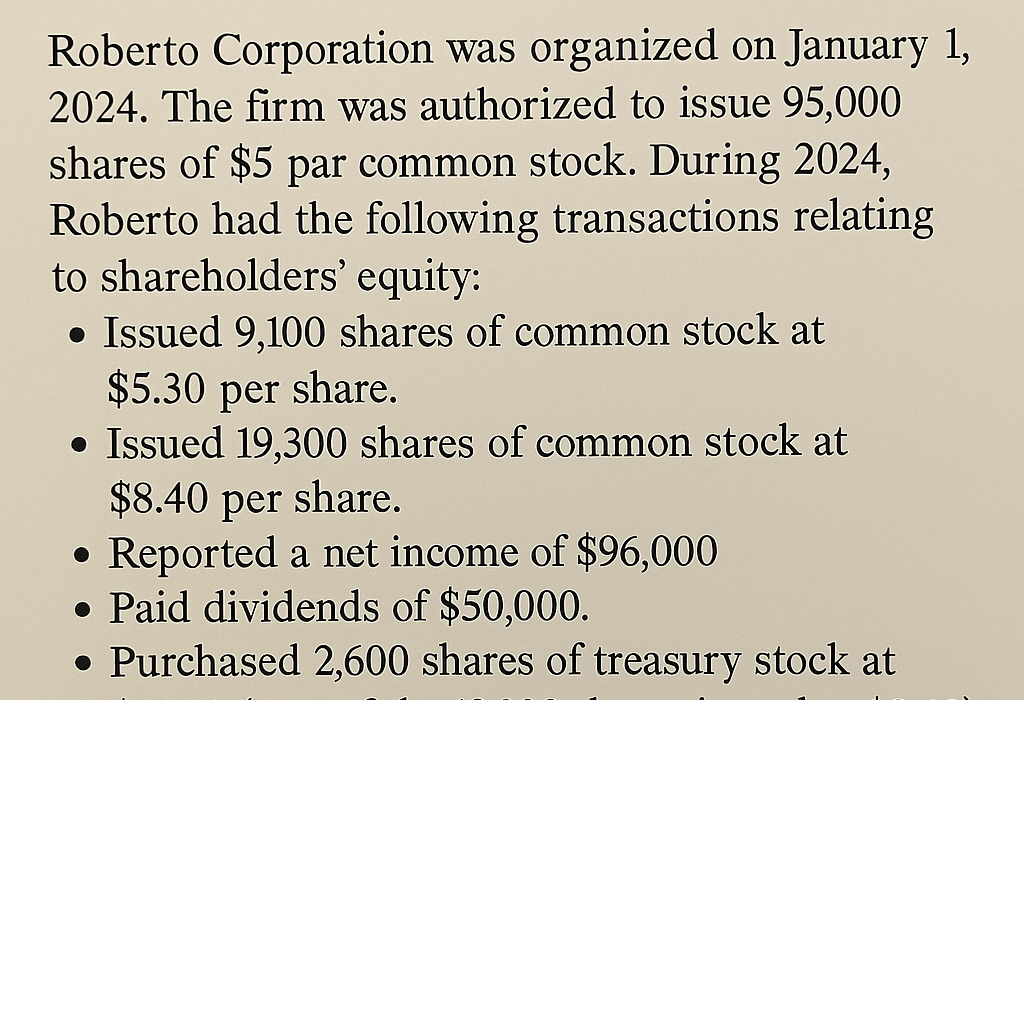

Roberto Corporation was organized on January 1, 2024. The firm was authorized to issue 95,000 shares of $5 par common stock. During 2024, Roberto had the following transactions relating to shareholders’ equity:

Issued 9,100 shares of common stock at $5.30 per share.

Issued 19,300 shares of common stock at $8.40 per share.

Reported a net income of $96,000.

Paid dividends of $50,000.

Purchased 2,600 shares of treasury stock at $10.40 (part of the 19,300 shares issued at $8.40).

What is total shareholders’ equity at the end of 2024?

$279,310

$232,310

$252,270

$229,310

The correct answer and explanation is :

To calculate total shareholders’ equity at the end of 2024 for Roberto Corporation, we need to follow these steps:

Step 1: Common Stock Issued

Par value = $5

Authorized shares = 95,000

First issuance:

- 9,100 shares @ $5.30

- Proceeds = 9,100 × $5.30 = $48,230

- Par value = 9,100 × $5 = $45,500

- Additional Paid-In Capital (APIC) = $48,230 – $45,500 = $2,730

Second issuance:

- 19,300 shares @ $8.40

- Proceeds = 19,300 × $8.40 = $162,120

- Par value = 19,300 × $5 = $96,500

- APIC = $162,120 – $96,500 = $65,620

Step 2: Treasury Stock

- Purchased 2,600 shares at $10.40 = $27,040

- Treasury stock reduces equity

Step 3: Net Income and Dividends

- Net Income = $96,000

- Dividends = $50,000

Step 4: Calculate Ending Shareholders’ Equity

| Component | Amount |

|---|---|

| Common Stock (total par value) | $45,500 + $96,500 = $142,000 |

| APIC | $2,730 + $65,620 = $68,350 |

| Retained Earnings | $96,000 – $50,000 = $46,000 |

| Less: Treasury Stock | ($27,040) |

| Total Shareholders’ Equity | $229,310 |

✅ Final Answer: $229,310

Explanation (Approx. 300 words)

Shareholders’ equity represents the owners’ claim on the assets of a corporation after all liabilities have been deducted. It typically consists of common stock, additional paid-in capital (APIC), retained earnings, and treasury stock (which reduces equity).

In Roberto Corporation’s case, common stock was issued twice during the year. In the first issuance, 9,100 shares were sold slightly above par at $5.30, generating both par value and a small premium (APIC). In the second round, 19,300 shares were issued at a higher price of $8.40, again above par, contributing significantly to both common stock and APIC.

Treasury stock is a repurchase of previously issued shares. When Roberto bought back 2,600 shares at $10.40, this was recorded at cost, and the total ($27,040) is subtracted from equity.

Net income for the year adds to retained earnings, while dividends paid reduce it. In this case, after netting $96,000 income and subtracting $50,000 in dividends, retained earnings add $46,000 to equity.

Adding up the components—par value of common stock ($142,000), APIC ($68,350), and retained earnings ($46,000)—and then subtracting treasury stock ($27,040) results in total shareholders’ equity of $229,310 at year-end 2024.

This figure reflects the company’s financing from shareholders, earnings retained in the business, and adjustments from share repurchases.