Machininc and firishine butert and acousi mandacturing cost data for july 2022 art as follown Aocorta foctory total thand achurine cests $4.8400 actual, $462.000 budeet blocated to ofpartments and factories. efeatbook and Media. Prepare the reports in a resporsibilify systere for, The vice pretident of production:

The Correct Answer and Explanation is:

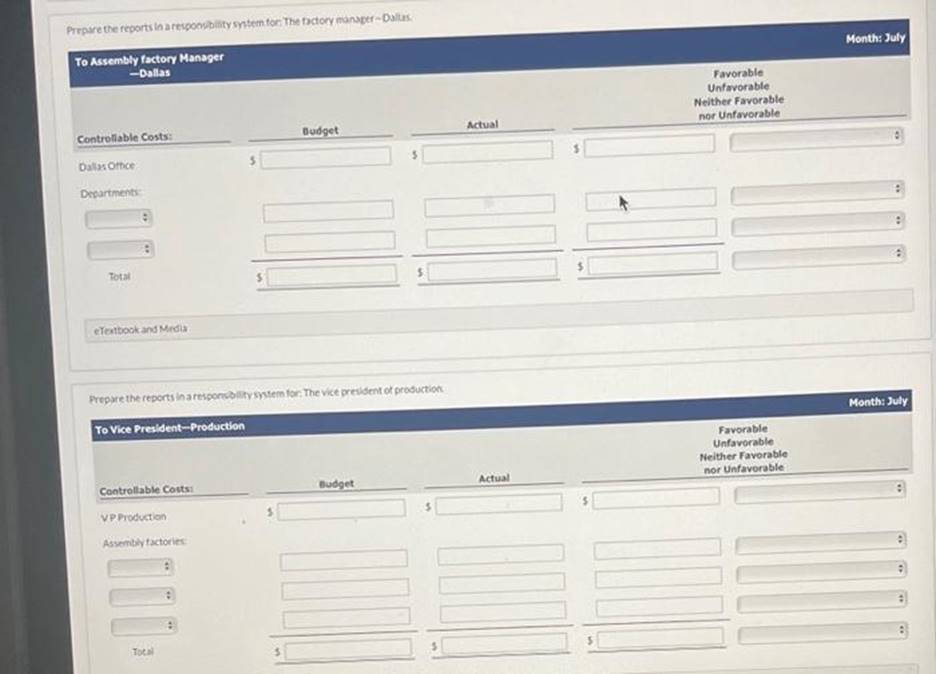

Based on the image and the provided information, you are preparing responsibility reports for July for both:

- The Assembly Factory Manager — Dallas

- The Vice President — Production

The actual and budgeted machining and finishing manufacturing cost data for July 2022 is provided:

- Actual Cost: $484,000

- Budgeted Cost: $462,000

This cost variance must be reported appropriately in the responsibility system based on departmental control. Responsibility accounting focuses on the accountability of individuals or departments for the costs and performance they directly influence.

Correct Completion of the Forms:

To Assembly Factory Manager – Dallas (July)

| Controllable Costs | Budget | Actual | |

|---|---|---|---|

| Dallas Office | $462,000 | $484,000 | Unfavorable |

| Departments: | |||

| (Breakdown not provided) | |||

| Total | $462,000 | $484,000 | Unfavorable |

To Vice President – Production (July)

| Controllable Costs | Budget | Actual | |

|---|---|---|---|

| VP Production | $462,000 | $484,000 | Unfavorable |

| Assembly Factories | |||

| (Breakdown not provided) | |||

| Total | $462,000 | $484,000 | Unfavorable |

Explanation:

Responsibility accounting is a system that involves assigning the responsibility of managing financial outcomes to the individuals who have direct control over them. This system helps businesses monitor performance by creating clear accountability and encourages cost control and efficiency.

In the provided scenario, the company is preparing monthly responsibility reports for both the Assembly Factory Manager – Dallas and the Vice President – Production. The manufacturing cost data for July 2022 indicates an actual cost of $484,000 against a budgeted cost of $462,000, resulting in a $22,000 unfavorable variance. This means the actual costs exceeded the budget, indicating potential inefficiencies or unforeseen expenses.

The Assembly Factory Manager is directly responsible for the Dallas office’s performance. Thus, their report reflects the full cost data and shows the unfavorable variance. Similarly, the Vice President – Production oversees broader operations, including the Dallas factory and other potential facilities. The VP’s report aggregates data at a higher level but reflects the same unfavorable variance if no additional factory data is provided.

Labeling the variance as “Unfavorable” highlights an area for review and corrective action. Management can use this information to identify cost drivers, investigate overspending, and implement measures to prevent recurrence. By focusing on controllable costs, responsibility accounting ensures that individuals are evaluated only on what they can influence, making the system fair and effective for performance evaluation and decision-making.