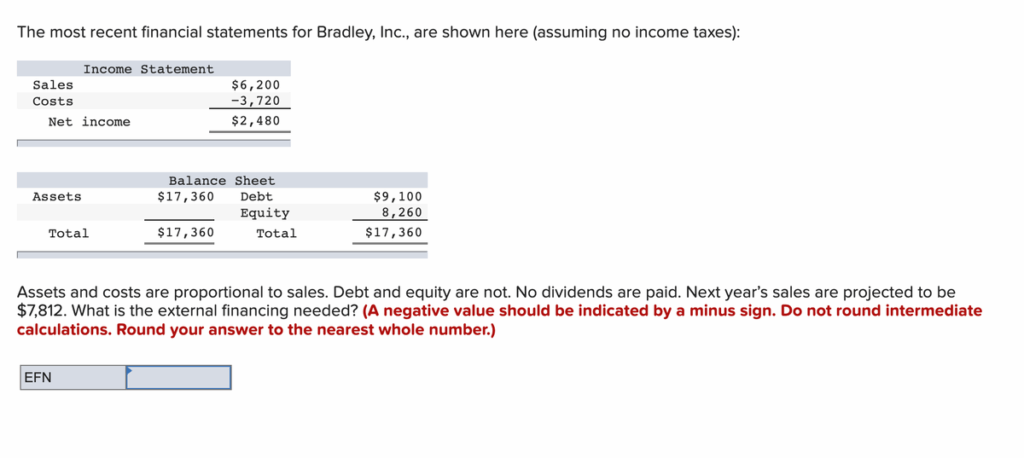

$7,812. What is the external financing needed? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.) None The most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Sales Costs Net income Assets Income Statement Total EFN $6,200 -3,720 $2,480 Balance Sheet $17,360 $17,360 Debt Equity Total $9,100 8,260 $17,360 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year’s sales are projected to be $7,812. What is the external financing needed? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.)

To calculate External Financing Needed (EFN), follow these steps:

Step 1: Calculate the projected increase in sales

Projected Sales = \$7,812

Current Sales = \$6,200

Growth Rate = $\frac{7812}{6200} = 1.26$

Step 2: Forecast Assets

Assets are proportional to sales:

$$

\text{Projected Assets} = 17,360 \times 1.26 = 21,873.6

$$

Step 3: Forecast Spontaneous Liabilities (none are mentioned)

Only debt and equity are listed on the balance sheet. Since debt is not proportional to sales, and there are no spontaneous liabilities, we don’t adjust liabilities yet.

Step 4: Forecast Retained Earnings (Net Income)

Costs are also proportional to sales:

- Net income margin = $\frac{2,480}{6,200} = 0.4$

- Projected Net Income = $7,812 \times 0.4 = 3,124.8$

This full amount is retained (no dividends).

Step 5: Determine EFN

$$

\text{EFN} = \text{Projected Assets} – (\text{Current Liabilities} + \text{Current Equity} + \text{Retained Earnings})

$$

$$

\text{EFN} = 21,873.6 – (9,100 + 8,260 + 3,124.8) = 21,873.6 – 20,484.8 = \boxed{1,389}

$$

✅ Final Answer: EFN = \$1,389

Explanation

External Financing Needed (EFN) is used to determine how much external funding a firm will require to support projected growth when internal funds (retained earnings) are insufficient. In Bradley Inc.’s case, both assets and costs are assumed to scale proportionally with sales, while debt and equity remain constant.

To compute EFN, we first calculate the projected sales growth. Sales are expected to rise from \$6,200 to \$7,812, a 26% increase. Since assets scale with sales, we apply the same growth rate to the current assets (\$17,360), arriving at projected assets of \$21,873.60.

Next, we determine the net income expected from the higher sales. The current net income margin is 40% (i.e., \$2,480 ÷ \$6,200). Applying this margin to the new sales figure yields a projected net income of \$3,124.80. Since no dividends are paid, the entire net income increases retained earnings.

Now, we calculate how much funding is available to support the new asset level. The company will retain \$3,124.80 in earnings, and it retains its existing debt (\$9,100) and equity (\$8,260). Summing these gives total available financing of \$20,484.80.

The gap between projected assets and available financing represents the EFN:

$$

EFN = 21,873.60 – 20,484.80 = \$1,389

$$

This positive EFN indicates the company will need to raise \$1,389 in external funds—possibly through borrowing or issuing stock—to support its growth.

Thus, the correct external financing needed is \$1,389.