Helen Strand’s regular hourly wage rate is

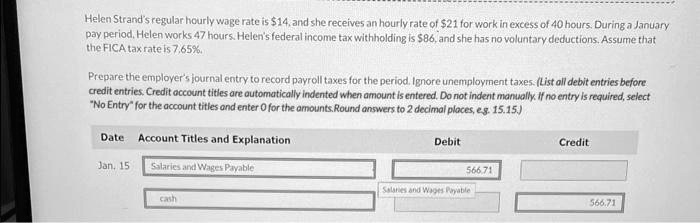

21 for work in excess of 40 hours. During a January pay period, Helen works 47 hours. Helen’s federal income tax withholding is $86, and she has no voluntary deductions. Assume that the FICA tax rate is 7.65%. Prepare the employer’s journal entry to record payroll taxes for the period. Ignore unemployment taxes. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Round answers to 2 decimal places, e.g. 15.15.) Date Account Titles and Explanation Jan. 15 Salaries and Wages Payable cash Debit Credit 566.71 Salaries and Wages Payable 566.71

The Correct Answer and Explanation is:

Employer’s journal entry – to record the pay-period payroll taxes (no unemployment taxes)

| Date | Account Titles & Explanation | Debit | Credit |

|---|---|---|---|

| Jan. 15 | Payroll Tax Expense | $54.08 | |

| FICA Taxes Payable – OASDI (Social Security) | $43.83 | ||

| FICA Taxes Payable – Medicare | $10.25 |

(If your system uses a single liability account, credit “FICA Taxes Payable $54.08” instead of the two separate lines.)

Why these amounts are correct

- Determine the wages subject to FICA.

Helen worked 47 hours in the period.

Regular pay = 40 h × $14 = $560

Overtime pay = 7 h × $21 = $147

Gross earnings = $560 + $147 = $707 All $707 are subject to FICA because they are dramatically below the 2024 Social-Security wage base and Medicare has no cap. - Apply the employer FICA rates.

- OASDI (Social Security) = 6.2 % of $707

$707 × 0.062 = $43.834 → $43.83 (rounded to cents). - Medicare (HI) = 1.45 % of $707

$707 × 0.0145 = $10.2515 → $10.25.

Remember: The 7.65 % rate (6.2 % + 1.45 %) is paid twice—once by the employee (withheld from pay) and once by the employer (an additional payroll cost). The question asks only for the employer’s portion. - OASDI (Social Security) = 6.2 % of $707

- Prepare the journal entry.

- Debit Payroll Tax Expense for the cost the company incurs ($54.08).

- Credit liability accounts because the taxes are owed to the federal government until they are remitted. Many textbooks split the credit into “FICA Taxes Payable—OASDI” and “FICA Taxes Payable—Medicare” to mirror how they must be reported on IRS Forms 941 and 940. Some software combines them into a single “FICA Taxes Payable” account—the dollar total is the same.

- What is not included?

- Employee withholdings (federal income tax $86 and the employee’s own FICA $54.08) were booked in the payroll entry that reduced Helen’s net check ($566.91).

- Federal and state unemployment taxes (FUTA/SUTA) are specifically excluded by the problem instruction.

By matching the statutory 7.65 % employer share to the $707 wage base, the entry above correctly records the employer’s legal payroll-tax obligation and recognizes the related expense in the period the wages were earned.