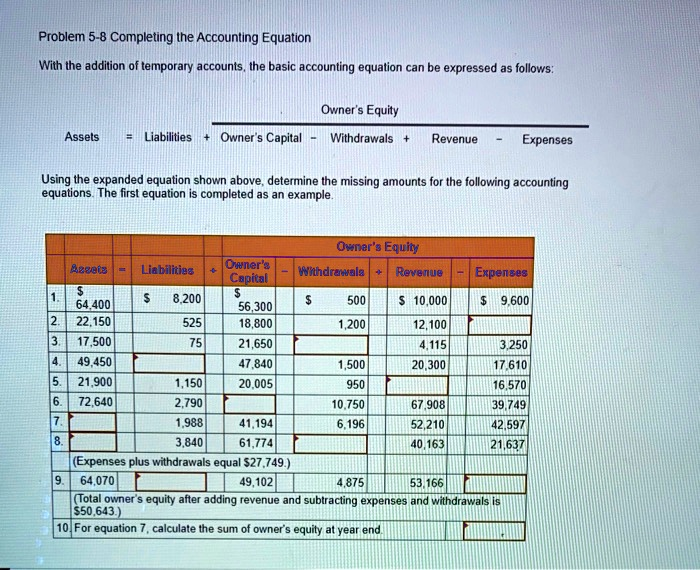

Problem 5-8: Completing the Accounting Equation With the addition of temporary accounts, the basic accounting equation can be expressed as follows: Owner’s Equity = Assets – Liabilities + Owner’s Capital + Withdrawals + Revenue – Expenses Using the expanded equation shown above, determine the missing amounts for the following accounting equations. The first equation is completed as an example: Owner’s Equity = Withdrawals + Revenue + Assets – Liabilities + Owner’s Capital – Expenses 1. Assets =

22,150 3. Owner’s Capital =

49,450 5. Revenue =

72,640 7. Owner’s Equity =

525 9. Revenue =

56,300 11. Liabilities =

21,650 13. Expenses =

20,005 15. Withdrawals =

10,000 17. Liabilities =

4,115 19. Expenses =

9,600 21. Withdrawals =

3,250 23. Liabilities =

16,570 25. Expenses =

42,597 27. Withdrawals =

1,500 29. Liabilities =

10,750 31. Expenses =

1,150 33. Withdrawals =

1,988 35. Liabilities =

67,908 37. Expenses =

40,163 39. Withdrawals =

61,774 (Expenses plus withdrawals equal

50,643.) 10. For equation 7, calculate the sum of owner’s equity at year end.

The Correct Answer and Explanation is:

To solve Equation 7 and calculate the owner’s equity at year end, we will apply the expanded accounting equation: Assets=Liabilities+Owner’s Capital+Revenues−Expenses−Withdrawals\text{Assets} = \text{Liabilities} + \text{Owner’s Capital} + \text{Revenues} – \text{Expenses} – \text{Withdrawals}

Given Values in Row 7:

- Liabilities = 1,988

- Owner’s Capital = 41,194

- Withdrawals = 6,196

- Revenue = 52,210

- Expenses = 42,597

- Assets = Missing

- Owner’s Equity (year end) = To be calculated

Step 1: Calculate Ending Owner’s Equity

Using: Owner’s Equity=Owner’s Capital+Revenue−Expenses−Withdrawals\text{Owner’s Equity} = \text{Owner’s Capital} + \text{Revenue} – \text{Expenses} – \text{Withdrawals}

Substitute values: Owner’s Equity=41,194+52,210−42,597−6,196\text{Owner’s Equity} = 41,194 + 52,210 – 42,597 – 6,196 =93,404−48,793=44,611= 93,404 – 48,793 = \boxed{44,611}

Step 2: Calculate Assets (if needed)

Now use: Assets=Liabilities+Owner’s Equity\text{Assets} = \text{Liabilities} + \text{Owner’s Equity} Assets=1,988+44,611=46,599\text{Assets} = 1,988 + 44,611 = \boxed{46,599}

✅ Final Answer for Equation 7:

Owner’s Equity at year end = $44,611

Explanation

In accounting, the expanded accounting equation incorporates both permanent and temporary components of owner’s equity. This includes capital contributed by the owner, revenues earned, expenses incurred, and withdrawals taken during the accounting period.

To find the owner’s equity at year-end for Equation 7, we use the formula: Ending Owner’s Equity=Owner’s Capital+Revenues−Expenses−Withdrawals\text{Ending Owner’s Equity} = \text{Owner’s Capital} + \text{Revenues} – \text{Expenses} – \text{Withdrawals}

This formula reflects the net change in owner’s equity due to business activities. In this case, the owner originally invested $41,194. The business earned revenue of $52,210, which increases equity. However, the business also had $42,597 in expenses and the owner withdrew $6,196, both of which decrease equity. After accounting for these factors, the ending owner’s equity totals $44,611.

This figure represents the residual interest in the company’s assets after deducting liabilities. If needed, we can calculate the total assets using the formula: Assets=Liabilities+Owner’s Equity\text{Assets} = \text{Liabilities} + \text{Owner’s Equity}

Which yields $46,599. This confirms that the business’s financial position remains solvent, as assets exceed liabilities. Understanding how these elements interact is essential for tracking a company’s financial performance and position throughout the year.