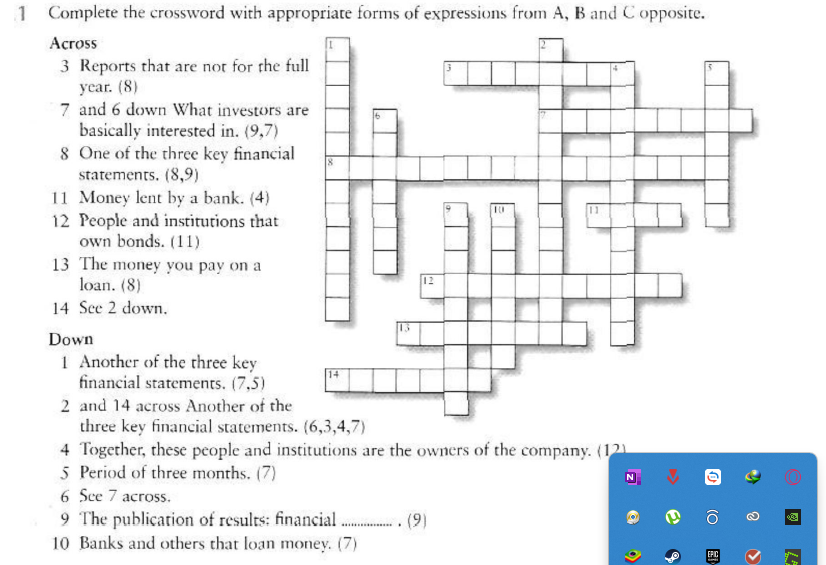

Complete the crossword with appropriate forms of expressions from A, B and C opposite

The Correct Answer and Explanation is:

✅ Crossword Answers:

Across:

3. Interim

7. Earnings

8. IncomeStatement

11. Loan

12. Bondholders

13. Interest

14. BalanceSheet

Down:

- CashFlow

- BalanceSheet

- Shareholders

- Quarter

- PerShare

- Disclosure

- Lenders

Explanation:

This crossword focuses on financial and accounting terminology commonly used in corporate finance and investment contexts. The answers are primarily derived from three categories of financial information: financial statements, investment terminology, and institutional roles.

Clues 1, 2, and 8 reference the three key financial statements used by companies:

- Income Statement (8 Across) outlines revenue and expenses over a period.

- Balance Sheet (2 Down & 14 Across) shows the company’s assets, liabilities, and equity at a specific point.

- Cash Flow Statement (1 Down) details cash inflows and outflows from operating, investing, and financing activities.

Clues like 7 Across and 6 Down point toward what investors analyze to make decisions. Earnings per share (EPS) is a core metric representing net profit divided by the number of outstanding shares. Investors also look at earnings in general to gauge profitability.

Other clues explain financial roles or instruments:

- Loan (11 Across) and Lenders (10 Down) describe the act of borrowing and entities that lend money.

- Interest (13 Across) refers to the cost of borrowing, typically paid periodically.

- Bondholders (12 Across) are individuals or institutions owning debt securities issued by corporations or governments.

Clue 4 Down refers to shareholders, the owners of a corporation.

Quarter (5 Down) is a typical reporting period in corporate finance.

Disclosure (9 Down) refers to the formal release of financial information.

Understanding these terms is crucial for anyone analyzing a company’s financial health or making investment decisions. The crossword reinforces familiarity with essential financial vocabulary used globally in accounting, banking, and investing.