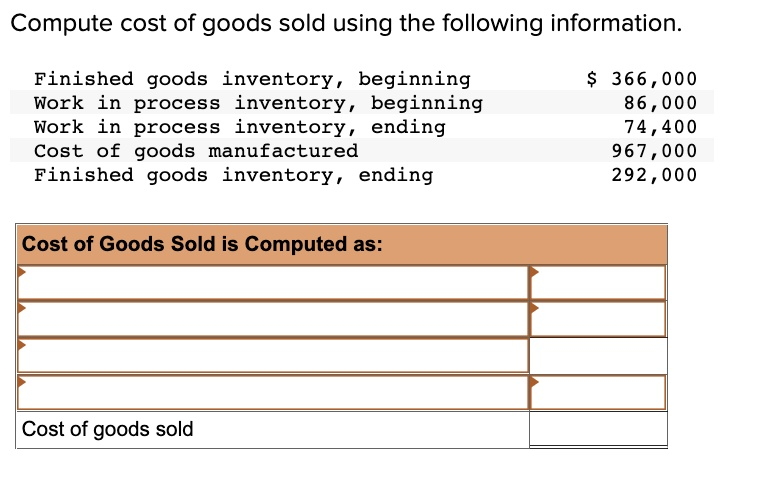

Compute cost of goods sold using the following information. Finished goods inventory, beginning Work in process inventory, beginning Work in process inventory, ending Cost of goods manufactured Finished goods inventory, ending Cost of Goods Sold is Computed as: $ 366,000 86,000 74,400 967,000 292,000 Cost of goods sold

The Correct Answer and Explanation is:

The cost of goods sold is computed using the formula:

Cost of Goods Sold = Beginning Finished Goods Inventory + Cost of Goods Manufactured – Ending Finished Goods Inventory

Substituting the provided values:

Cost of Goods Sold = 366,000 + 967,000 – 292,000 Cost of Goods Sold = 1,333,000 – 292,000 Cost of Goods Sold = 1,041,000

Explanation:

Cost of goods sold represents the direct expenses associated with producing goods that were sold during a given period. This metric is crucial in determining a company’s profitability because it directly affects the gross profit. Gross profit is calculated by subtracting the cost of goods sold from total revenue.

The formula used incorporates finished goods inventory at the beginning and end of the period to reflect the true cost of items that have been sold. The cost of goods manufactured accounts for all production expenses incurred during the period, including raw materials, labor, and overhead costs. By adding the beginning finished goods inventory to the cost of goods manufactured and subtracting the ending finished goods inventory, we identify the actual cost of items sold.

Understanding this calculation helps businesses analyze their production efficiency and pricing strategies. If the cost of goods sold is high relative to revenue, it might indicate excessive production costs, leading to lower profit margins. Companies use this information to optimize processes, control costs, and improve profitability.

In financial reporting, cost of goods sold is a key figure in income statements, as it reflects operational performance. A company that effectively manages production expenses and inventory levels can maintain competitive pricing while maximizing profits. This demonstrates the importance of accurate cost tracking and efficient inventory management.