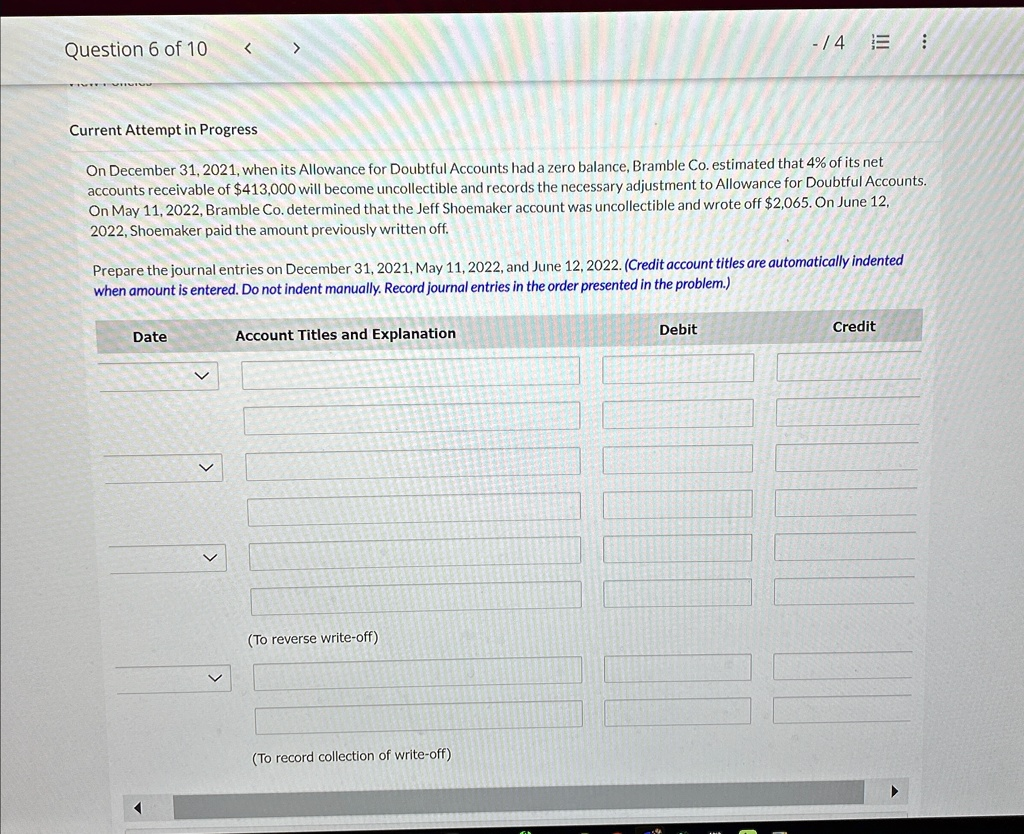

Current Attempt in Progress

The Correct Answer and Explanation is:

Here are the correct journal entries for the transactions described.

Journal Entries

1. December 31, 2021

- Debit: Bad Debt Expense, $16,520

- Credit: Allowance for Doubtful Accounts, $16,520

2. May 11, 2022

- Debit: Allowance for Doubtful Accounts, $2,065

- Credit: Accounts Receivable, $2,065

3. June 12, 2022 (To reverse write-off)

- Debit: Accounts Receivable, $2,065

- Credit: Allowance for Doubtful Accounts, $2,065

4. June 12, 2022 (To record collection of write-off)

- Debit: Cash, $2,065

- Credit: Accounts Receivable, $2,065

Explanation of Journal Entries

Here is a detailed explanation for each journal entry required by the problem.

1. December 31, 2021: Adjusting Entry for Bad Debts

The first entry records the estimated bad debt expense for the year. Bramble Co. uses the percentage of receivables method. The calculation is 4% of the $413,000 accounts receivable, which equals

16,520(16,520(413,000 * 0.04). This amount represents the total estimated uncollectible accounts at year end. Since the Allowance for Doubtful Accounts had a zero balance, the full $16,520 must be recorded. The entry involves debiting Bad Debt Expense to recognize the expense on the income statement and crediting Allowance for Doubtful Accounts, a contra asset account that reduces the net book value of accounts receivable on the balance sheet.

2. May 11, 2022: Write Off of an Uncollectible Account

When the specific account of Jeff Shoemaker for $2,065 is determined to be uncollectible, it must be written off. This action does not affect the net realizable value of accounts receivable or net income. Instead, it reduces the specific customer’s Accounts Receivable balance and the corresponding amount from the Allowance for Doubtful Accounts that was previously established. The journal entry is a debit to Allowance for Doubtful Accounts (decreasing the allowance) and a credit to Accounts Receivable (decreasing the receivable balance).

3. June 12, 2022: Collection of a Previously Written Off Account

This event requires a two step process. First, the write off from May 11 must be reversed. This reinstates Jeff Shoemaker’s account balance, which is necessary for proper record keeping and to show that the customer ultimately paid. This entry is a debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts for $2,065.

Second, the cash payment is recorded. Now that the receivable is back on the books, the collection can be recorded like any other payment. This entry involves debiting Cash to increase its balance and crediting Accounts Receivable to decrease its balance, showing the debt has been settled.