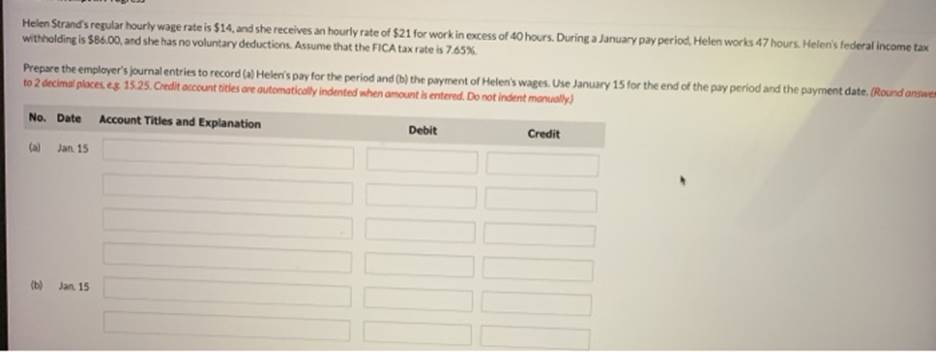

Helen Strand’s regular hourly wage rate is $14, and she receives an hourly rate of $21 for work in excess of 40 hours. During a January pay period Helen works 47 hours. Helen’s federal income tax withholding is $86.00, and she has no voluntary deductions. Assume that the FICA tax rate is 7.65%. Prepare the employer’s journal entries to record (al Heler’s pay for the period and (b) the payment of Helen’s wages. Use January 15 for the end of the pay period and the payment date. (Round answer to 2 decimal places. e.8. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually) No. Date Account Titles and Explanation Debit Credit Jan 15 Jan 15

The Correct Answer and Explanation is :

To prepare the employer’s journal entries for Helen Strand’s pay for the period, follow these steps:

Step 1: Calculate Helen’s Gross Pay

- Regular pay: ( 40 \, \text{hours} \times 14.00 \, \text{\$/hour} = 560.00 )

- Overtime pay: ( 7 \, \text{hours} \times 21.00 \, \text{\$/hour} = 147.00 )

- Total Gross Pay: ( 560.00 + 147.00 = 707.00 )

Step 2: Calculate Deductions

- FICA Tax: ( 707.00 \times 0.0765 = 54.12 )

- Federal Income Tax Withholding: ( 86.00 )

- Total Deductions: ( 54.12 + 86.00 = 140.12 )

Step 3: Calculate Net Pay

- Net Pay: ( 707.00 – 140.12 = 566.88 )

Step 4: Journal Entries

(a) To record Helen’s pay:

Date: January 15

Account Titles and Explanation Debit Credit

Salaries and Wages Expense 707.00

FICA Taxes Payable 54.12

Federal Income Taxes Payable 86.00

Salaries and Wages Payable 566.88(b) To record the payment of Helen’s wages:

Date: January 15

Account Titles and Explanation Debit Credit

Salaries and Wages Payable 566.88

Cash 566.88Explanation

- Gross Pay and Deductions: Helen’s gross pay is based on her regular hours and overtime hours. Deductions include FICA taxes (Social Security and Medicare) and federal income taxes.

- Journal Entry (a): The employer records the total payroll expense as a debit to “Salaries and Wages Expense.” The deductions are credited to “FICA Taxes Payable” and “Federal Income Taxes Payable,” and the remaining net pay is credited to “Salaries and Wages Payable.”

- Journal Entry (b): When wages are paid, “Salaries and Wages Payable” is debited, and cash is credited for the net amount.

- Accuracy in Rounding: Amounts are rounded to two decimal places to ensure compliance with accounting standards.

This process ensures that the employer’s payroll accounting is accurate, transparent, and in line with tax obligations.