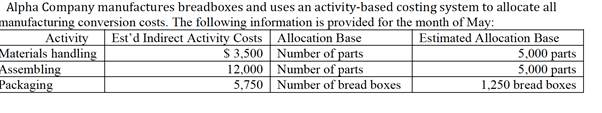

Alpha Company manufactures breadboxes and uses an activity-based costing system to allocate all manufacturing conversion costs. The following information is provided for the month of May: Activity Estd Indirect Activity Costs Allocation Base | Estimated Allocation Base Materials handling $ 3,500 Number of parts 5,000 parts Assembling 12,000 Number of parts 5,000 parts Packaging 5,750 | Number of bread boxes 1,250 bread boxes

Each breadbox consists of 4 parts. The direct materials cost per breadbox is $9.00

What is the total manufacturing cost per breadbox?

A. $12.40 B. $17.40 C. $24.00 D. $26.00 E. None

The Correct Answer and Explanation is :

To calculate the total manufacturing cost per breadbox, we must include the direct materials cost and the allocated activity costs based on activity-based costing (ABC). Let’s go step by step.

Step 1: Calculate Total Allocation Base for Each Activity

- Materials handling:

Allocation rate = Estimated cost / Allocation base = ( \frac{3500}{5000} = \$0.70 ) per part.

Each breadbox has 4 parts, so total parts for 1,250 breadboxes = ( 1,250 \times 4 = 5,000 ) parts. - Assembling:

Allocation rate = Estimated cost / Allocation base = ( \frac{12,000}{5000} = \$2.40 ) per part.

Total parts = 5,000 (same as above). - Packaging:

Allocation rate = Estimated cost / Allocation base = ( \frac{5750}{1250} = \$4.60 ) per breadbox.

Step 2: Compute Allocated Costs per Breadbox

- Materials handling cost per breadbox:

( 4 \, \text{parts per breadbox} \times 0.70 \, \text{(rate per part)} = \$2.80 ). - Assembling cost per breadbox:

( 4 \, \text{parts per breadbox} \times 2.40 \, \text{(rate per part)} = \$9.60 ). - Packaging cost per breadbox:

Direct allocation = ( 4.60 \, \text{(rate per breadbox)} ).

Step 3: Add Direct Material Costs

Direct material cost per breadbox = ( 9.00 ).

Step 4: Total Cost per Breadbox

( 2.80 \, \text{(materials handling)} + 9.60 \, \text{(assembling)} + 4.60 \, \text{(packaging)} + 9.00 \, \text{(direct materials)} = 26.00 ).

Final Answer: D. $26.00

Explanation:

Activity-based costing ensures accurate allocation by assigning indirect costs based on specific cost drivers (e.g., parts and breadboxes). In this case:

- The direct materials cost forms a substantial part of the total cost.

- Activity rates are multiplied by the relevant allocation base (number of parts or breadboxes) for precision.

- Adding these costs together gives a comprehensive view of the per-unit manufacturing cost.

Thus, the manufacturing cost per breadbox is $26.00.