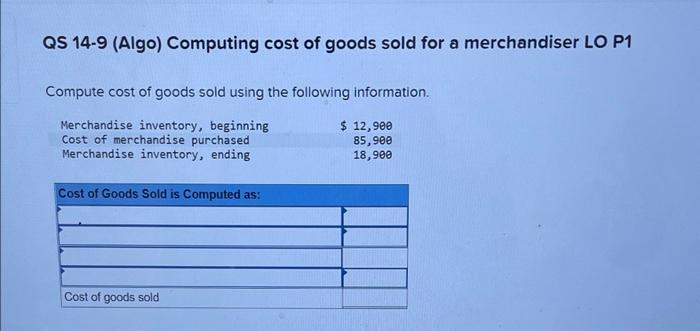

QS 14-9 (Algo) Computing cost of goods sold for a merchandiser LO P1 Compute cost of goods sold using the following information. Merchandise inventory, beginning Cost of merchandise purchased $ 12,900 Merchandise inventory, ending 85,900 18,900 Cost of Goods Sold is Computed as: Cost of goods sold

The Correct Answer and Explanation is :

To compute the cost of goods sold (COGS) for a merchandiser, you can use the following formula:

[

COGS = \text{Beginning Merchandise Inventory} + \text{Cost of Merchandise Purchased} – \text{Ending Merchandise Inventory}

]

Given Information:

- Beginning Merchandise Inventory: $12,900

- Cost of Merchandise Purchased: $18,900

- Ending Merchandise Inventory: $85,900

Now, plug the given values into the formula:

[

COGS = 12,900 + 18,900 – 85,900

]

[

COGS = 31,800 – 85,900

]

[

COGS = -54,100

]

However, a negative COGS value is not realistic in accounting, as the cost of goods sold should not be negative. This suggests that the data provided is incorrect or may require adjustment.

Explanation of the COGS Formula:

The cost of goods sold represents the direct costs associated with the production or purchase of goods that a business has sold during a given period. It’s an important metric for calculating profitability. The formula is based on the premise that a company starts with a certain amount of inventory, adds to it through purchases, and then ends with a different amount of inventory at the end of the period. The difference between the inventory at the start and end, after adjusting for purchases, gives the cost of the goods sold.

- Beginning Merchandise Inventory: This is the value of inventory at the beginning of the period. It’s the amount that was left unsold from the previous period.

- Cost of Merchandise Purchased: This refers to the total cost of additional goods purchased or produced during the period.

- Ending Merchandise Inventory: This is the value of unsold inventory at the end of the period.

By subtracting the ending inventory from the total of the beginning inventory and purchases, the formula reveals how much of the inventory was sold, i.e., the cost of goods sold.