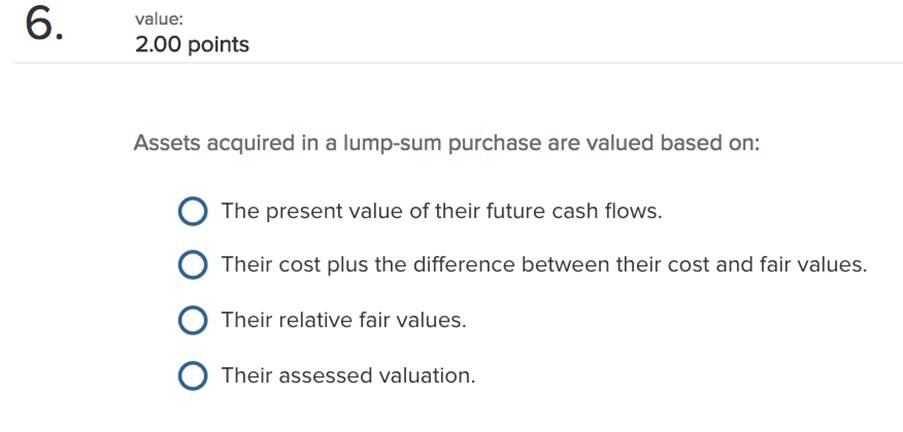

value: 2.00 points Assets acquired in a lump-sum purchase are valued based on: O The present value of their future cash flows. O Their cost plus the difference between their cost and

The correct answer and explanation is:

Correct Answer:

The relative fair values of the individual assets.

Explanation:

When assets are acquired in a lump-sum purchase, the total cost paid is allocated among the individual assets based on their relative fair values. This approach ensures that the cost is distributed in proportion to the value of each asset, reflecting their contribution to the total purchase price.

Key Concepts:

- Lump-Sum Purchase:

A lump-sum purchase involves acquiring multiple assets (e.g., land, buildings, and equipment) in a single transaction for a total price. The total cost must be allocated because each asset typically has different uses, lifespans, and depreciation methods. - Relative Fair Value Method:

The fair value of each asset is first determined, often using appraisals or market comparisons. Then, the total purchase price is distributed proportionally based on the ratio of each asset’s fair value to the total fair value of all assets. Formula: Allocated Cost of Asset=(Fair Value of AssetTotal Fair Value of All Assets)×Total Purchase Price\text{Allocated Cost of Asset} = \left(\frac{\text{Fair Value of Asset}}{\text{Total Fair Value of All Assets}}\right) \times \text{Total Purchase Price} - Rationale for the Method:

This method ensures a logical and equitable distribution of the purchase cost. For example, if the lump-sum includes land worth $100,000 and a building worth $300,000 (total fair value: $400,000), and the purchase price is $320,000, the allocated cost would be $80,000 for the land and $240,000 for the building. - Importance of Allocation:

Proper allocation is critical for accurate financial reporting. It affects depreciation, asset valuation, and future financial performance assessments. Misallocation could distort profit margins, tax liabilities, or investment decisions.

This approach aligns with accounting standards like GAAP and IFRS, which emphasize the use of fair value for initial asset recognition in lump-sum purchases.