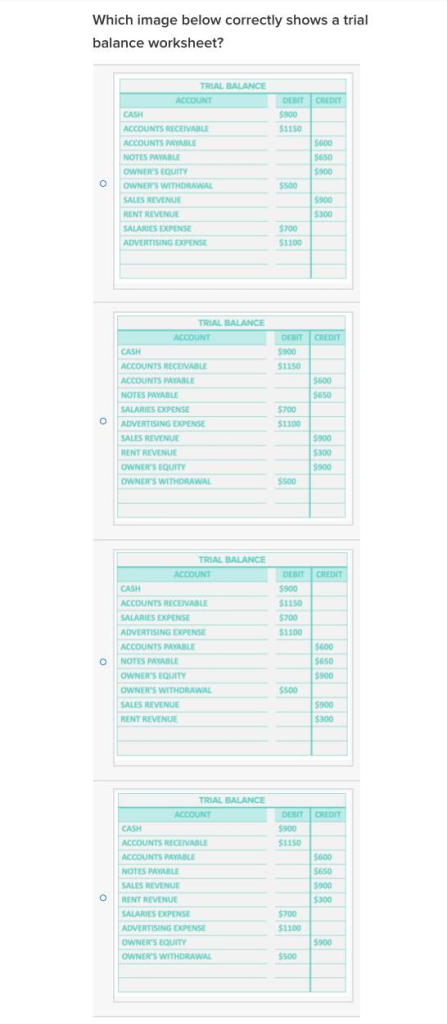

Which image below correctly shows a trial balance worksheet? TRIAL BALANCE CREDIT DEBIT $900 $1150 ACCOUNT CASH ACCOUNTS RECEIVABLE ACCOUNTS PAYABLE NOTES PAYABLE OWNER’S EQUITY OWNER’S WITHDRAWAL SALES REVENUE RENT REVENUE SALARIES EXPENSE ADVERTISING EXPENSE $600 $650 $900 a $500 $900 $300 $700 $1100 TRIAL BALANCE ACCOUNT CASH ACCOUNTS RECEIVABLE ACCOUNTS PAYABLE NOTES PAYABLE SALARIES EXPENSE ADVERTISING EXPENSE SALES REVENUE RENT REVENUE OWNER’S EQUITY OWNER’S WITHDRAWAL DEBIT CREDIT $900 $1150 $600 $650 $700 $1100 $900 $300 $900 $500 O CREDIT DEBIT $900 $1150 $700 $1100 TRIAL BALANCE ACCOUNT CASH ACCOUNTS RECEIVABLE SALARIES EXPENSE ADVERTISING EXPENSE ACCOUNTS PAYABLE NOTES PAYABLE OWNER’S EQUITY OWNER’S WITHDRAWAL SALES REVENUE RENT REVENUE O $600 $650 $900 $500 $900 $300 CREDIT DEBIT $900 $1150 $600 $650 TRIAL BALANCE ACCOUNT CASH ACCOUNTS RECEIVABLE ACCOUNTS PAYABLE NOTES PAYABLE SALES REVENUE RENT REVENUE SALARIES EXPENSE ADVERTISING EXPENSE OWNER’S EQUITY OWNER’S WITHDRAWAL $900 $300 o $700 $1100 $900 $500

The correct answer and explanation is:

The correct trial balance worksheet is the one where the total debits equal the total credits while listing all accounts systematically with their respective balances under the appropriate columns. Based on the details provided, the worksheet should adhere to the basic structure of a trial balance, ensuring the following principles:

- Accounts are categorized into assets, liabilities, equity, revenues, and expenses.

- Debits include assets, expenses, and withdrawals, while credits include liabilities, equity, and revenues.

- Total Debits = Total Credits, ensuring the accounts are balanced.

Explanation:

A trial balance is a worksheet used to ensure that the sum of all debits matches the sum of all credits in a double-entry accounting system. It provides a foundation for preparing financial statements and serves as a tool for detecting recording errors.

Each account’s balance is recorded in either the debit or credit column, based on its nature:

- Assets (e.g., cash, accounts receivable) and expenses (e.g., salaries expense, advertising expense) increase with debits and decrease with credits.

- Liabilities (e.g., accounts payable, notes payable), equity (e.g., owner’s equity, owner’s withdrawals), and revenues (e.g., sales revenue, rent revenue) increase with credits and decrease with debits.

If the trial balance is not balanced, it indicates an error in the accounting process, such as:

- Recording only one side of a transaction.

- Incorrect amounts in the ledger.

- Posting an entry to the wrong account.

In the correct trial balance, total debits and credits are equal (e.g., $3,000 debits = $3,000 credits), confirming that the accounting system has followed the double-entry principle accurately. Balancing does not guarantee the absence of all errors, but it confirms arithmetic accuracy and proper ledger posting.

A proper trial balance also ensures clarity by listing accounts in a structured order (assets, liabilities, equity, revenues, expenses) for easy preparation of income statements and balance sheets.