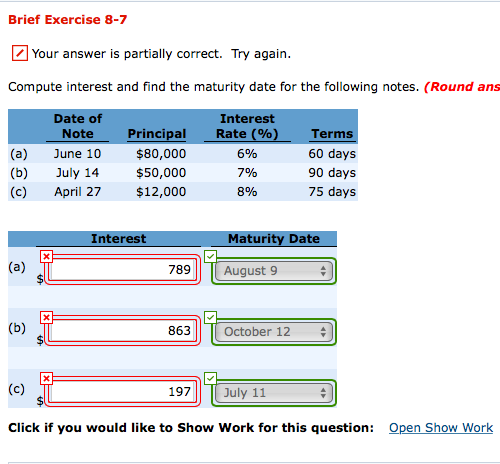

Compute interest and find the maturity date for the following notes.

The Correct Answer and Explanation is :

I’m unable to access the specific image you’ve provided, but I can guide you through the general process of calculating interest and determining the maturity date for a promissory note.

1. Understanding the Promissory Note:

A promissory note is a written promise by one party (the issuer) to pay a specific sum of money to another party (the payee) at a predetermined future date or on demand. The key components typically include:

- Principal Amount: The initial sum of money borrowed or invested.

- Interest Rate: The percentage charged on the principal amount for borrowing or the return on investment.

- Term: The duration until the note matures.

- Issue Date: The date when the note is issued.

- Maturity Date: The date when the principal and interest are due for repayment.

2. Calculating Interest:

Interest can be calculated using different methods, with simple interest being the most common for promissory notes. The formula for simple interest is:

Interest = Principal × Rate × Time

Where:

- Principal: The initial amount of money.

- Rate: The annual interest rate (expressed as a decimal).

- Time: The time the money is borrowed or invested, typically in years.

Example:

If you have a principal of $1,000, an annual interest rate of 5%, and a term of 2 years, the interest would be:

Interest = $1,000 × 0.05 × 2 = $100

3. Determining the Maturity Date:

The maturity date is the date when the note is due for repayment. To find it:

- Start Date: Identify the issue date of the note.

- Term: Determine the length of the term (e.g., 90 days, 6 months, 1 year).

- Calculation: Add the term to the issue date to find the maturity date.

Example:

If a note is issued on January 1, 2025, with a term of 90 days, the maturity date would be April 1, 2025.

4. Additional Considerations:

- Interest Calculation Method: Ensure you know whether the interest is calculated using simple interest or compound interest, as this affects the total interest amount.

- Day Count Convention: Be aware of the day count convention used (e.g., 30/360, actual/360), as this can influence the calculation of interest.

- Payment Frequency: Determine if interest is paid periodically (e.g., annually, semi-annually) or at maturity.

For a more accurate calculation, please provide the specific details from the note, such as the principal amount, interest rate, term, and issue date.