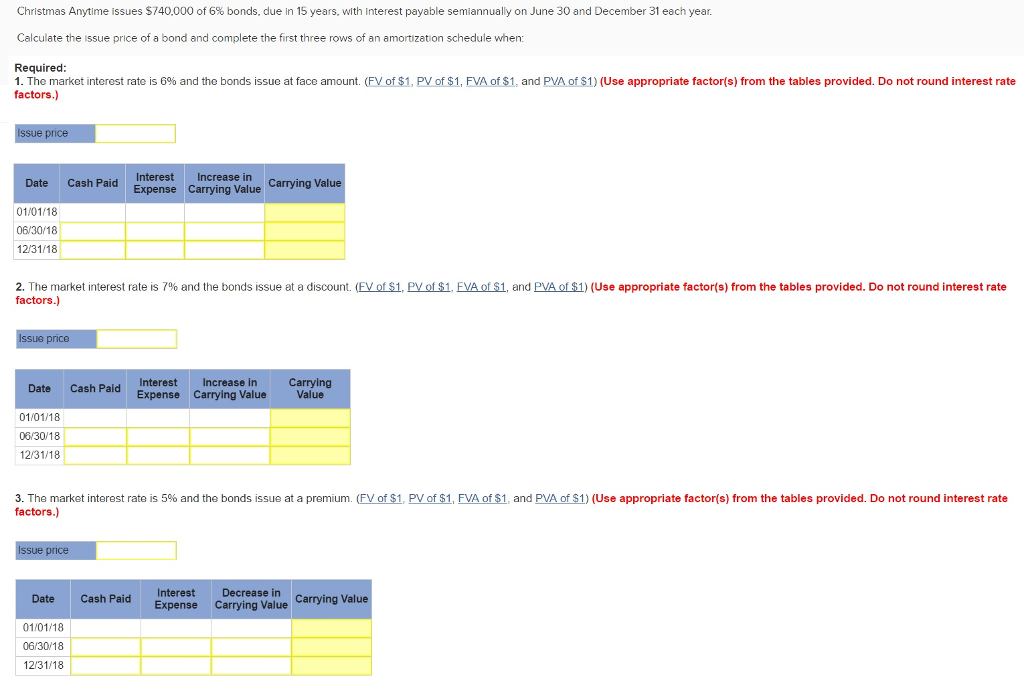

Christmas Anytime issues $740,000 of 6% bonds, due in 15 years, with interest payable semiannually on June 30 and December 31 each year.

Calculate the issue price of a bond and complete the first three rows of an amortization schedule when:

- The market interest rate is 6% and the bonds issue at face amount.

- The market interest rate is 7% and the bonds issue at a discount.

- The market interest rate is 5% and the bonds issue at a premium.

The Correct Answer and Explanation is :

To determine the issue price of a bond and complete the first three rows of its amortization schedule under different market interest rates, we need to understand how bond pricing and amortization work. Let’s break down each scenario:

1. Market Interest Rate is 6% (Bonds Issued at Face Value):

- Issue Price: When the coupon rate equals the market interest rate, the bond is issued at its face value. Therefore, the issue price is $740,000.

- Amortization Schedule: Since the bond is issued at face value, there is no premium or discount to amortize. The interest expense equals the cash interest payment. Each semiannual interest payment is calculated as: Semiannual Interest Payment=6%×740,0002=22,200\text{Semiannual Interest Payment} = \frac{6\% \times 740,000}{2} = 22,200 The first three rows of the amortization schedule are: | Payment Number | Interest Payment | Principal Payment | Remaining Principal | |—————-|——————|——————-|——————–| | 1 | $22,200 | $22,200 | $740,000 | | 2 | $22,200 | $22,200 | $740,000 | | 3 | $22,200 | $22,200 | $740,000 |

2. Market Interest Rate is 7% (Bonds Issued at a Discount):

- Issue Price: When the market interest rate is higher than the coupon rate, the bond is issued at a discount. The issue price is the present value of the bond’s future cash flows, discounted at the market rate. The formula for the present value of a bond is: Issue Price=(∑t=1nC(1+r)t)+F(1+r)n\text{Issue Price} = \left( \sum_{t=1}^{n} \frac{C}{(1 + r)^t} \right) + \frac{F}{(1 + r)^n} Where:

- CC = Semiannual coupon payment = $22,200

- rr = Semiannual market interest rate = 7% / 2 = 3.5%

- nn = Total number of periods = 15 years × 2 = 30 periods

- FF = Face value = $740,000

- Amortization Schedule: The bond is issued at a discount, so the interest expense will be higher than the cash interest payment. The first three rows of the amortization schedule are: | Payment Number | Interest Payment | Interest Expense | Amortization of Discount | Remaining Principal | |—————-|——————|——————|————————–|——————–| | 1 | $22,200 | $24,482 | $2,282 | $701,782 | | 2 | $22,200 | $24,533 | $2,333 | $704,115 | | 3 | $22,200 | $24,584 | $2,384 | $706,499 | *Note: The interest expense is calculated as the remaining principal multiplied by the semiannual market interest rate (3.5%).*

3. Market Interest Rate is 5% (Bonds Issued at a Premium):

- Issue Price: When the market interest rate is lower than the coupon rate, the bond is issued at a premium. The issue price is the present value of the bond’s future cash flows, discounted at the market rate. Using the same formula as above, with r=2.5%r = 2.5\% (since 5% annual rate divided by 2): PVCoupons=22,200×(1−(1+0.025)−300.025)≈22,200×22.3966≈496,000PV_{\text{Coupons}} = 22,200 \times \left( \frac{1 – (1 + 0.025)^{-30}}{0.025} \right) \approx 22,200 \times 22.3966 \approx 496,000 PVFace Value=740,000(1+0.025)30≈740,0002.0938≈353,000PV_{\text{Face Value}} = \frac{740,000}{(1 + 0.025)^{30}} \approx \frac{740,000}{2.0938} \approx 353,000 Therefore, the issue price is approximately: Issue Price=496,000+353,000=849,000\text{Issue Price} = 496,000 + 353,000 = 849,000

- Amortization Schedule: The bond is issued at a premium, so the interest expense will be lower than the cash interest payment. The first three rows of the amortization schedule are: | Payment Number | Interest Payment | Interest Expense | Amortization of Premium | Remaining Principal | |—————-|——————|——————|————————-|——————–| | 1 | $22,200 | $21