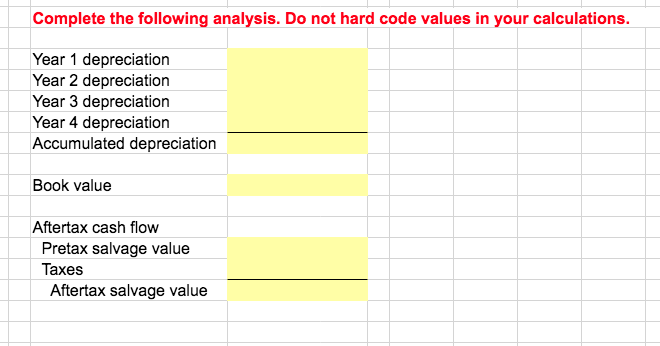

An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,500,000 and will be sold for $1,600,000 at the end of the project. If the tax rate is 21 percent, what is the aftertax salvage value of the asset?

The Correct Answer and Explanation is :

To calculate the after-tax salvage value of an asset, we need to account for the tax effect of the sale of the asset at the end of the project. The after-tax salvage value (ATSV) is determined by subtracting the taxes owed on the difference between the salvage value and the book value from the salvage value.

Formula:

[

\text{After-tax Salvage Value} = \text{Salvage Value} – \left( \text{Tax Rate} \times (\text{Salvage Value} – \text{Book Value}) \right)

]

Step-by-step Calculation:

- Identify given values:

- Acquisition cost (Initial investment): \$6,500,000

- Salvage value (Final sale price): \$1,600,000

- Tax rate: 21%

- Asset’s MACRS class: 5-year (though we are dealing with 4 years of depreciation here)

- Calculate the Depreciation:

For the asset in the 5-year MACRS class, depreciation over 4 years is determined by applying the appropriate MACRS depreciation percentages. According to the IRS MACRS depreciation table for a 5-year class asset, the percentages for the first 4 years are:

- Year 1: 20%

- Year 2: 32%

- Year 3: 19.2%

- Year 4: 11.52% Applying these percentages to the acquisition cost of \$6,500,000:

- Year 1 Depreciation = \$6,500,000 × 20% = \$1,300,000

- Year 2 Depreciation = \$6,500,000 × 32% = \$2,080,000

- Year 3 Depreciation = \$6,500,000 × 19.2% = \$1,248,000

- Year 4 Depreciation = \$6,500,000 × 11.52% = \$748,800 Total Depreciation over 4 years:

[

\text{Total Depreciation} = 1,300,000 + 2,080,000 + 1,248,000 + 748,800 = 5,376,800

]

- Calculate the Book Value:

The book value at the end of Year 4 is the acquisition cost minus the total depreciation:

[

\text{Book Value} = 6,500,000 – 5,376,800 = 1,123,200

] - Calculate the After-tax Salvage Value:

Now, apply the formula for the after-tax salvage value:

[

\text{After-tax Salvage Value} = 1,600,000 – (0.21 \times (1,600,000 – 1,123,200))

]

[

\text{After-tax Salvage Value} = 1,600,000 – (0.21 \times 476,800)

]

[

\text{After-tax Salvage Value} = 1,600,000 – 100,088

]

[

\text{After-tax Salvage Value} = 1,499,912

]

Conclusion:

The after-tax salvage value of the asset is \$1,499,912. This reflects the impact of taxes on the gain from the sale, where the tax rate reduces the effective value of the sale proceeds. The book value, which is lower than the acquisition cost due to depreciation, helps determine the taxable gain or loss on the asset sale. The lower the depreciation, the higher the taxable gain, which increases the tax liability and reduces the after-tax salvage value.