Consider the following data for a closed economy:

Y = $12 Trillion

C = $8 Trillion

G = $2 Trillion

Spublic = -$0.5 Trillion

T = $2 Trillion

Use these data to calculate the following:

a. Private saving

b. Investment spending

c. Transfer Payments

d. The government budget deficit or budget surplus

The Correct Answer and Explanation is :

Let’s break down the problem step by step:

Given the data:

- Y (Income or GDP) = $12 Trillion

- C (Consumption) = $8 Trillion

- G (Government Spending) = $2 Trillion

- Spublic (Public Saving) = -$0.5 Trillion

- T (Taxes) = $2 Trillion

a. Private Saving

Private saving is the income that households and businesses save after paying for taxes and consumption. It is calculated using the following formula:

[

S_{private} = Y – T – C

]

Where:

- (Y) is income,

- (T) is taxes, and

- (C) is consumption.

Substituting the values:

[

S_{private} = 12 – 2 – 8 = 2 \, \text{Trillion}

]

Thus, Private Saving = $2 Trillion.

b. Investment Spending

In a closed economy, investment is equal to the sum of private saving and public saving:

[

I = S_{private} + S_{public}

]

We already know that:

- Private Saving = $2 Trillion,

- Public Saving = -$0.5 Trillion.

So, the investment spending is:

[

I = 2 + (-0.5) = 1.5 \, \text{Trillion}

]

Thus, Investment Spending = $1.5 Trillion.

c. Transfer Payments

Transfer payments are the payments made by the government to households that do not correspond to the purchase of goods or services. To calculate the transfer payments, we can use the following relationship:

[

S_{public} = T – G – \text{Transfer Payments}

]

We are given:

- Spublic = -$0.5 Trillion,

- T = $2 Trillion,

- G = $2 Trillion.

Rearranging the formula to find the transfer payments:

[

\text{Transfer Payments} = T – G – S_{public}

]

[

\text{Transfer Payments} = 2 – 2 – (-0.5) = 0.5 \, \text{Trillion}

]

Thus, Transfer Payments = $0.5 Trillion.

d. Government Budget Deficit or Surplus

The government budget deficit or surplus is the difference between government revenue (taxes) and government spending. If taxes exceed government spending, it’s a budget surplus, and if government spending exceeds taxes, it’s a deficit. It can be calculated as:

[

\text{Budget Deficit/Surplus} = T – G

]

Substituting the values:

[

\text{Budget Deficit/Surplus} = 2 – 2 = 0

]

Thus, the government has neither a surplus nor a deficit—it’s balanced.

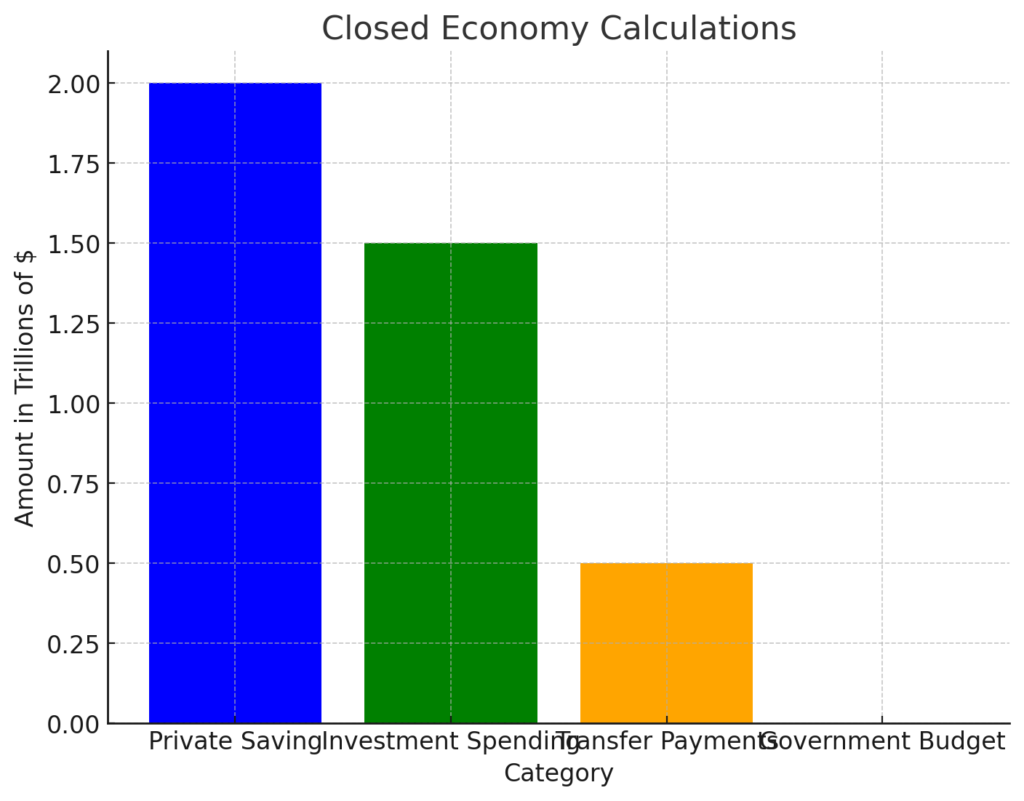

Summary of Results:

- Private Saving = $2 Trillion

- Investment Spending = $1.5 Trillion

- Transfer Payments = $0.5 Trillion

- Government Budget = Balanced (no surplus or deficit)

I will now generate an image summarizing these calculations.

Here is the bar chart that summarizes the results of the calculations:

- Private Saving = $2 Trillion

- Investment Spending = $1.5 Trillion

- Transfer Payments = $0.5 Trillion

- Government Budget = Balanced (no deficit or surplus)