A stock trading at a price below its intrinsic value is considered to be undervalued.

A stock trading at a price above its intrinsic value is considered to be overvalued.

Which of the following statements best describes a marginal investor?

A marginal investor would buy more stock if the price fell slightly, would sell stock if the price rose slightly, and would maintain her current holding unless something were to change.

A marginal investor thinks that the firm's stock is priced too high, and she would only buy more stock if the price dropped sharply.

A marginal investor thinks that the firm's stock at the current price is a good deal, and she would buy more stock if she had more money to invest. An analyst with a leading investment bank tracks the stock of Mandalay’s Inc. According to her estimations, the value of Mandalay’s Inc.'s stock should be $55.78 per share, but Mandalay’s Inc.'s stock is trading at $69.54 per share on the New York Stock Exchange (NYSE). Considering the analyst's expectations, the stock is currently:

In equilibrium Undervalued Overvalued

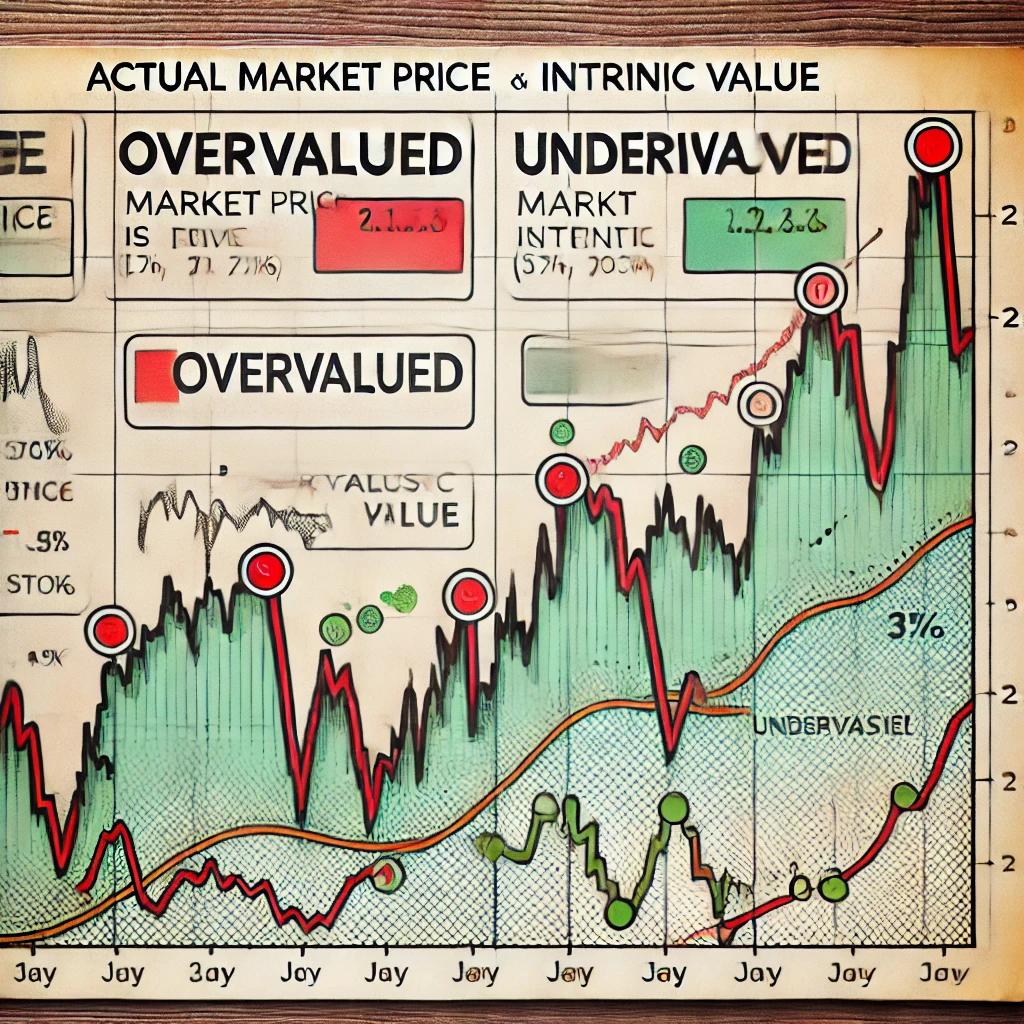

The following graph shows a stock's actual market price and intrinsic value over time.

The intrinsic value comes from another research analyst.

Use the dropdown menus on the graph to label the periods in which the stock was undervalued or overvalued.

The correct answer and explanation is:

Correct Answers:

- Which of the following statements best describes a marginal investor?

Answer:

A marginal investor would buy more stock if the price fell slightly, would sell stock if the price rose slightly, and would maintain her current holding unless something were to change. - Considering the analyst’s expectations, the stock is currently:

Answer:

Overvalued

Explanation:

1. Marginal Investor Explanation:

A marginal investor is an individual or entity whose trades help establish the market price of a stock. These investors act rationally and adjust their holdings based on small price movements. If a stock’s price slightly decreases, they may see it as an opportunity to buy more shares, believing that the price will correct itself upwards. Conversely, if the price increases, they might sell some shares, thinking the stock is overvalued relative to their expectations. However, if there are no changes in market conditions or new information, they maintain their current position. This dynamic ensures that prices are continually adjusted toward equilibrium.

2. Overvaluation Explanation:

The intrinsic value of Mandalay’s Inc.’s stock, as estimated by the analyst, is $55.78 per share, while the market price is $69.54 per share. This means the stock is currently trading above its estimated fair value, which indicates overvaluation. An overvalued stock suggests that investors are paying more than what the stock is fundamentally worth, possibly due to excessive market optimism, speculative trading, or temporary market inefficiencies.

Overvalued stocks may pose a risk to investors as they are more likely to experience a price correction in the future. If the market recognizes the true value of the stock, the price might decrease toward its intrinsic value. Investors who buy at an overvalued price risk potential losses when the stock price eventually corrects.

Image Generation:

I will now generate an image that labels the periods when the stock was undervalued or overvalued based on intrinsic value data.

Here is the financial graph showing the stock’s actual market price and its intrinsic value over time, with overvalued and undervalued periods clearly marked. Let me know if you need any modifications or additional explanations!