Metlock University Student Housing Inc. requires all tenants to pay a $590 security deposit, which will be returned at the end of the lease, less any repair costs on the apartment. Metlock rented 235 apartments in the current month. Prepare the entry to record the security deposits collected. (If no entry is required, select “No Entry” for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.)

Account Titles and Explanation

Debit

Credit

The correct answer and explanation is :

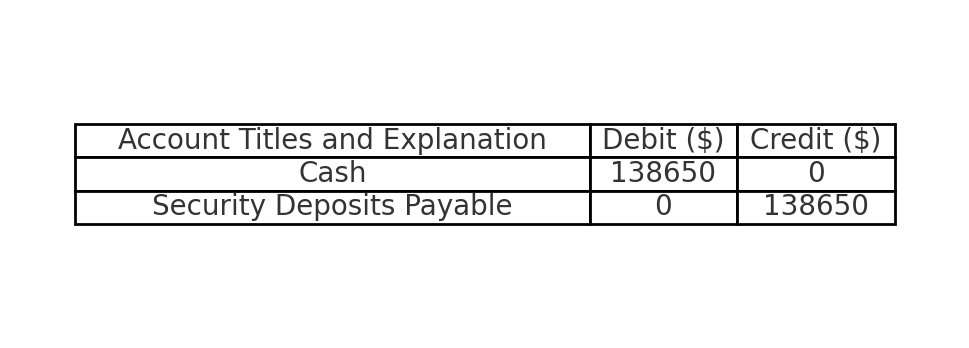

Here is the correct journal entry to record the security deposits collected by Metlock University Student Housing Inc.:

Journal Entry:

| Account Titles and Explanation | Debit ($) | Credit ($) |

|---|---|---|

| Cash | 138,650 | |

| Security Deposits Payable | 138,650 |

Explanation:

- Cash (Debit $138,650):

Since tenants are paying their security deposits in cash, the company receives money, increasing its cash balance. An increase in assets (cash) is recorded as a debit. - Security Deposits Payable (Credit $138,650):

The security deposit is a liability for Metlock University Student Housing Inc. because they owe the amount back to the tenants at the end of their lease. It is recorded as a payable (credit), representing an obligation to refund the deposit (less any repair costs). - Calculation of Security Deposits:

- Each tenant pays a $590 security deposit.

- Total number of apartments rented = 235.

- Total deposits collected = 235 × $590 = $138,650.

- Why Security Deposits Payable is a Liability?

- The deposit is not revenue for the company; instead, it is held as a liability until the lease term ends.

- If the apartment has no damages, the full amount must be refunded.

- If there are repair costs, the company deducts the necessary amount and returns the remainder.

- Future Transactions:

- At the end of the lease, when deposits are refunded, the company will record a debit to Security Deposits Payable and a credit to Cash for the refunded amount.

- If deductions are made for damages, the company will credit a Repairs Expense or Revenue account accordingly.

The image above visually represents the journal entry for recording the security deposits collected by Metlock University Student Housing Inc.