The outstanding share capital of Flint Corporation consists of 3,190 preferred shares and 8,700 common shares for which $261,000 was received. The preferred shares carry a dividend of $7 per share and have a $100 stated value.

(a) Assuming that the company has retained earnings of $101,600 that is to be entirely paid out in dividends and that preferred dividends were not paid during the 2 years preceding the current year, state how much each class of shares should receive if the preferred shares are non-cumulative and non-participating.

The correct answer and explanation is :

To determine the dividend distribution between preferred and common shareholders of Flint Corporation, we need to consider the characteristics of the preferred shares and the total dividends to be distributed.

Preferred Shares:

- Quantity: 3,190 shares

- Dividend per Share: $7

- Stated Value: $100

- Type: Non-cumulative and non-participating

Common Shares:

- Quantity: 8,700 shares

Total Dividends Available:

The company has retained earnings of $101,600, which are to be entirely paid out as dividends.

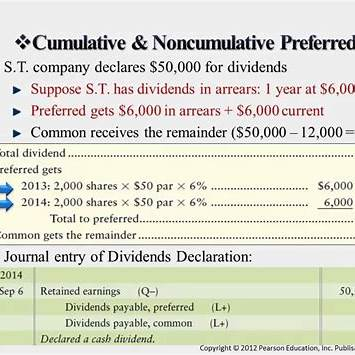

Dividend Distribution:

- Preferred Dividends: Since the preferred shares are non-cumulative, they are entitled only to the current year’s dividend and do not accumulate dividends from previous years. Therefore, any unpaid dividends from the past two years are forfeited.

- Total Preferred Dividend: 3,190 shares × $7/share = $22,330

- Common Dividends: After distributing dividends to preferred shareholders, the remaining amount is allocated to common shareholders.

- Remaining Amount for Common Dividends: $101,600 (total dividends) – $22,330 (preferred dividends) = $79,270

- Dividend per Common Share: $79,270 ÷ 8,700 shares ≈ $9.11 per share

Summary:

- Preferred Shareholders: Each receives $7, totaling $22,330.

- Common Shareholders: Each receives approximately $9.11, totaling $79,270.

Explanation:

In dividend distribution, preferred shareholders typically have priority over common shareholders. However, the specific terms of the preferred shares significantly influence this distribution.

- Non-Cumulative Preferred Shares: These shares do not accumulate unpaid dividends from previous years. If a dividend is not declared in a given year, shareholders of non-cumulative preferred shares are not entitled to claim those missed dividends in the future.

- Non-Participating Preferred Shares: These shares are entitled only to their fixed dividend and do not share in any additional profits or dividends beyond that fixed amount.

Given these characteristics, Flint Corporation’s preferred shareholders are entitled only to the current year’s fixed dividend of $7 per share, totaling $22,330. The remaining earnings designated for dividends, amounting to $79,270, are then distributed among common shareholders, resulting in approximately $9.11 per common share.

This allocation ensures that preferred shareholders receive their stipulated dividends first, with common shareholders receiving the residual amount, reflecting the typical hierarchy in dividend distribution.