Select one bolded section that interests you and read through it. Summarize what the rules cover. Is there anything missing that you feel should be added? Are there any guidelines that you would eliminate? What would be the biggest challenge an auditor might face following your chosen section? Be sure to respond to at least one of your classmates’ posts with new information about the topic, a clarifying example, and so on.

The correct answer and explanation is :

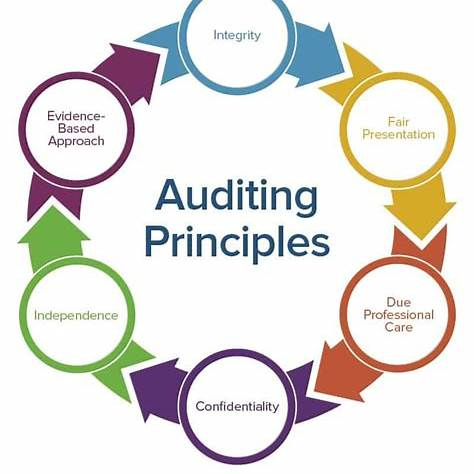

The Independence of Auditors is a fundamental principle ensuring that auditors perform their duties without bias or undue influence, thereby maintaining the integrity and objectivity of the audit process. This independence is crucial for providing stakeholders with confidence in the accuracy and reliability of financial statements.

Summary of Auditor Independence Rules:

- Personal Independence: Auditors must avoid personal relationships with clients that could impair their objectivity. This includes refraining from financial interests or familial ties with the audited entity.

- External Influences: Auditors should not be subjected to external pressures from clients, regulatory bodies, or other stakeholders that could compromise their impartiality.

- Organizational Independence: Audit firms must establish policies to ensure that their staff can operate without interference, maintaining a clear separation between the audit team and other services provided to the client.

Potential Additions to the Guidelines:

- Mandatory Rotation of Audit Firms: Implementing a policy requiring companies to change their audit firms after a certain period could prevent long-term relationships that might compromise independence.

- Enhanced Disclosure Requirements: Auditors could be mandated to disclose any non-audit services provided to the client, ensuring transparency about potential conflicts of interest.

Guidelines That Could Be Reassessed:

- Provision of Non-Audit Services: While some non-audit services are permissible, allowing auditors to provide extensive consultancy services to their audit clients can create conflicts of interest. It might be prudent to eliminate or further restrict such allowances.

Challenges Auditors Might Face:

- Navigating Complex Relationships: In large firms, auditors may encounter intricate networks of relationships that could inadvertently affect their independence. Identifying and managing these potential conflicts require vigilance and robust internal policies.

- Pressure from Clients: Auditors might face subtle or overt pressure from clients, especially if significant fees are at stake, challenging their commitment to independence.

- Regulatory Variations: Differences in independence standards across jurisdictions can pose challenges for auditors operating internationally, requiring them to adapt to varying expectations and regulations.

In conclusion, auditor independence is vital for the credibility of financial reporting. While existing guidelines provide a strong foundation, continuous evaluation and adaptation are necessary to address emerging challenges and ensure that auditors can operate without bias, thereby upholding the trust placed in financial statements by stakeholders.