Currency held outside banks + demand deposits + travelers checks + other checkable deposits = Group of answer choices

M3.

M3 – M1.

M2 – M1.

M1.

The correct answer and explanation is :

The correct answer is: M1

Explanation:

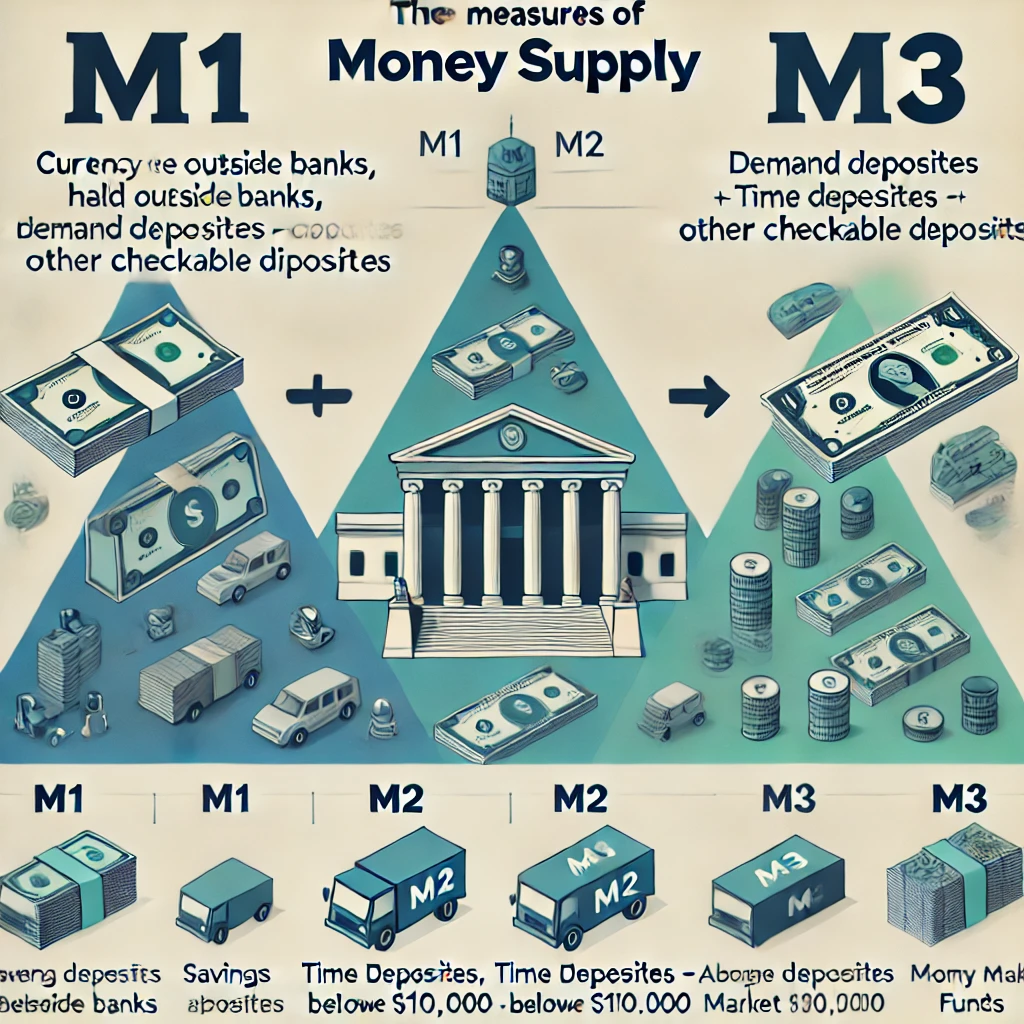

The money supply in an economy is categorized into different measures, primarily M1, M2, and M3, based on the liquidity of financial assets. Understanding these classifications helps economists and policymakers analyze financial stability, inflation, and monetary policy effectiveness.

Breakdown of the Given Formula

The formula provided is:

Currency held outside banks + demand deposits + travelers’ checks + other checkable deposits

Each of these components is included in M1, which is the most liquid form of money in an economy. Let’s break them down:

- Currency Held Outside Banks – This includes physical money (coins and paper currency) that is in circulation but not stored in financial institutions.

- Demand Deposits – These are funds in bank accounts that can be withdrawn at any time without prior notice, such as checking accounts.

- Travelers’ Checks – A type of prepaid, fixed-amount check that can be used as a secure alternative to cash.

- Other Checkable Deposits – Includes checking accounts that allow withdrawals via checks, electronic transfers, or debit card transactions.

Since all these components are part of M1, the correct answer is M1.

How M1 Relates to Other Money Supply Measures:

- M2 includes M1 plus less liquid assets like savings accounts, time deposits (below $100,000), and money market mutual funds.

- M3 includes M2 plus larger time deposits (above $100,000) and institutional money market funds, which are even less liquid.

Since the given formula strictly includes only M1 components, the answer cannot be M2 – M1, M3 – M1, or M3 because those measures include broader financial instruments.

Here is an infographic explaining the different measures of money supply (M1, M2, M3). The diagram visually represents how M1 is the most liquid form of money, with M2 and M3 progressively including less liquid assets.