Why are product costs sometimes called inventoriable costs? Describe the flow of such costs in a manufacturing company from the point of incurrence until they finally become expenses on the income statement.

The correct answer and explanation is :

Why Are Product Costs Called Inventoriable Costs?

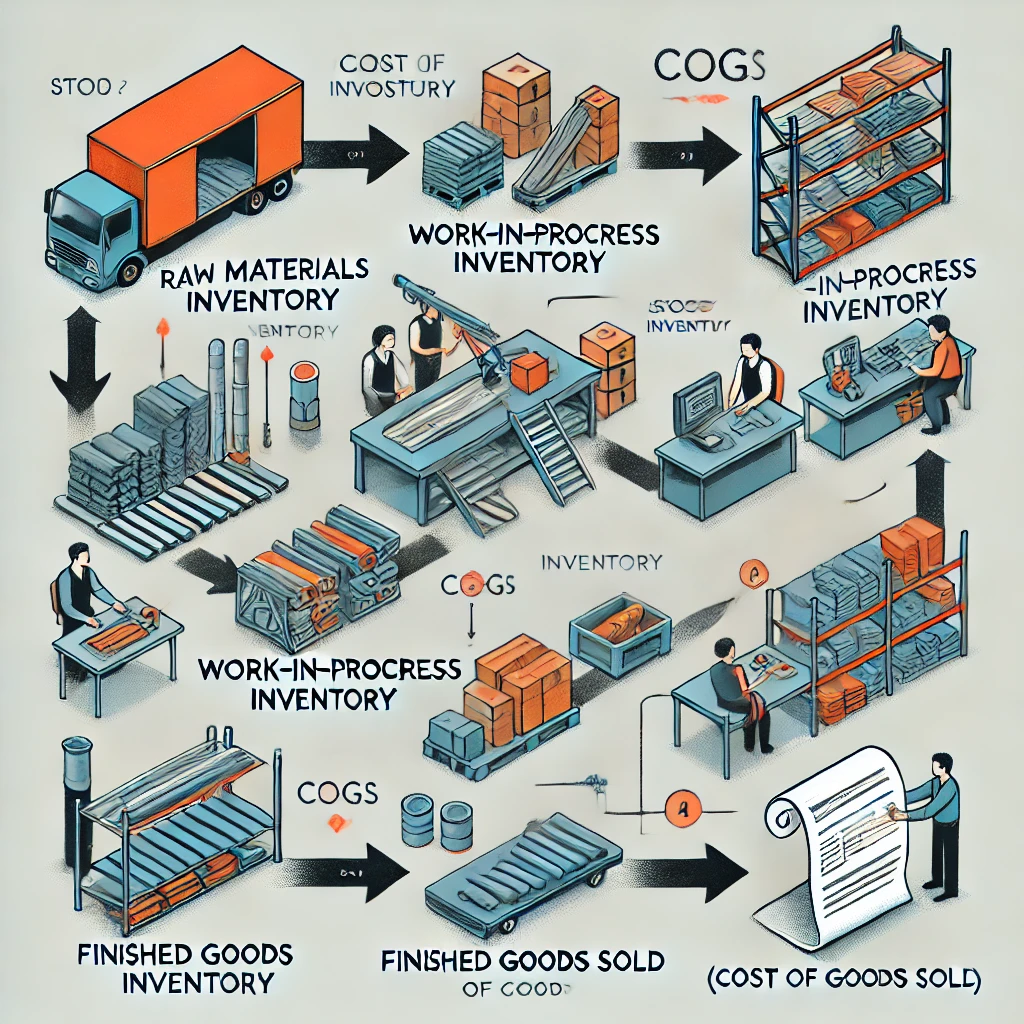

Product costs are often referred to as inventoriable costs because they are initially recorded as part of inventory on the balance sheet rather than being expensed immediately. These costs include direct materials, direct labor, and manufacturing overhead—all of which are necessary to produce goods. They remain on the balance sheet as inventory (an asset) until the products are sold, at which point they become cost of goods sold (COGS) on the income statement.

Flow of Inventoriable Costs in a Manufacturing Company

- Raw Materials Inventory – The process begins when a company purchases raw materials, which are recorded as inventory on the balance sheet.

- Work-in-Process (WIP) Inventory – As raw materials are used in production and combined with direct labor and manufacturing overhead, they move into the work-in-process inventory account. This stage reflects products that are partially completed.

- Finished Goods Inventory – Once production is completed, the goods move from WIP to the finished goods inventory account. At this stage, the costs associated with production are still recorded as an asset.

- Cost of Goods Sold (COGS) – When the finished products are sold, their costs are transferred from finished goods inventory to COGS on the income statement. At this point, they become an expense, reducing net income.

Conclusion

Inventoriable costs are crucial in matching expenses with revenues, following the matching principle in accounting. By treating product costs as assets until the goods are sold, companies ensure that financial statements accurately reflect profitability.

Here is a flowchart illustrating the movement of inventoriable costs in a manufacturing company.