Cash equivalents include short term investments within

Multiple choice question.

one year of their due date

three months of their due date

six months of their due date

one month of their due date

The correct answer and explanation is :

Correct Answer: three months of their due date

Explanation:

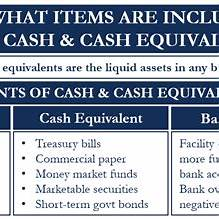

Cash equivalents are short-term, highly liquid investments that are readily convertible to known amounts of cash and are subject to an insignificant risk of changes in value. To qualify as cash equivalents, these investments typically have original maturities of three months or less from the date of acquisition.

Key Characteristics of Cash Equivalents:

- Short-Term Maturity: Investments must have original maturities of three months or less. This ensures that the funds are readily available for use in the short term.

- High Liquidity: Cash equivalents are easily convertible to known amounts of cash, facilitating quick access to funds when needed.

- Low Risk: These investments carry minimal risk of changes in value, providing stability to the company’s cash position.

Examples of Cash Equivalents:

- Treasury Bills (T-Bills): Short-term government securities with maturities of less than three months.

- Commercial Paper: Unsecured short-term debt instruments issued by corporations, typically with maturities under 90 days.

- Money Market Funds: Mutual funds that invest in short-term, highly liquid instruments such as T-bills and commercial paper.

- Certificates of Deposit (CDs): Short-term, high-quality bank instruments with maturities of three months or less.

Exclusions from Cash Equivalents:

Investments that do not meet the criteria of high liquidity, low risk, and short-term maturity are excluded from cash equivalents. For example, stocks, bonds, and derivatives are not considered cash equivalents, even if they are easily convertible to cash, due to their potential for value fluctuations.

Understanding the definition and characteristics of cash equivalents is crucial for accurate financial reporting and analysis. Proper classification ensures that stakeholders have a clear view of a company’s liquidity position and its ability to meet short-term obligations.