Which of the following is NOT a period cost?

A. Monthly depreciation of the equipment in a fitness room used by factory workers.

B. Salary of a billing clerk.

C. Insurance on a company showroom, where current and potential customers can view new products.

D. Cost of a seminar concerning tax law updates that was attended by the company’s controller.

The correct answer and explanation is :

Correct Answer:

A. Monthly depreciation of the equipment in a fitness room used by factory workers.

Explanation:

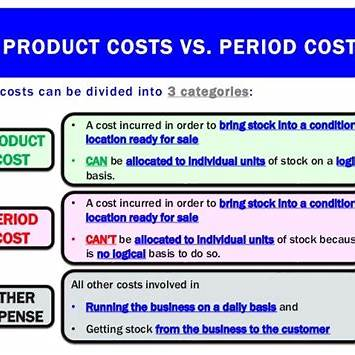

In cost accounting, period costs are expenses that are not directly tied to the production of goods or services. These costs are expensed in the period in which they are incurred, rather than being included in inventory costs. Examples include selling, general, and administrative expenses (SG&A), marketing expenses, and executive salaries.

Let’s analyze each option:

- (A) Monthly depreciation of the equipment in a fitness room used by factory workers:

This is not a period cost because the fitness room is provided for factory workers. Costs associated with factory operations, including depreciation on equipment used for employees’ well-being, are classified as product costs (specifically manufacturing overhead) rather than period costs. These costs are allocated to the cost of production and only expensed when the finished goods are sold. - (B) Salary of a billing clerk:

This is a period cost because it is part of the administrative expenses. A billing clerk’s job is related to accounting and customer invoicing rather than production. - (C) Insurance on a company showroom:

Since the showroom is used to display products for current and potential customers, this insurance expense is a selling cost, which is classified as a period cost under selling and administrative expenses. - (D) Cost of a seminar on tax law updates:

This is a period cost because it falls under general and administrative expenses. The seminar helps the company’s financial personnel stay informed about tax regulations but does not contribute directly to production.

Conclusion:

Only option A is not a period cost since it relates to factory operations and is considered manufacturing overhead (a product cost).