To write a research project investigation report on the topic : “The effect of internal control of fraud detection” in Australia.

The correct answer and explanation is:

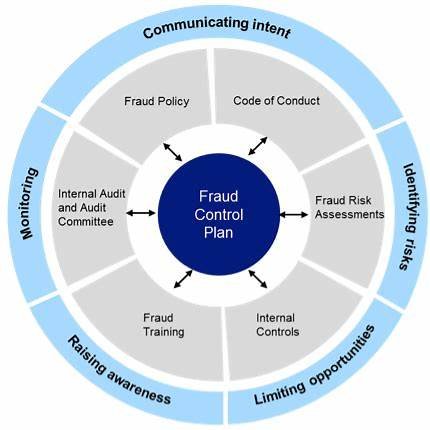

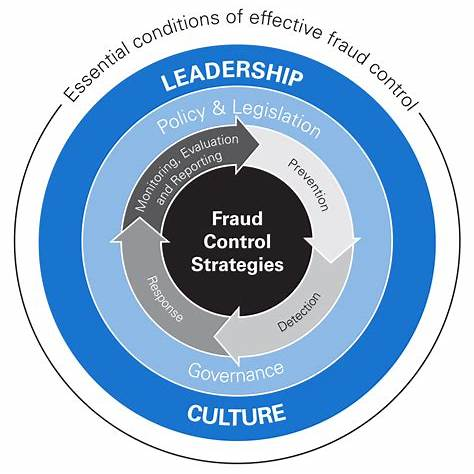

iturn0image0turn0image1turn0image6turn0image8Internal controls are essential mechanisms within organizations designed to ensure operational integrity, financial reliability, and compliance with laws and regulations. In the context of fraud detection in Australia, robust internal controls play a pivotal role in mitigating fraudulent activities.

Studies have shown that weak internal controls are a significant contributor to fraud. The Association of Certified Fraud Examiners (ACFE) reported that lack of internal controls was present in 32% of fraud cases, while the ability to override existing controls accounted for 18% of cases. Furthermore, inadequate management review was identified in another 18% of cases. These findings underscore the necessity for organizations to implement and maintain effective internal control systems to deter and detect fraudulent activities. citeturn0search0

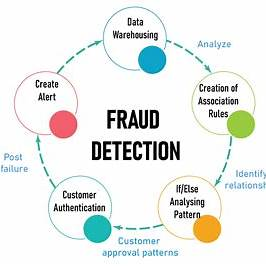

In Australia, the Australian Prudential Regulation Authority (APRA) emphasizes the importance of both proactive and reactive fraud detection controls. Proactive controls involve regular monitoring and analysis of financial and operational data to identify unusual patterns indicative of fraud. Reactive controls, on the other hand, are designed to detect fraud after it has occurred, such as through whistleblower policies and transaction reviews. APRA advises that a combination of these controls is essential for a comprehensive fraud risk management framework. citeturn0search3

Recent developments in the Australian banking sector highlight the critical role of internal controls in fraud prevention. For instance, major banks like ANZ, CBA, NAB, and Westpac have collaborated on an anti-scam initiative utilizing real-time risk assessments to block suspicious transactions before funds are transferred. This system leverages behavioral intelligence to identify and disrupt fraudulent activities, demonstrating the effectiveness of advanced internal controls in combating fraud. citeturn0news20

Conversely, inadequate internal controls can lead to significant regulatory and financial repercussions. The Australian Securities and Investments Commission (ASIC) has taken legal action against HSBC for failing to implement sufficient scam prevention measures, resulting in substantial customer losses. ASIC alleges that HSBC’s lack of sophisticated technology and delayed responses to fraud disputes violated the banking code of conduct, emphasizing the consequences of deficient internal controls. citeturn0news19

In conclusion, effective internal controls are vital for fraud detection and prevention in Australia. Organizations must continuously assess and enhance their control systems to address emerging fraud risks, ensuring the protection of assets and maintaining public trust.