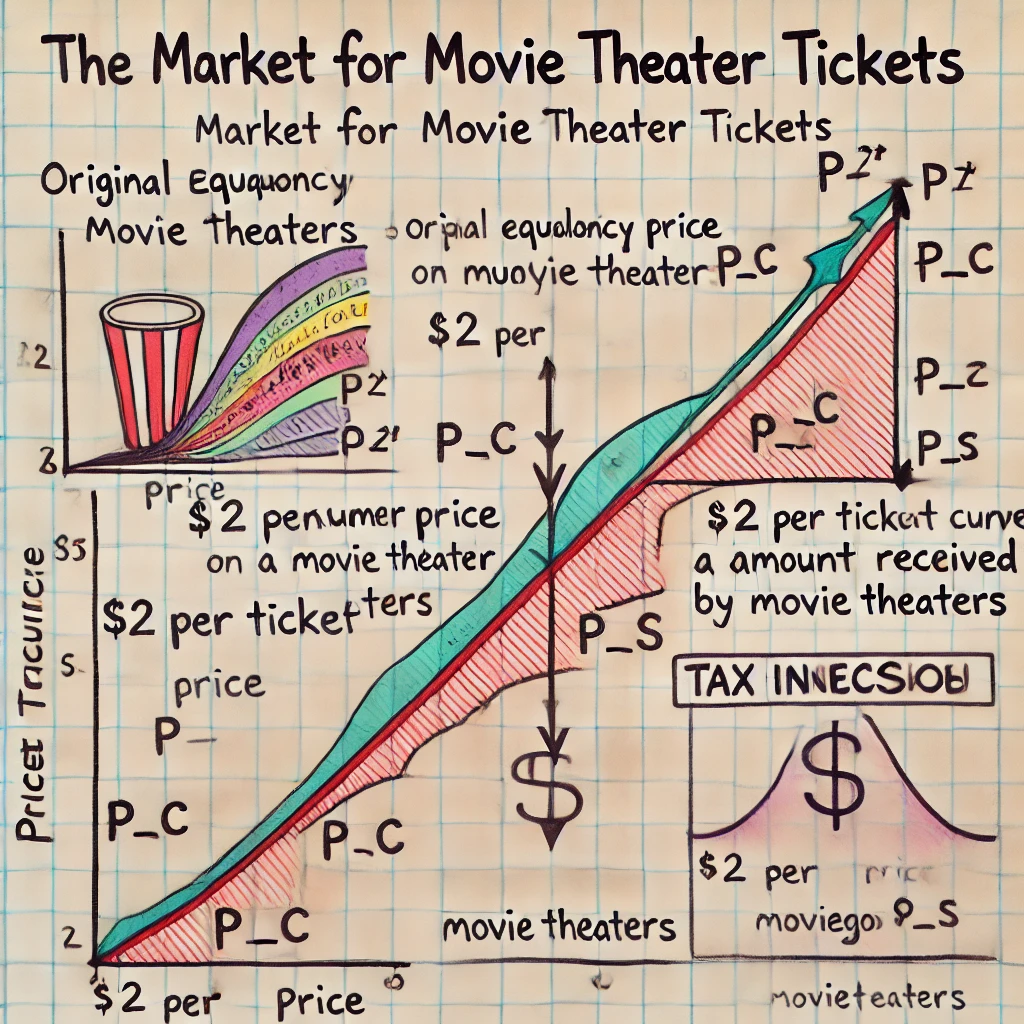

Consider the market for movie theater tickets shown in the accompanying graph. What is the equilibrium price and quantity? Illustrate graphically what happens to the supply curve if the government imposes a $2 per ticket tax on movie theaters. Identify the amount consumers now pay for a ticket and the amount movie theaters get to keep. How is the economic burden shared? Show on the graph what happens if instead the government imposes a $2 per ticket tax on movie goers. Identify the amount consumers now pay for a ticket and the amount movie theaters get to keep. How is the economic burden shared? Compare your answer from when the statutory burden was on movie theaters. What impact does the statutory burden of a tax have on the tax incidence? Who bears the economic burden and why?

The correct answer and explanation is:

Equilibrium Price and Quantity

The equilibrium price and quantity occur at the intersection of the supply and demand curves. This is where the quantity of movie tickets demanded equals the quantity supplied. From the graph, the equilibrium price is P∗P^* and the equilibrium quantity is Q∗Q^*.

Impact of a $2 Tax on Movie Theaters

If the government imposes a $2 per ticket tax on movie theaters, the supply curve shifts upward (or to the left) by the amount of the tax. This happens because the tax increases the cost of selling tickets for theaters. As a result:

- The new price that consumers pay increases to PCP_C.

- The amount that theaters keep after paying the tax decreases to PS=PC−2P_S = P_C – 2.

- The new quantity of tickets sold, QTQ_T, is lower than the original equilibrium quantity Q∗Q^*.

- The economic burden of the tax is shared between consumers and theaters. Consumers pay a higher price, while theaters receive less per ticket.

Impact of a $2 Tax on Moviegoers

If the government instead imposes a $2 per ticket tax on consumers, the demand curve shifts downward (or to the left) by the amount of the tax. This happens because consumers now effectively have to pay an extra $2, reducing their willingness to buy tickets. As a result:

- The new price that consumers pay is still PCP_C, which is higher than P∗P^*.

- The amount that theaters receive after tax is PS=PC−2P_S = P_C – 2, which is the same as when the tax was imposed on theaters.

- The new quantity sold QTQ_T is also lower than the original equilibrium quantity Q∗Q^*.

Tax Incidence and Economic Burden

Regardless of whether the statutory burden is placed on movie theaters or consumers, the economic burden is shared between them. The incidence of the tax depends on the price elasticity of demand and supply. If demand is inelastic, consumers bear more of the burden; if supply is inelastic, theaters bear more. The statutory burden (who pays the tax legally) does not change the economic burden (who actually bears the cost).

Here is the economic graph illustrating the market for movie theater tickets, showing the effects of a $2 per ticket tax on both movie theaters and consumers. The graph highlights the shifts in supply and demand, as well as the tax incidence and economic burden distribution. Let me know if you need any modifications!