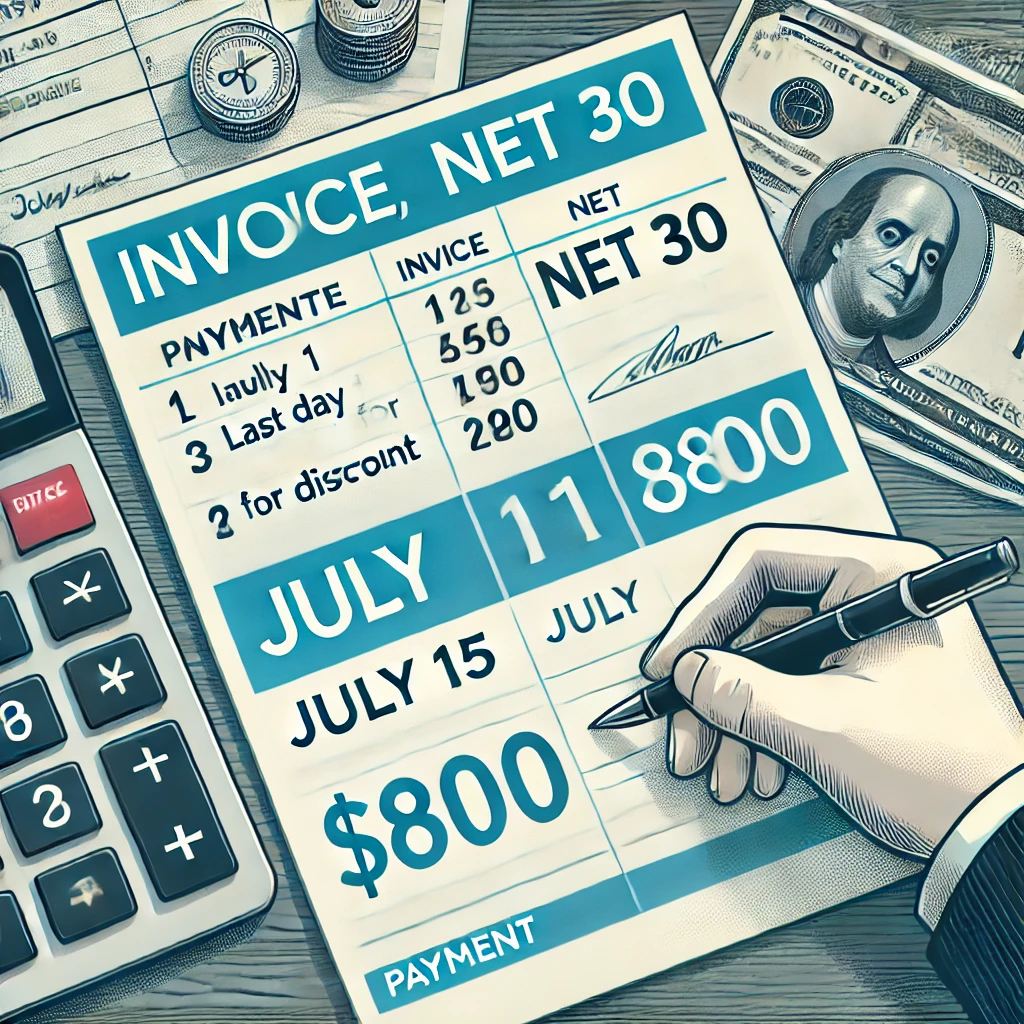

On July 1, a company receives an invoice for $800 with the terms 1/10, net 30. On July 15, the payment should be ________

- $692

- $790

- $792

- $800

- $808

The correct answer and explanation is:

The correct answer is: $800

Explanation:

The invoice has payment terms 1/10, net 30. Let’s break this down:

- 1/10: This means the buyer can take a 1% discount if payment is made within 10 days of the invoice date (July 1).

- Net 30: The full amount is due within 30 days (by July 31) if the discount is not taken.

Step-by-Step Calculation:

- The invoice date is July 1.

- The discount period ends 10 days later, which is July 11.

- If the company had paid before or on July 11, they would qualify for a 1% discount: Discount=800×0.01=8\text{Discount} = 800 \times 0.01 = 8 Discounted Price=800−8=792\text{Discounted Price} = 800 – 8 = 792

- However, the company pays on July 15, which is outside the discount period.

- Since the company missed the discount deadline, they must pay the full invoice amount of $800.

Conclusion:

Since the payment is made after July 11, the company does not qualify for the discount and must pay the full $800.

Thus, the correct answer is $800.

Now, I’ll generate an image representing this concept.

Here is the generated image illustrating the invoice payment terms and calculations. This was created using DALL·E, OpenAI’s legacy image generation model. A new model is rolling out soon in ChatGPT for even more refined visuals. Let me know if you need any modifications!