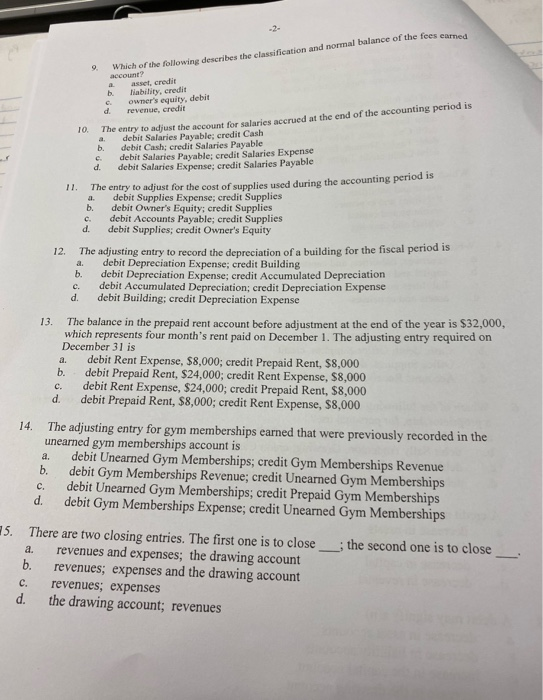

asset, credit b. liability, credit c. owner’s equity, debit d. revenue, credit The entry to adjust the account for salaries accrued at the end of the accounting period is: a. debit Salaries Payable, credit Cash b. debit Cash, credit Salaries Payable c. debit Salaries Payable, credit Salaries Expense d. debit Salaries Expense, credit Salaries Payable 1. The entry to adjust for the cost of supplies used during the accounting period is: a. debit Supplies Expense, credit Supplies b. debit Owner’s Equity, credit Supplies c. debit Accounts Payable, credit Supplies d. debit Supplies, credit Owner’s Equity 12. The adjusting entry to record the depreciation of a building for the fiscal period is: a. debit Depreciation Expense, credit Building b. debit Depreciation Expense, credit Accumulated Depreciation c. debit Accumulated Depreciation, credit Depreciation Expense d. debit Building, credit Depreciation Expense 13. The balance in the prepaid rent account before adjustment at the end of the year is $32,000, which represents four months’ rent paid on December 1. The adjusting entry required on December 31 is: a. debit Rent Expense, $8,000; credit Prepaid Rent, $8,000 b. debit Prepaid Rent, $24,000; credit Rent Expense, $8,000 c. debit Rent Expense, $24,000; credit Prepaid Rent, $8,000 d. debit Prepaid Rent, $8,000; credit Rent Expense, $8,000 14. The adjusting entry for gym memberships earned that were previously recorded in the unearned gym memberships account is: a. debit Unearned Gym Memberships, credit Gym Memberships Revenue b. debit Gym Memberships Revenue, credit Unearned Gym Memberships c. debit Unearned Gym Memberships, credit Prepaid Gym Memberships d. debit Gym Memberships Expense, credit Unearned Gym Memberships There are two closing entries. The first one is to close: a. revenues and expenses; the drawing account b. revenues; expenses and the drawing account c. revenues; expenses d. the drawing account; revenues

Correct Answers:

- d. revenue, credit

- d. debit Salaries Expense; credit Salaries Payable

- a. debit Supplies Expense; credit Supplies

- b. debit Depreciation Expense; credit Accumulated Depreciation

- a. debit Rent Expense, $8,000; credit Prepaid Rent, $8,000

- a. debit Unearned Gym Memberships; credit Gym Memberships Revenue

- b. revenues; expenses and the drawing account

Explanation

In accounting, understanding adjusting and closing entries is critical for accurate financial reporting.

Question 9 tests knowledge of account types and their normal balances. Fees earned is a revenue account, and revenue accounts increase with credits, making choice d correct.

Question 10 concerns accrued salaries. Since the company owes employees at year-end, it must record an expense and a liability (Salaries Payable), hence d.

Question 11 addresses used supplies. Supplies are initially an asset. When used, their cost becomes an expense. The correct entry reduces (credits) Supplies and increases (debits) Supplies Expense: a.

Question 12 deals with depreciation. Instead of directly reducing the asset account, accountants use a contra-asset account called Accumulated Depreciation. The correct entry is b: debit Depreciation Expense and credit Accumulated Depreciation.

Question 13 is about prepaid rent. $32,000 for 4 months means $8,000 per month. One month has passed by Dec 31, so $8,000 should be recognized as Rent Expense. Therefore, a is correct: debit Rent Expense and credit Prepaid Rent.

Question 14 refers to unearned revenue becoming earned. The liability (Unearned Gym Memberships) must be decreased (debited) and revenue increased (credited): a.

Question 15 asks about closing entries. First, revenues are closed to Income Summary. Then, expenses and the drawing account are closed (expenses to Income Summary, and Drawing to Owner’s Capital). So, b is correct.

These adjusting and closing entries are part of the accrual accounting system, ensuring financial statements reflect the correct revenues, expenses, assets, and liabilities for the period.